Form Dol-4n - Employer'S Quarterly Tax And Wage Report - Georgia Department Of Labor

ADVERTISEMENT

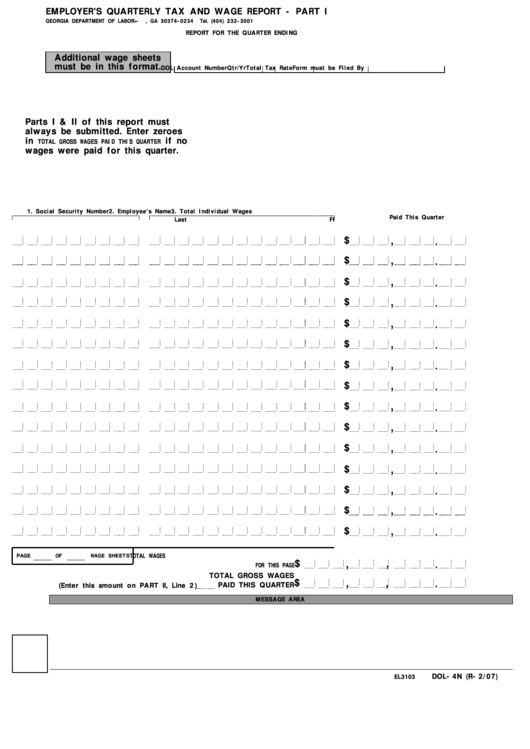

EMPLOYER'S QUARTERLY TAX AND WAGE REPORT - PART I

GEORGIA DEPARTMENT OF LABOR<- P.O. BOX 740234 - ATLANTA, GA 30374-0234

Tel. (404) 232-3001

REPORT FOR THE QUARTER ENDING

Additional wage sheets

must be in this format.

DOL Account Number

Qtr/Yr

Total Tax Rate

Form must be Filed By

Parts I & II of this report must

always be submitted. Enter zeroes

in

if no

TOTAL GROSS WAGES PAID THIS QUARTER

wages were paid for this quarter.

1. Social Security Number

2. Employee's Name

3. Total Individual Wages

Paid This Quarter

Last

FI

,

.

$

,

$

.

,

.

$

,

.

$

,

.

$

,

$

.

,

.

$

,

.

$

,

$

.

,

.

$

,

.

$

,

.

$

,

$

.

,

$

.

,

.

$

TOTAL WAGES

PAGE

OF

WAGE SHEETS

,

,

.

$

FOR THIS PAGE

TOTAL GROSS WAGES

,

,

.

$

(Enter this amount on PART II, Line 2)

PAID THIS QUARTER

MESSAGE AREA

DOL-4N (R-2/07)

EL3103

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2