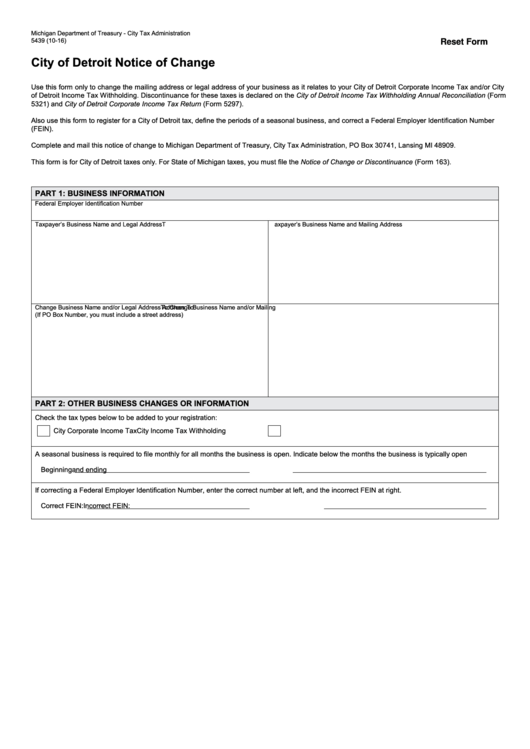

Michigan Department of Treasury - City Tax Administration

5439 (10-16)

Reset Form

City of Detroit Notice of Change

Use this form only to change the mailing address or legal address of your business as it relates to your City of Detroit Corporate Income Tax and/or City

of Detroit Income Tax Withholding. Discontinuance for these taxes is declared on the City of Detroit Income Tax Withholding Annual Reconciliation (Form

5321) and City of Detroit Corporate Income Tax Return (Form 5297).

Also use this form to register for a City of Detroit tax, define the periods of a seasonal business, and correct a Federal Employer Identification Number

(FEIN).

Complete and mail this notice of change to Michigan Department of Treasury, City Tax Administration, PO Box 30741, Lansing MI 48909.

This form is for City of Detroit taxes only. For State of Michigan taxes, you must file the Notice of Change or Discontinuance (Form 163).

PART 1: BUSINESS INFORMATION

Federal Employer Identification Number

Taxpayer’s Business Name and Legal Address

T

axpayer’s Business Name and Mailing Address

Change Business Name and/or Legal Address

To:

Change Business Name and/or Mailing

Address To:

(If PO Box Number, you must include a street address)

PART 2: OTHER BUSINESS CHANGES OR INFORMATION

Check the tax types below to be added to your registration:

City Corporate Income Tax

City Income Tax Withholding

A seasonal business is required to file monthly for all months the business is open. Indicate below the months the business is typically open

Beginning

and ending

If correcting a Federal Employer Identification Number, enter the correct number at left, and the incorrect FEIN at right.

Correct FEIN:

Incorrect FEIN:

1

1