PREPARE FOR YOUR TELEFILE CALL BY COMPLETING

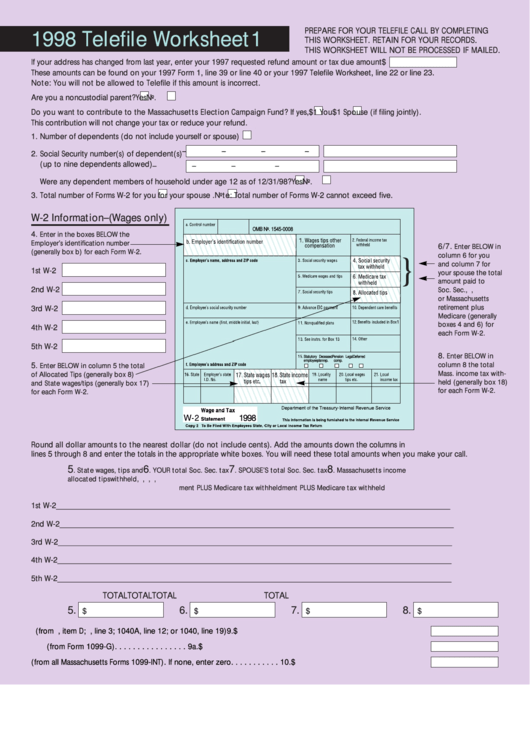

1998 Telefile Worksheet 1

THIS WORKSHEET. RETAIN FOR YOUR RECORDS.

THIS WORKSHEET WILL NOT BE PROCESSED IF MAILED.

If your address has changed from last year, enter your 1997 requested refund amount or tax due amount

$

These amounts can be found on your 1997 Form 1, line 39 or line 40 or your 1997 Telefile Worksheet, line 22 or line 23.

Note: You will not be allowed to Telefile if this amount is incorrect.

Are you a noncustodial parent?

Yes

No.

Do you want to contribute to the Massachusetts Election Campaign Fund? If yes,

$1 You

$1 Spouse (if filing jointly).

This contribution will not change your tax or reduce your refund.

1. Number of dependents (do not include yourself or spouse)

–

–

–

–

2. Social Security number(s) of dependent(s)

(up to nine dependents allowed)

–

–

–

–

Were any dependent members of household under age 12 as of 12/31/98?

Yes

No.

3. Total number of Forms W-2 for you

for your spouse

. Note: Total number of Forms W-2 cannot exceed five.

W-2 Information – (Wages only)

OMB No. 1545-0008

4.

Enter in the boxes BELOW the

Employer’s identification number

6/7.

Enter BELOW in

(generally box b) for each Form W-2.

column 6 for you

}

and column 7 for

1st W-2

your spouse the total

amount paid to

2nd W-2

Soc. Sec., U.S., R.R.

or Massachusetts

retirement plus

3rd W-2

Medicare (generally

boxes 4 and 6) for

4th W-2

each Form W-2.

5th W-2

8.

Enter BELOW in

Statutory Deceased Pension Legal Deferred

employee

plan

rep.

comp.

column 8 the total

5.

Enter BELOW in column 5 the total

Mass. income tax with-

of Allocated Tips (generally box 8)

held (generally box 18)

and State wages/tips (generally box 17)

for each Form W-2.

for each Form W-2.

1998

Round all dollar amounts to the nearest dollar (do not include cents). Add the amounts down the columns in

lines 5 through 8 and enter the totals in the appropriate white boxes. You will need these total amounts when you make your call.

5

6

7

8

. State wages, tips and

. YOUR total Soc. Sec. tax

. SPOUSE’S total Soc. Sec. tax

. Massachusetts income

allocated tips

withheld, U.S., R.R. or MA retire-

withheld, U.S., R.R. or MA retire-

tax withheld

ment PLUS Medicare tax withheld

ment PLUS Medicare tax withheld

1st W-2

_________________________

_________________________

_________________________

_________________________

2nd W-2

_________________________

_________________________

_________________________

_________________________

3rd W-2

_________________________

_________________________

_________________________

_________________________

4th W-2

_________________________

_________________________

_________________________

_________________________

5th W-2

_________________________

_________________________

_________________________

_________________________

TOTAL

TOTAL

TOTAL

TOTAL

5.

6.

7.

8.

$

$

$

$

29. Unemployment Compensation (from U.S. Telefile, item D; U.S. 1040EZ, line 3; 1040A, line 12; or 1040, line 19) 9. $

a. Total Massachusetts withholding for unemployment compensation (from Form 1099-G) . . . . . . . . . . . . . . . . 9a. $

10. Total Massachusetts Bank Interest (from all Massachusetts Forms 1099-INT). If none, enter zero . . . . . . . . . . . 10. $

1

1 2

2 3

3