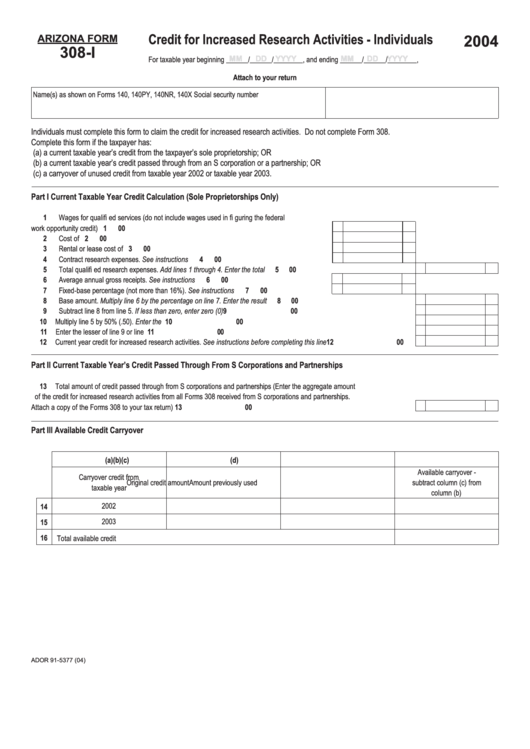

Arizona Form 308-I - Credit For Increased Research Activities - Individuals - 2004

ADVERTISEMENT

2004

ARIZONA FORM

Credit for Increased Research Activities - Individuals

308-I

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________,

Attach to your return

Name(s) as shown on Forms 140, 140PY, 140NR, 140X

Social security number

Individuals must complete this form to claim the credit for increased research activities. Do not complete Form 308.

Complete this form if the taxpayer has:

(a) a current taxable year’s credit from the taxpayer’s sole proprietorship; OR

(b) a current taxable year’s credit passed through from an S corporation or a partnership; OR

(c) a carryover of unused credit from taxable year 2002 or taxable year 2003.

Part I

Current Taxable Year Credit Calculation (Sole Proprietorships Only)

1 Wages for qualifi ed services (do not include wages used in fi guring the federal

work opportunity credit) ....................................................................................................................

1

00

2 Cost of supplies ................................................................................................................................

2

00

3 Rental or lease cost of computers ....................................................................................................

3

00

4 Contract research expenses. See instructions .................................................................................

4

00

5 Total qualifi ed research expenses. Add lines 1 through 4. Enter the total .......................................................................................

5

00

6 Average annual gross receipts. See instructions..............................................................................

6

00

7 Fixed-base percentage (not more than 16%). See instructions........................................................

7

00

8 Base amount. Multiply line 6 by the percentage on line 7. Enter the result .....................................................................................

8

00

9 Subtract line 8 from line 5. If less than zero, enter zero (0) .............................................................................................................

9

00

10 Multiply line 5 by 50% (.50). Enter the result ................................................................................................................................... 10

00

11 Enter the lesser of line 9 or line 10 ..................................................................................................................................................

11

00

12 Current year credit for increased research activities. See instructions before completing this line .................................................

12

00

Part II

Current Taxable Year’s Credit Passed Through From S Corporations and Partnerships

13 Total amount of credit passed through from S corporations and partnerships (Enter the aggregate amount

of the credit for increased research activities from all Forms 308 received from S corporations and partnerships.

Attach a copy of the Forms 308 to your tax return)..........................................................................................................................

13

00

Part III

Available Credit Carryover

(a)

(b)

(c)

(d)

Available carryover -

Carryover credit from

Original credit amount

Amount previously used

subtract column (c) from

taxable year

column (b)

2002

14

2003

15

16

Total available credit carryover..........................................................................................................................................

ADOR 91-5377 (04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2