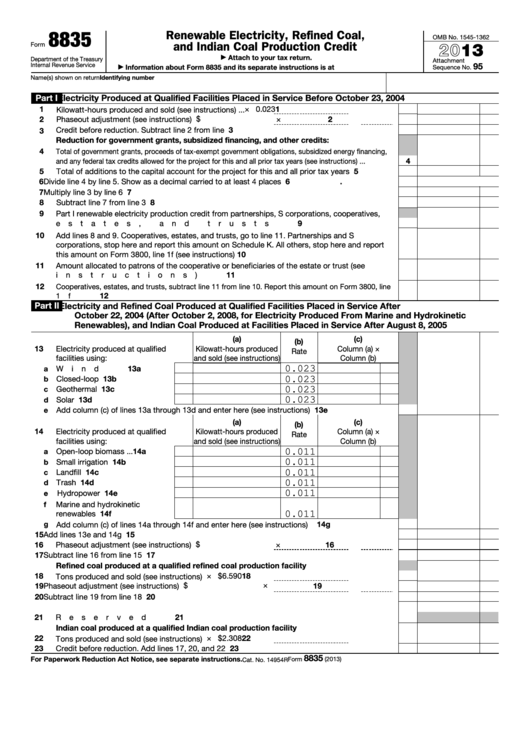

8835

Renewable Electricity, Refined Coal,

OMB No. 1545-1362

and Indian Coal Production Credit

2013

Form

Attach to your tax return.

Department of the Treasury

▶

Attachment

95

Internal Revenue Service

Information about Form 8835 and its separate instructions is at

Sequence No.

▶

Name(s) shown on return

Identifying number

Part I

Electricity Produced at Qualified Facilities Placed in Service Before October 23, 2004

1

× 0.023

1

Kilowatt-hours produced and sold (see instructions) .

.

.

$

2

Phaseout adjustment (see instructions) .

.

.

.

.

.

.

×

2

3

Credit before reduction. Subtract line 2 from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Reduction for government grants, subsidized financing, and other credits:

4

Total of government grants, proceeds of tax-exempt government obligations, subsidized energy financing,

4

and any federal tax credits allowed for the project for this and all prior tax years (see instructions) .

.

.

5

Total of additions to the capital account for the project for this and all prior tax years .

.

.

.

5

6

6

.

Divide line 4 by line 5. Show as a decimal carried to at least 4 places .

.

.

.

.

.

.

.

.

7

7

Multiply line 3 by line 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Subtract line 7 from line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Part I renewable electricity production credit from partnerships, S corporations, cooperatives,

estates, and trusts .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Add lines 8 and 9. Cooperatives, estates, and trusts, go to line 11. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, stop here and report

10

this amount on Form 3800, line 1f (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Cooperatives, estates, and trusts, subtract line 11 from line 10. Report this amount on Form 3800, line

12

1f

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part II

Electricity and Refined Coal Produced at Qualified Facilities Placed in Service After

October 22, 2004 (After October 2, 2008, for Electricity Produced From Marine and Hydrokinetic

Renewables), and Indian Coal Produced at Facilities Placed in Service After August 8, 2005

(a)

(c)

(b)

13

Electricity produced at qualified

Kilowatt-hours produced

Column (a) ×

Rate

facilities using:

and sold (see instructions)

Column (b)

13a

a

Wind

.

.

.

.

.

.

.

.

0.023

Closed-loop biomass .

.

.

13b

b

0.023

Geothermal .

.

.

.

.

.

13c

c

0.023

Solar

.

.

.

.

.

.

.

.

13d

d

0.023

13e

e

Add column (c) of lines 13a through 13d and enter here (see instructions) .

.

.

.

.

.

.

.

(a)

(c)

(b)

14

Electricity produced at qualified

Kilowatt-hours produced

Column (a) ×

Rate

facilities using:

and sold (see instructions)

Column (b)

Open-loop biomass

.

.

.

14a

a

0.011

Small irrigation power .

.

.

14b

b

0.011

14c

c

Landfill gas .

.

.

.

.

.

0.011

14d

d

Trash .

.

.

.

.

.

.

.

0.011

Hydropower .

.

.

.

.

.

14e

e

0.011

f

Marine and hydrokinetic

renewables .

.

.

.

.

.

14f

0.011

14g

g

Add column (c) of lines 14a through 14f and enter here (see instructions) .

.

.

.

.

.

.

.

15

15

Add lines 13e and 14g

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

Phaseout adjustment (see instructions) .

.

.

.

.

.

.

$

×

16

17

Subtract line 16 from line 15

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

Refined coal produced at a qualified refined coal production facility

18

× $6.590

18

Tons produced and sold (see instructions) .

.

.

.

.

.

×

19

$

19

Phaseout adjustment (see instructions) .

.

.

.

.

.

.

20

Subtract line 19 from line 18

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

20

21

Reserved .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

Indian coal produced at a qualified Indian coal production facility

22

22

× $2.308

Tons produced and sold (see instructions) .

.

.

.

.

.

23

23

Credit before reduction. Add lines 17, 20, and 22 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8835

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2013)

Cat. No. 14954R

1

1 2

2