Instructions And Worksheet For 2008 Maine Estate Tax Return

ADVERTISEMENT

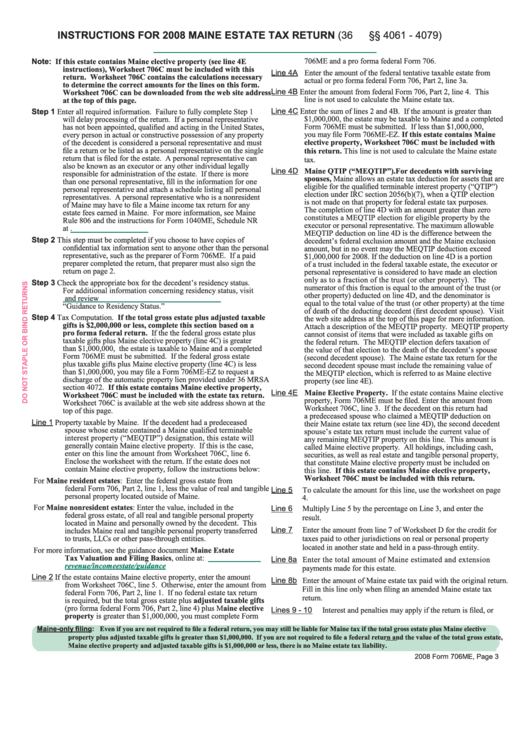

INSTRUCTIONS FOR 2008 MAINE ESTATE TAX RETURN (36 M.R.S.A. §§ 4061 - 4079)

Note:

If this estate contains Maine elective property (see line 4E

706ME and a pro forma federal Form 706.

instructions), Worksheet 706C must be included with this

Line 4A Enter the amount of the federal tentative taxable estate from

return. Worksheet 706C contains the calculations necessary

actual or pro forma federal Form 706, Part 2, line 3a.

to determine the correct amounts for the lines on this form.

Line 4B Enter the amount from federal Form 706, Part 2, line 4. This

Worksheet 706C can be downloaded from the web site address

line is not used to calculate the Maine estate tax.

at the top of this page.

Line 4C Enter the sum of lines 2 and 4B. If the amount is greater than

Step 1 Enter all required information. Failure to fully complete Step 1

$1,000,000, the estate may be taxable to Maine and a completed

will delay processing of the return. If a personal representative

Form 706ME must be submitted. If less than $1,000,000,

has not been appointed, qualified and acting in the United States,

you may file Form 706ME-EZ. If this estate contains Maine

every person in actual or constructive possession of any property

elective property, Worksheet 706C must be included with

of the decedent is considered a personal representative and must

file a return or be listed as a personal representative on the single

this return. This line is not used to calculate the Maine estate

return that is filed for the estate. A personal representative can

tax.

also be known as an executor or any other individual legally

Line 4D Maine QTIP (“MEQTIP”). For decedents with surviving

responsible for administration of the estate. If there is more

spouses, Maine allows an estate tax deduction for assets that are

than one personal representative, fill in the information for one

eligible for the qualified terminable interest property (“QTIP”)

personal representative and attach a schedule listing all personal

election under IRC section 2056(b)(7), when a QTIP election

representatives. A personal representative who is a nonresident

is not made on that property for federal estate tax purposes.

of Maine may have to file a Maine income tax return for any

The completion of line 4D with an amount greater than zero

estate fees earned in Maine. For more information, see Maine

constitutes a MEQTIP election for eligible property by the

Rule 806 and the instructions for Form 1040ME, Schedule NR

executor or personal representative. The maximum allowable

at

MEQTIP deduction on line 4D is the difference between the

Step 2 This step must be completed if you choose to have copies of

decedent’s federal exclusion amount and the Maine exclusion

confidential tax information sent to anyone other than the personal

amount, but in no event may the MEQTIP deduction exceed

representative, such as the preparer of Form 706ME. If a paid

$1,000,000 for 2008. If the deduction on line 4D is a portion

preparer completed the return, that preparer must also sign the

of a trust included in the federal taxable estate, the executor or

return on page 2.

personal representative is considered to have made an election

only as to a fraction of the trust (or other property). The

Step 3 Check the appropriate box for the decedent’s residency status.

