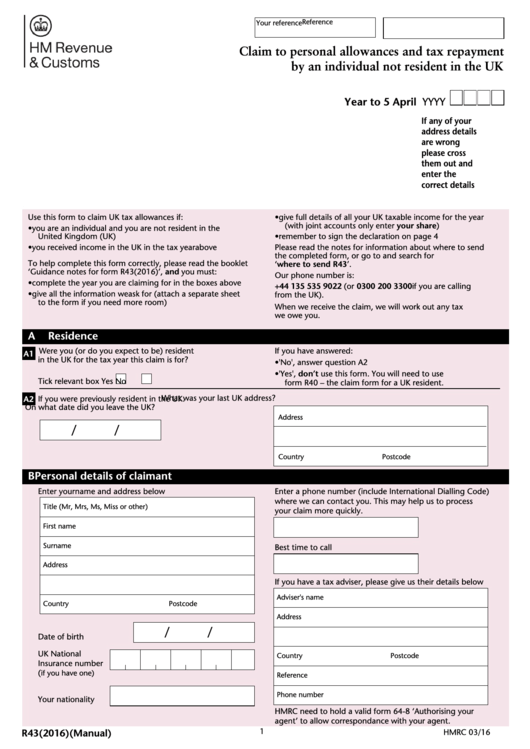

Form R43 - Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk

ADVERTISEMENT

Reference

Your reference

laim to personal allowances and tax repayment

by an individual not resident in the UK

Year to 5 April YYYY

If any of your

address details

are wrong

please cross

them out and

enter the

correct details

Use this form to claim UK tax allowances if:

• give full details of all your UK taxable income for the year

(with joint accounts only enter your share)

• you are an individual and you are not resident in the

United Kingdom (UK)

• remember to sign the declaration on page 4

• you received income in the UK in the tax year above

Please read the notes for information about where to send

the completed form, or go to and search for

To help complete this form correctly, please read the booklet

‘where to send R43’.

‘Guidance notes for form R43(2016)’, and you must:

Our phone number is:

• complete the year you are claiming for in the boxes above

+44 135 535 9022 (or 0300 200 3300 if you are calling

• give all the information we ask for (attach a separate sheet

from the UK).

to the form if you need more room)

When we receive the claim, we will work out any tax

we owe you.

A

Residence

Were you (or do you expect to be) resident

If you have answered:

A1

in the UK for the tax year this claim is for?

• 'No', answer question A2

• 'Yes', don’t use this form. You will need to use

Tick relevant box Yes

No

form R40 – the claim form for a UK resident.

What was your last UK address?

A2

If you were previously resident in the UK.

On what date did you leave the UK? DD.MM.YYYY

Address

/

/

Country

Postcode

B

Personal details of claimant

Enter your name and address below

Enter a phone number (include International Dialling Code)

where we can contact you. This may help us to process

Title (Mr, Mrs, Ms, Miss or other)

your claim more quickly.

First name

Surname

Best time to call

Address

If you have a tax adviser, please give us their details below

Adviser's name

Country

Postcode

Address

/

/

Date of birth

UK National

Country

Postcode

Insurance number

(

if you have one)

Reference

Phone number

Your nationality

HMRC need to hold a valid form 64-8 ‘Authorising your

agent’ to allow correspondance with your agent.

1

R43(2016)(Manual)

HMRC 03/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4