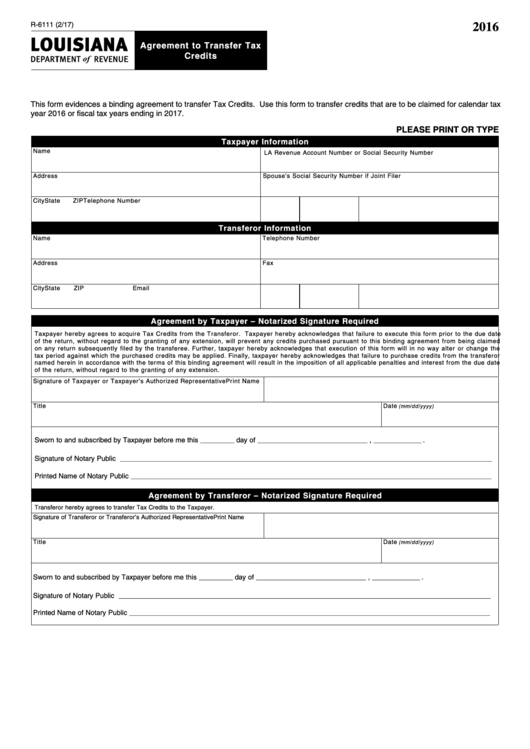

2016

R-6111 (2/17)

Agreement to Transfer Tax

Credits

This form evidences a binding agreement to transfer Tax Credits. Use this form to transfer credits that are to be claimed for calendar tax

year 2016 or fiscal tax years ending in 2017.

PLEASE PRINT OR TYPE

Taxpayer Information

Name

LA Revenue Account Number or Social Security Number

Address

Spouse’s Social Security Number if Joint Filer

City

State

ZIP

Telephone Number

Transferor Information

Name

Telephone Number

Address

Fax

City

State

ZIP

Email

Agreement by Taxpayer – Notarized Signature Required

Taxpayer hereby agrees to acquire Tax Credits from the Transferor. Taxpayer hereby acknowledges that failure to execute this form prior to the due date

of the return, without regard to the granting of any extension, will prevent any credits purchased pursuant to this binding agreement from being claimed

on any return subsequently filed by the transferee. Further, taxpayer hereby acknowledges that execution of this form will in no way alter or change the

tax period against which the purchased credits may be applied. Finally, taxpayer hereby acknowledges that failure to purchase credits from the transferor

named herein in accordance with the terms of this binding agreement will result in the imposition of all applicable penalties and interest from the due date

of the return, without regard to the granting of any extension.

Signature of Taxpayer or Taxpayer’s Authorized Representative

Print Name

Title

Date

(mm/dd/yyyy)

Sworn to and subscribed by Taxpayer before me this

day of

,

.

____________

_______________________________________

_________________

Signature of Notary Public

____________________________________________________________________________________________________________________________________

Printed Name of Notary Public

________________________________________________________________________________________________________________________________

Agreement by Transferor – Notarized Signature Required

Transferor hereby agrees to transfer Tax Credits to the Taxpayer.

Print Name

Signature of Transferor or Transferor’s Authorized Representative

Title

Date

(mm/dd/yyyy)

Sworn to and subscribed by Taxpayer before me this

day of

,

.

____________

_______________________________________

_________________

Signature of Notary Public

____________________________________________________________________________________________________________________________________

Printed Name of Notary Public

________________________________________________________________________________________________________________________________

1

1