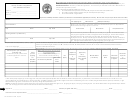

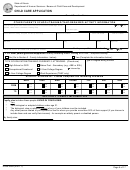

State of Illinois

Department of Human Services - Bureau of Child Care and Development

CHILD CARE APPLICATION

Parent/Guardian Name:

21) How can my child care provider expect to be paid?

IDHS is offering for family home child care providers to receive their payments through the Illinois Debit MasterCard. The Debit Card presents the

opportunity for home child care providers to receive their payments in a quicker, less expensive manner than a paper check. The provider will

receive payment for all children they are providing care for on one card. No more worrying about lost or stolen checks! Each month the provider will

receive a statement identifying each case for which they are receiving payment. For more information regarding the Illinois Debit MasterCard, go to

the following website:

or contact your CCR&R.

Payments can be deposited directly into your provider's bank account. This can be especially helpful if your provider has been having trouble with

mail. Call 217-557-0930 to set up direct deposit. For purposes of record keeping, your provider may want to ask the bank what kind of receipt

information they can pass on, as the provider will not receive payment information from IDHS or the Comptroller's office when using direct deposit.

Effective September 20, 2011, Home Child Care Providers will receive all provider payments on the Illinois Debit Mastercard card unless they

choose direct deposit. Paper checks will remain an option if the provider cannot accept an electronic method for receiving funds.

The IDHS Child Care Telephone Billing System is an easier and faster way to get paid. Contact your CCR&R for more information.

22) How can I or my child care provider check status of payments?

Clients and providers can call the IDHS toll free phone number to find out payment information. If you have a touch-tone phone, you can call

1-800-804-3833 to find out if your payments have been entered by the CCR&R and mailed by the State Comptroller. This toll free number is

available 24 hours a day, seven days a week. You can also get payment information by visiting the State Comptroller's web site at:

and select "vendor payments."

OTHER

23) What should I do if my circumstances change?

The parent or provider should call us when any of the following changes occur:

* Change Providers

* Change address

* Stop working or change jobs * Stop receiving TANF

* Stop attending school or training

* Have medical/maternity leave

* Change family size

* Have any other changes that may affect your eligibility

* Change income

Failure to report any changes within 10 days may result in an overpayment which you will have to pay back and/or loss of child care benefits. If you

stop working, you may be able to continue to receive a child care subsidy up to 30 days after the loss of your job while you look for work.

24) If I am a client or child care provider and I move, will my mail and checks be forwarded?

No, all clients and providers must fill out and submit a client/provider address form within 10 days of relocating.

25) How can I verify employment if I am self employed or cash paid?

A copy of the most recent, signed federal income tax return and all applicable schedules and attachments. After April 15th of each year, only the tax

return for the previous year is acceptable. If the tax return was submitted electronically, you must provide a copy of the receipt in the absence of a

signature. If a tax return is not available, a monthly statement of earnings and expenses must be submitted until an income tax return is submitted.

If you are paid in cash, a payment verification letter is required from each individual who pays you in cash for performing a service. You cannot

write the letter yourself. It MUST be from the person who pays you.

All verifications must include the following information:

1. The name, address, and phone number, of the individual completing the letter;

2. The type of work performed;

3. Who performed the work;

4. The date(s) the work was completed or if the activity is on-going;

5. The rate of pay; and

6. The employee's schedule. If the expenses exceed the gross receipts, the self-employment income will be zero (-0-). Those additional expenses

which exceed the gross receipts will not be subtracted from other earned or unearned income in the household. If the number of hours worked

cannot be verified, the amount of child care services allowed shall not exceed the documented income divided by the current State minimum

hourly wage.

Example: A parent reports that she cleans 5 homes per week and only earns $100 per week. To calculate the number of hours/days to approve, divide $100

by $8.25 (State minimum wage effective 7/1/10) = 12.12 hours. Depending on the parent's actual work/transportation schedule, the parent could be approved

for either: 1 full and 1 part time day,

2 full and 1 part day, or

3 part days of care.

IL444-3455 (R-6-11)

Page 17 of 17

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17