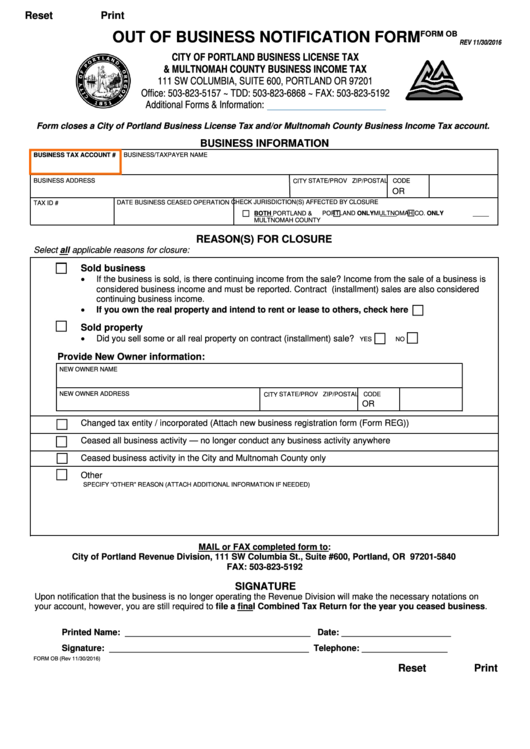

Reset

Print

FORM OB

OUT OF BUSINESS NOTIFICATION FORM

REV 11/30/2016

CITY OF PORTLAND BUSINESS LICENSE TAX

& MULTNOMAH COUNTY BUSINESS INCOME TAX

111 SW COLUMBIA, SUITE 600, PORTLAND OR 97201

Office: 503-823-5157 ~ TDD: 503-823-6868 ~ FAX: 503-823-5192

Additional Forms & Information:

Form closes a City of Portland Business License Tax and/or Multnomah County Business Income Tax account.

BUSINESS INFORMATION

BUSINESS/TAXPAYER NAME

BUSINESS TAX ACCOUNT #

BUSINESS ADDRESS

CITY

STATE/PROV ZIP/POSTAL CODE

OR

CHECK JURISDICTION(S) AFFECTED BY CLOSURE

TAX ID #

DATE BUSINESS CEASED OPERATION

BOTH PORTLAND &

PORTLAND ONLY

MULTNOMAH CO. ONLY

MULTNOMAH COUNTY

REASON(S) FOR CLOSURE

Select all applicable reasons for closure:

Sold business

If the business is sold, is there continuing income from the sale? Income from the sale of a business is

considered business income and must be reported. Contract (installment) sales are also considered

continuing business income.

If you own the real property and intend to rent or lease to others, check here

Sold property

Did you sell some or all real property on contract (installment) sale?

YES

NO

Provide New Owner information:

NEW OWNER NAME

NEW OWNER ADDRESS

CITY

STATE/PROV ZIP/POSTAL CODE

OR

Changed tax entity / incorporated (Attach new business registration form (Form REG))

Ceased all business activity — no longer conduct any business activity anywhere

Ceased business activity in the City and Multnomah County only

Other

SPECIFY “OTHER” REASON (ATTACH ADDITIONAL INFORMATION IF NEEDED)

MAIL or FAX completed form to:

City of Portland Revenue Division, 111 SW Columbia St., Suite #600, Portland, OR 97201-5840

FAX: 503-823-5192

SIGNATURE

Upon notification that the business is no longer operating the Revenue Division will make the necessary notations on

your account, however, you are still required to file a final Combined Tax Return for the year you ceased business.

Printed Name: _______________________________________ Date: _______________________

Signature: __________________________________________ Telephone: __________________

FORM OB (Rev 11/30/2016)

Reset

Print

1

1