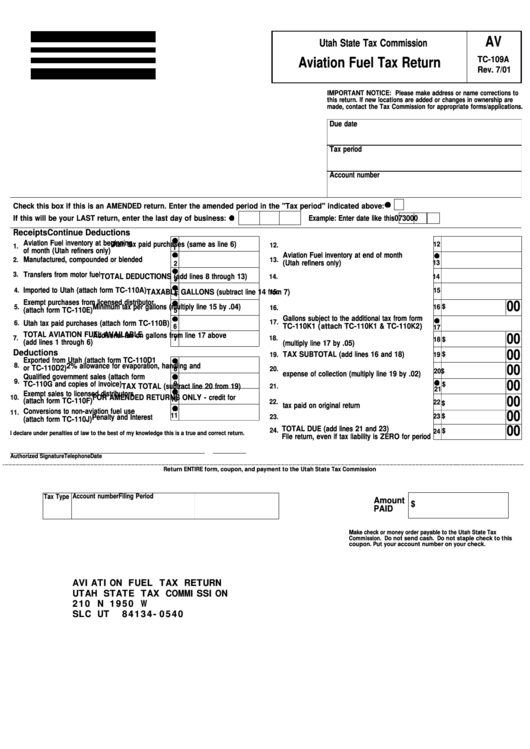

Form Tc-109a - Aviation Fuel Tax Return - Utah State Tax Commission

ADVERTISEMENT

AV

Utah State Tax Commission

TC-109A

Aviation Fuel Tax Return

Rev. 7/01

IMPORTANT NOTICE:

Please make address or name corrections to

this return. If new locations are added or changes in ownership are

made, contact the Tax Commission for appropriate forms/applications.

Due date

Tax period

Account number

Check this box if this is an AMENDED return. Enter the amended period in the "Tax period" indicated above:

If this will be your LAST return, enter the last day of business:

Example: Enter date like this

07 30 00

Receipts

Continue Deductions

Aviation Fuel inventory at beginning

Utah tax paid purchases (same as line 6)

12

12.

1.

1

of month (Utah refiners only)

Aviation Fuel inventory at end of month

Manufactured, compounded or blended

13.

2.

(Utah refiners only)

13

2

Transfers from motor fuel

3.

TOTAL DEDUCTIONS (add lines 8 through 13)

14.

14

3

Imported to Utah (attach form TC-110A)

4.

15

TAXABLE GALLONS (subtract line 14 from 7)

15.

4

Exempt purchases from licensed distributor

00

Minimum tax per gallons (multiply line 15 by .04)

5.

16

$

16.

(attach form TC-110E)

5

Gallons subject to the additional tax from form

17.

6.

Utah tax paid purchases (attach form TC-110B)

TC-110K1 (attach TC-110K1 & TC-110K2)

6

17

TOTAL AVIATION FUEL AVAILABLE

Additional tax on gallons from line 17 above

00

7.

18.

7

18 $

(add lines 1 through 6)

(multiply line 17 by .05)

Deductions

00

TAX SUBTOTAL (add lines 16 and 18)

$

19.

19

Exported from Utah (attach form TC-110D1

8.

2% allowance for evaporation, handling and

00

or TC-110D2)

8

20.

20 $

expense of collection (multiply line 19 by .02)

Qualified government sales (attach form

9.

00

TC-110G and copies of invoice)

9

$

21.

TAX TOTAL (subtract line 20 from 19)

21

Exempt sales to licensed distributors

FOR AMENDED RETURNS ONLY - credit for

10.

00

10

(attach form TC-110F)

22.

22 $

tax paid on original return

Conversions to non-aviation fuel use

11.

00

11

23

$

Penalty and Interest

23.

(attach form TC-110J)

TOTAL DUE (add lines 21 and 23)

00

24.

$

24

I declare under penalties of law to the best of my knowledge this is a true and correct return.

File return, even if tax liability is ZERO for period

Authorized Signature

Telephone

Date

Return ENTIRE form, coupon, and payment to the Utah State Tax Commission

109A.FRM Rev. 7/01

Account number

Filing Period

Tax Type

Amount

$

PAID

Make check or money order payable to the Utah State Tax

Commission.

Do not send cash. Do not staple check to this

coupon. Put your account number on your check.

AVIATION FUEL TAX RETURN

UTAH STATE TAX COMMISSION

210 N 1950 W

SLC UT

84134-0540

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1