Instructions For Completing Form WH−3 Annual Reconciliation Form

Line 1 − Enter the total Indiana state income tax withheld as shown on Forms W−2, WH−18, and 1099.

Line 2 − Enter the total Indiana county income tax withheld as shown on Forms W−2, WH−18, and 1099. All entries on this line must be

broken down on Form WH−3 by counties for which the amounts were withheld. The sum of the county break down must equal

the amount on Line 2.

Line 3 − Enter Indiana Advance Earned Income Credit. Do not include any Federal Advance Earned Income Credit.

Line 4 − Add Lines 1 and 2; subtract Line 3 and enter the total here. If your account has been overpaid, continue to Line 5. If you

have underpaid the withholding tax, see instructions for underpayment of Indiana withholding.

Line 5 − Complete this line only if your account has been overpaid and you are claiming a refund. Enter the amount of your overpayment

on Line 5. No refund will be issued unless all areas of the Form WH−3 are complete and all W−2s, WH−18s, and 1099s are

enclosed.

Note: − Remittance must be made with the WH−1U or by EFT, but not with the WH−3.

3

WH−3

08−10

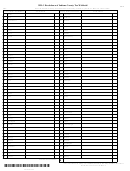

Taxpayer ID Number

For Tax Period

Due on or Before

Enter the total amount of state tax withheld during the tax year as shown on W−2s,

WH−18s, and 1099s.........................................................................................................................

1.

Enter the total amount of county tax withheld during the tax year as shown on W−2s,

WH−18s, and 1099s*.......................................................................................................................

2.

Enter Advance Earned Income Credit Do not include Federal AEIC on this line......................

3.

4.

Total − Add Lines 1 & 2; Subtract Line 3**...................................................................................

5.

Refund Claimed − See the instructions..........................................................................................

Any amount due must be paid on the

WH−1U.

* The amount entered on this line must be broken down by county on the reverse side.

** Compare the amount on Line 4 with the amount of withholding tax you actually paid (excluding late fees and interest) for the tax year 2010. If you underpaid your

withholding tax, complete Form WH−1U and mail it along with your payment.

I have completed the breakdown of county tax withheld for each county on the reverse page.

Check if Magnetic Media is enclosed.

Total # of W−2s, WH−18s & 1099s Enclosed

X

Authorized Signature_______________________________

Date

Phone

I declare under penalties of perjury that this is a true, correct and

complete return.

Check if amending or correcting a previously filed

WH−3.

2010

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 6108

INDIANAPOLIS, IN 46206-6108

1

1 2

2