Financial Disclosure For Reasonable And Affordable Rehabilitation Payments Form - U.s. Department Of Education

ADVERTISEMENT

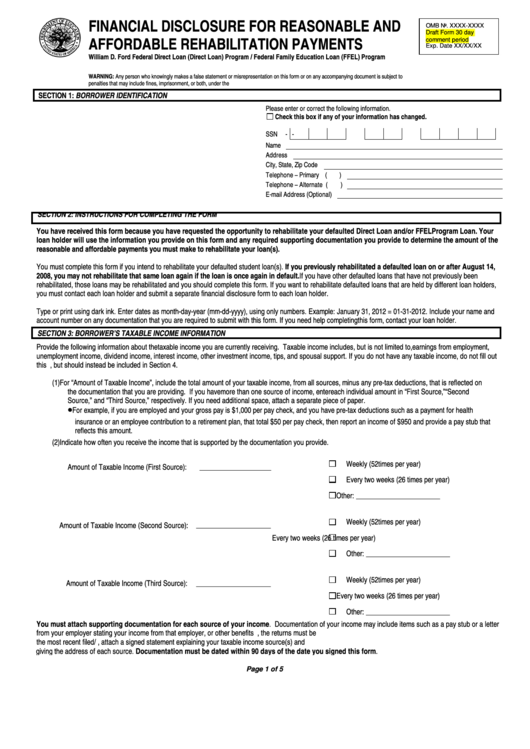

FINANCIAL DISCLOSURE FOR REASONABLE AND

OMB No. XXXX-XXXX

Draft Form 30 day

AFFORDABLE REHABILITATION PAYMENTS

comment period

Exp. Date XX/XX/XX

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family Education Loan (FFEL) Program

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to

penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER IDENTIFICATION

Please enter or correct the following information.

Check this box if any of your information has changed.

SSN

-

-

Name

Address

City, State, Zip Code

Telephone

Primary (

)

–

Telephone

Alternate (

)

–

E-mail Address (Optional)

SECTION 2: INSTRUCTIONS FOR COMPLETING THE FORM

You have received this form because you have requested the opportunity to rehabilitate your defaulted Direct Loan and/or FFEL Program Loan. Your

loan holder will use the information you provide on this form and any required supporting documentation you provide to determine the amount of the

reasonable and affordable payments you must make to rehabilitate your loan(s).

You must complete this form if you intend to rehabilitate your defaulted student loan(s). If you previously rehabilitated a defaulted loan on or after August 14,

2008, you may not rehabilitate that same loan again if the loan is once again in default. If you have other defaulted loans that have not previously been

rehabilitated, those loans may be rehabilitated and you should complete this form. If you want to rehabilitate defaulted loans that are held by different loan holders,

you must contact each loan holder and submit a separate financial disclosure form to each loan holder.

Type or print using dark ink. Enter dates as month-day-year (mm-dd-yyyy), using only numbers. Example: January 31, 2012 = 01-31-2012. Include your name and

account number on any documentation that you are required to submit with this form. If you need help completing this form, contact your loan holder.

SECTION 3: BORROWER’S TAXABLE INCOME INFORMATION

Provide the following information about the taxable income you are currently receiving. Taxable income includes, but is not limited to, earnings from employment,

unemployment income, dividend income, interest income, other investment income, tips, and spousal support. If you do not have any taxable income, do not fill out

this section. Please note that untaxed assistance payments should not be included in this section, but should instead be included in Section 4.

(1) For “Amount of Taxable Income”, include the total amount of your taxable income, from all sources, minus any pre-tax deductions, that is reflected on

the documentation that you are providing. If you have more than one source of income, enter each individual amount in “First Source,” “Second

Source,” and “Third Source,” respectively. If you need additional space, attach a separate piece of paper.

•

For example, if you are employed and your gross pay is $1,000 per pay check, and you have pre-tax deductions such as a payment for health

insurance or an employee contribution to a retirement plan, that total $50 per pay check, then report an income of $950 and provide a pay stub that

reflects this amount.

(2) Indicate how often you receive the income that is supported by the documentation you provide.

Weekly (52 times per year)

Amount of Taxable Income (First Source):

_______________________

Every two weeks (26 times per year)

Other:

___________________________

Weekly (52 times per year)

Amount of Taxable Income (Second Source):

________________________

Every two weeks (26 times per year)

Other:

___________________________

Weekly (52 times per year)

Amount of Taxable Income (Third Source):

________________________

Every two weeks (26 times per year)

Other:

___________________________

You must attach supporting documentation for each source of your income. Documentation of your income may include items such as a pay stub or a letter

from your employer stating your income from that employer, or other benefits statements. If you send tax returns as documentation of income, the returns must be

the most recent filed/available. If you do not have documentation of your taxable income, attach a signed statement explaining your taxable income source(s) and

giving the address of each source. Documentation must be dated within 90 days of the date you signed this form.

Page 1 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5