numerator of this fraction is equal to the amount of the trust (or

For additional information concerning residency status,

visit

other property) deducted on line 4D, and the denominator is

and review

equal to the total value of the trust (or other property) at the time

“Guidance to Residency Status.”

of death of the deducting decedent (first decedent spouse). Visit

Step 4 Tax Computation. If the total gross estate plus adjusted taxable

the web site address at the top of this page for more information.

gifts is $2,000,000 or less, complete this section based on a

Attach a description of the MEQTIP property. MEQTIP property

pro forma federal return. If the the federal gross estate plus

cannot consist of items that were included as taxable gifts on

taxable gifts plus Maine elective property (line 4C) is greater

the federal return. The MEQTIP election defers taxation of

than $1,000,000, the estate is taxable to Maine and a completed

the value of that election to the death of the decedent’s spouse

Form 706ME must be submitted. If the federal gross estate

(second decedent spouse). The Maine estate tax return for the

plus taxable gifts plus Maine elective property (line 4C) is less

second decedent spouse must include the remaining value of

than $1,000,000, you may file a Form 706ME-EZ to request a

the MEQTIP election, which is referred to as Maine elective

discharge of the automatic property lien provided under 36 MRSA

property (see line 4E).

section 4072. If this estate contains Maine elective property,

Line 4E Maine Elective Property. If the estate contains Maine elective

Worksheet 706C must be included with the estate tax return.

property, Form 706ME must be filed. Enter the amount from

Worksheet 706C is available at the web site address shown at the

Worksheet 706C, line 3. If the decedent on this return had

top of this page.

a predeceased spouse who claimed a MEQTIP deduction on

Line 1

Property taxable by Maine. If the decedent had a predeceased

their Maine estate tax return (see line 4D), the second decedent

spouse whose estate contained a Maine qualified terminable

spouse’s estate tax return must include the current value of

interest property (“MEQTIP”) designation, this estate will

any remaining MEQTIP property on this line. This amount is

generally contain Maine elective property. If this is the case,

called Maine elective property. All holdings, including cash,

enter on this line the amount from Worksheet 706C, line 6.

securities, as well as real estate and tangible personal property,

Enclose the worksheet with the return. If the estate does not

that constitute Maine elective property must be included on

contain Maine elective property, follow the instructions below:

this line. If this estate contains Maine elective property,

Worksheet 706C must be included with this return.

For Maine resident estates: Enter the federal gross estate from

federal Form 706, Part 2, line 1, less the value of real and tangible

Line 5

To calculate the amount for this line, use the worksheet on page

personal property located outside of Maine.

4.

For Maine nonresident estates: Enter the value, included in the

Line 6

Multiply Line 5 by the percentage on Line 3, and enter the

federal gross estate, of all real and tangible personal property

result.

located in Maine and personally owned by the decedent. This

Line 7. Enter the amount from line 7 of Worksheet D for the credit for

includes Maine real and tangible personal property transferred

taxes paid to other jurisdictions on real or personal property

to trusts, LLCs or other pass-through entities.

located in another state and held in a pass-through entity.

For more information, see the guidance document Maine Estate

Tax Valuation and Filing

Basics, online at:

Line 8a Enter the total amount of Maine estimated and extension

revenue/incomeestate/guidance

payments made for this estate.

Line 2

If the estate contains Maine elective property, enter the amount

Line 8b Enter the amount of Maine estate tax paid with the original return.

from Worksheet 706C, line 5. Otherwise, enter the amount from

Fill in this line only when filing an amended Maine estate tax

federal Form 706, Part 2, line 1. If no federal estate tax return

return.

is required, but the total gross estate plus adjusted taxable gifts

(pro forma federal Form 706, Part 2, line 4) plus Maine elective

Lines 9 - 10

Interest and penalties may apply if the return is filed, or

property is greater than $1,000,000, you must complete Form

Maine-only filing:. Even if you are not required to file a federal return, you may still be liable for Maine tax if the total gross estate plus Maine elective

property plus adjusted taxable gifts is greater than $1,000,000. If you are not required to file a federal return and the value of the total gross estate,

Maine elective property and adjusted taxable gifts is $1,000,000 or less, there is no Maine estate tax liability.

2008 Form 706ME, Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5