Form Pit-1 - New Mexico Personal Income Tax/form Pit-Adj - New Mexico Schedule Of Additions And Deductions/exemptions - 2011

ADVERTISEMENT

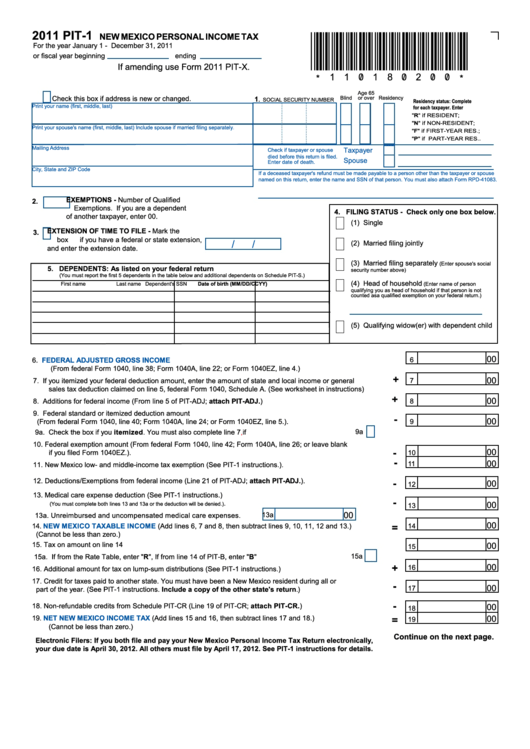

2011 PIT-1

NEW MEXICO PERSONAL INCOME TAX

*110180200*

For the year January 1 - December 31, 2011

or fiscal year beginning

ending

If amending use Form 2011 PIT-X.

Age 65

Check this box if address is new or changed.

Blind

or over Residency

1

. SoCIAL SECURITY NUMBER

Residency status: Complete

Print your name (first, middle, last)

for each taxpayer. Enter

"R" if RESIDENT;

"N" if NoN-RESIDENT;

Print your spouse's name (first, middle, last) Include spouse if married filing separately.

"F" if FIRST-YEAR RES.;

"P" if PART-YEAR RES..

Mailing Address

Taxpayer

Check if taxpayer or spouse

died before this return is filed.

Spouse

Enter date of death.

City, State and ZIP Code

If a deceased taxpayer's refund must be made payable to a person other than the taxpayer or spouse

named on this return, enter the name and SSN of that person. You must also attach Form RPD-41083.

EXEMPTIONS - Number of Qualified

2.

Exemptions. If you are a dependent

4. FILING STATUS - Check only one box below.

of another taxpayer, enter 00.

(1) Single

EXTENSION OF TIME TO FILE - Mark the

3.

box if you have a federal or state extension,

/

/

(2) Married filing jointly

and enter the extension date.

(3) Married filing separately

(Enter spouse's social

5. DEPENDENTS: As listed on your federal return

security number above)

(You must report the first 5 dependents in the table below and additional dependents on Schedule PIT-S.)

(4) Head of household

(Enter name of person

First name

Last name

Dependent's SSN

Date of birth (MM/DD/CCYY)

qualifying you as head of household if that person is not

counted as a qualified exemption on your federal return.)

(5) Qualifying widow(er) with dependent child

00

6

6.

FEDERAL ADJUSTED GROSS INCOME

....................................................................................................

(From federal Form 1040, line 38; Form 1040A, line 22; or Form 1040EZ, line 4.)

+

00

7.

If you itemized your federal deduction amount, enter the amount of state and local income or general

7

sales tax deduction claimed on line 5, federal Form 1040, Schedule A. (See worksheet in instructions) ....

+

00

8.

Additions for federal income (From line 5 of PIT-ADJ; attach PIT-ADJ.) ......................................................

8

9.

Federal standard or itemized deduction amount

-

00

(From federal Form 1040, line 40; Form 1040A, line 24; or Form 1040EZ, line 5.). ......................................

9

9a. Check the box if you itemized. You must also complete line

9a

7,

if applicable..................................

10. Federal exemption amount (From federal Form 1040, line 42; Form 1040A, line 26; or leave blank

-

00

if you filed Form 1040EZ.). .............................................................................................................................

10

-

00

11

11. New Mexico low- and middle-income tax exemption (See PIT-1 instructions.). ............................................

12. Deductions/Exemptions from federal income (Line 21 of PIT-ADJ; attach PIT-ADJ.). ................................

-

00

12

13. Medical care expense deduction (See PIT-1 instructions.)

-

. ...........................................................................

00

(You must complete both lines 13 and 13a or the deduction will be denied.)

13

00

13a

13a. Unreimbursed and uncompensated medical care expenses. .......

00

=

14.

NEW MEXICO TAXABLE INCOME

(Add lines 6, 7 and 8, then subtract lines 9, 10, 11, 12 and 13.) ..........

14

(Cannot be less than zero.)

15. Tax on amount on line 14 ................................................................................................................................

00

15

15a

15a. If from the Rate Table, enter "R", If from line 14 of PIT-B, enter "B".............................................

+

00

16

16. Additional amount for tax on lump-sum distributions (See PIT-1 instructions.) .............................................

17. Credit for taxes paid to another state. You must have been a New Mexico resident during all or

-

00

17

part of the year. (See PIT-1 instructions. Include a copy of the other state's return.) ..............................

-

18. Non-refundable credits from Schedule PIT-CR (Line 19 of PIT-CR; attach PIT-CR.) ..................................

00

18

=

00

19.

NET NEW MEXICO INCOME TAX

(Add lines 15 and 16, then subtract lines 17 and 18.) ...........................

19

(Cannot be less than zero.)

Continue on the next page.

Electronic Filers: If you both file and pay your New Mexico Personal Income Tax Return electronically,

your due date is April 30, 2012. All others must file by April 17, 2012. See PIT-1 instructions for details.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3