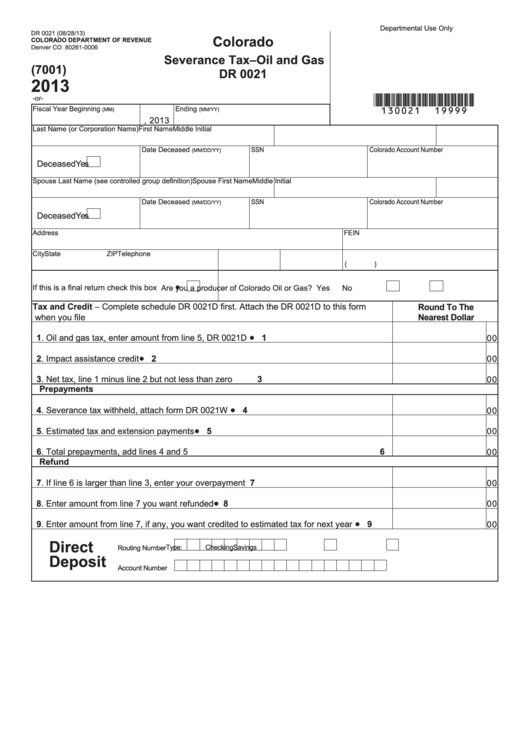

Form Dr 0021 - Colorado Severance Tax - Oil And Gas - 2013

ADVERTISEMENT

Departmental Use Only

DR 0021 (08/28/13)

Colorado

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

Severance Tax–Oil and Gas

(7001)

DR 0021

2013

*130021==19999*

-or-

Fiscal Year Beginning

Ending

(MM)

(MM/YY)

, 2013

Last Name (or Corporation Name)

First Name

Middle Initial

Date Deceased

SSN

Colorado Account Number

(MM/DD/YY)

Deceased

Yes

Spouse Last Name (see controlled group definition)

Spouse First Name

Middle Initial

Date Deceased

SSN

Colorado Account Number

(MM/DD/YY)

Deceased

Yes

Address

FEIN

City

State

ZIP

Telephone

(

)

If this is a final return check this box

Are you a producer of Colorado Oil or Gas?

Yes

No

Tax and Credit – Complete schedule DR 0021D first. Attach the DR 0021D to this form

Round To The

when you file

Nearest Dollar

•

1. Oil and gas tax, enter amount from line 5, DR 0021D

1

00

•

2. Impact assistance credit

2

00

3. Net tax, line 1 minus line 2 but not less than zero

3

00

Prepayments

•

4. Severance tax withheld, attach form DR 0021W

4

00

•

5. Estimated tax and extension payments

5

00

6. Total prepayments, add lines 4 and 5

6

00

Refund

7. If line 6 is larger than line 3, enter your overpayment

7

00

•

8. Enter amount from line 7 you want refunded

8

00

•

9. Enter amount from line 7, if any, you want credited to estimated tax for next year

9

00

Direct

Type:

Checking

Savings

Routing Number

Deposit

Account Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2