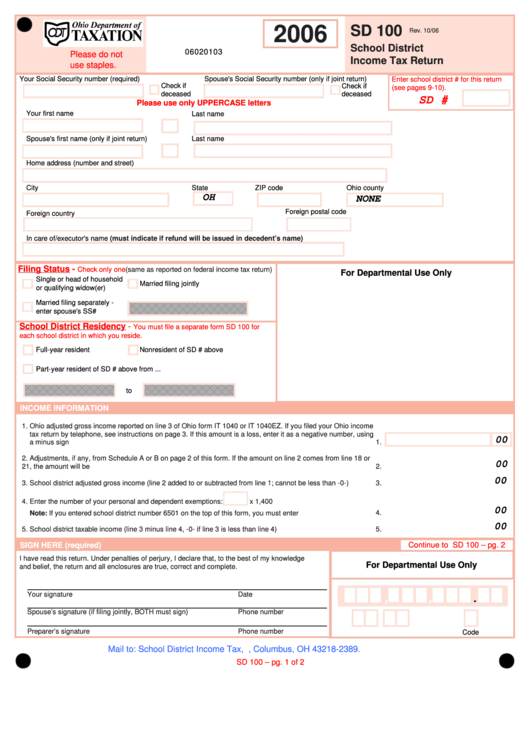

2006

SD 100

Rev. 10/06

School District

06020103

Please do not

Income Tax Return

use staples.

Your Social Security number (required)

Spouse's Social Security number (only if joint return)

Enter school district # for this return

Check if

Check if

(see pages 9-10).

deceased

deceased

SD #

Please use only UPPERCASE letters

Your first name

M.I.

Last name

Spouse's first name (only if joint return)

M.I.

Last name

Home address (number and street)

City

State

ZIP code

Ohio county

OH

NONE

Foreign postal code

Foreign country

In care of/executor's name

(must indicate if refund will be issued in decedent’s name)

Filing Status -

Check only one

(same as reported on federal income tax return)

For Departmental Use Only

Single or head of household

Married filing jointly

or qualifying widow(er)

Married filing separately -

enter spouse's SS#

School District Residency -

You must file a separate form SD 100 for

each school district in which you reside.

Full-year resident

Nonresident of SD # above

Part-year resident of SD # above from ...

to

INCOME INFORMATION

1. Ohio adjusted gross income reported on line 3 of Ohio form IT 1040 or IT 1040EZ. If you filed your Ohio income

tax return by telephone, see instructions on page 3. If this amount is a loss, enter it as a negative number, using

00

a minus sign .............................................................................................................................................................. 1.

2. Adjustments, if any, from Schedule A or B on page 2 of this form. If the amount on line 2 comes from line 18 or

00

21, the amount will be negative................................................................................................................................. 2.

00

3. School district adjusted gross income (line 2 added to or subtracted from line 1; cannot be less than -0-)...........

3.

4. Enter the number of your personal and dependent exemptions:

x 1,400

00

Note: If you entered school district number 6501 on the top of this form, you must enter -0-...................................

4.

00

5. School district taxable income (line 3 minus line 4, -0- if line 3 is less than line 4) ................................................... 5.

SIGN HERE (required)

Continue to SD 100 – pg. 2

I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge

For Departmental Use Only

and belief, the return and all enclosures are true, correct and complete.

Your signature

Date

,

,

.

Spouse’s signature (if filing jointly, BOTH must sign)

Phone number

Preparer’s signature

Phone number

Code

Mail to: School District Income Tax, P.O. Box 182389, Columbus, OH 43218-2389.

SD 100 – pg. 1 of 2

1

1 2

2