Form 5208 - Quarterly Tax Report - Washington Employment Security Department

ADVERTISEMENT

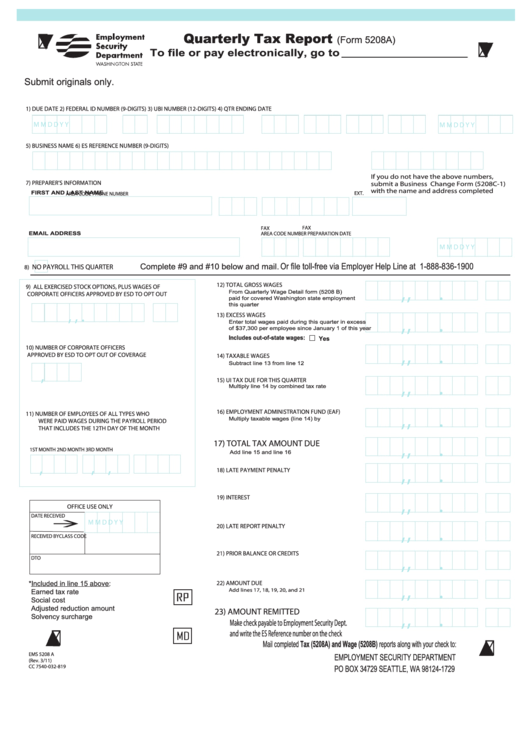

Quarterly Tax Report

(Form 5208A)

To file or pay electronically, go to

Submit originals only.

1) DUE DATE

2) FEDERAL ID NUMBER (9-DIGITS)

3) UBI NUMBER (12-DIGITS)

4) QTR ENDING DATE

M M

D

D

Y

Y

M M

D

D

Y

Y

5) BUSINESS NAME

6) ES REFERENCE NUMBER (9-DIGITS)

If you do not have the above numbers,

7) PREPARER’S INFORMATION

submit a Business Change Form (5208C-1)

with the name and address completed

FIRST AND LAST NAME

EXT.

AREA CODE

PHONE NUMBER

FAX

FAX

EMAIL ADDRESS

AREA CODE

NUMBER

PREPARATION DATE

M M

D

D

Y

Y

Or file toll-free via Employer Help Line at 1-888-836-1900

Complete #9 and #10 below and mail.

NO PAYROLL THIS QUARTER

8)

,

,

.

12) TOTAL GROSS WAGES

9) ALL EXERCISED STOCK OPTIONS, PLUS WAGES OF

From Quarterly Wage Detail form (5208 B)

CORPORATE OFFICERS APPROVED BY ESD TO OPT OUT

paid for covered Washington state employment

this quarter

,

,

.

13) EXCESS WAGES

,

,

.

Enter total wages paid during this quarter in excess

of $37,300 per employee since January 1 of this year

Includes out-of-state wages:

Yes

,

,

.

10) NUMBER OF CORPORATE OFFICERS

APPROVED BY ESD TO OPT OUT OF COVERAGE

14) TAXABLE WAGES

Subtract line 13 from line 12

,

,

,

.

15) UI TAX DUE FOR THIS QUARTER

Multiply line 14 by combined tax rate

,

,

.

16) EMPLOYMENT ADMINISTRATION FUND (EAF)

11) NUMBER OF EMPLOYEES OF ALL TYPES WHO

Multiply taxable wages (line 14) by

WERE PAID WAGES DURING THE PAYROLL PERIOD

THAT INCLUDES THE 12TH DAY OF THE MONTH

,

,

.

17) TOTAL TAX AMOUNT DUE

1ST MONTH

2ND MONTH

3RD MONTH

Add line 15 and line 16

,

,

,

,

,

.

18) LATE PAYMENT PENALTY

,

,

.

19) INTEREST

OFFICE USE ONLY

DATE RECEIVED

M M

D

D

Y

Y

,

,

.

20) LATE REPORT PENALTY

RECEIVED BY

CLASS CODE

21) PRIOR BALANCE OR CREDITS

,

,

.

DTO

,

,

.

*Included in line 15 above:

22) AMOUNT DUE

Add lines 17, 18, 19, 20, and 21

Earned tax rate

RP

Social cost

Adjusted reduction amount

23) AMOUNT REMITTED

,

,

.

Solvency surcharge

Make check payable to Employment Security Dept.

and write the ES Reference number on the check

Mail completed Tax (5208A) and Wage (5208B) reports along with your check to:

EMS 5208 A

EMPLOYMENT SECURITY DEPARTMENT

(Rev. 3/11)

CC 7540-032-819

PO BOX 34729 SEATTLE, WA 98124-1729

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1