Instructions For Form 541-Es - Estimated Tax For Fiduciaries - California Franchise Tax Board - 2001

ADVERTISEMENT

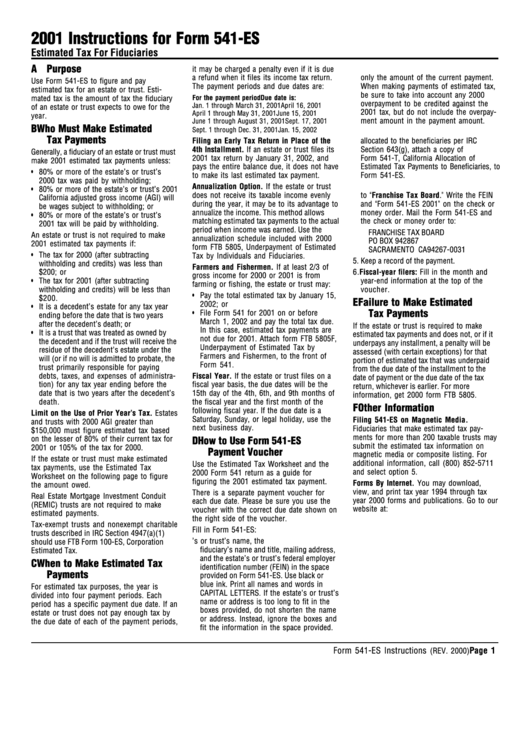

2001 Instructions for Form 541-ES

Estimated Tax For Fiduciaries

A Purpose

it may be charged a penalty even if it is due

2. Enter in the payment box of the voucher

a refund when it files its income tax return.

only the amount of the current payment.

Use Form 541-ES to figure and pay

The payment periods and due dates are:

When making payments of estimated tax,

estimated tax for an estate or trust. Esti-

be sure to take into account any 2000

For the payment period

Due date is:

mated tax is the amount of tax the fiduciary

overpayment to be credited against the

Jan. 1 through March 31, 2001

April 16, 2001

of an estate or trust expects to owe for the

2001 tax, but do not include the overpay-

April 1 through May 31, 2001

June 15, 2001

year.

ment amount in the payment amount.

June 1 through August 31, 2001

Sept. 17, 2001

B Who Must Make Estimated

Sept. 1 through Dec. 31, 2001

Jan. 15, 2002

3. If part of the estimated tax is to be

Tax Payments

Filing an Early Tax Return in Place of the

allocated to the beneficiaries per IRC

4th Installment. If an estate or trust files its

Section 643(g), attach a copy of

Generally, a fiduciary of an estate or trust must

2001 tax return by January 31, 2002, and

Form 541-T, California Allocation of

make 2001 estimated tax payments unless:

pays the entire balance due, it does not have

Estimated Tax Payments to Beneficiaries, to

• 80% or more of the estate’s or trust’s

to make its last estimated tax payment.

Form 541-ES.

2000 tax was paid by withholding;

Annualization Option. If the estate or trust

4. Make the check or money order payable

• 80% or more of the estate’s or trust’s 2001

does not receive its taxable income evenly

to “ Franchise Tax Board.” Write the FEIN

California adjusted gross income (AGI) will

during the year, it may be to its advantage to

and “Form 541-ES 2001” on the check or

be wages subject to withholding; or

annualize the income. This method allows

money order. Mail the Form 541-ES and

• 80% or more of the estate’s or trust’s

matching estimated tax payments to the actual

the check or money order to:

2001 tax will be paid by withholding.

period when income was earned. Use the

FRANCHISE TAX BOARD

An estate or trust is not required to make

annualization schedule included with 2000

PO BOX 942867

2001 estimated tax payments if:

form FTB 5805, Underpayment of Estimated

SACRAMENTO CA 94267-0031

• The tax for 2000 (after subtracting

Tax by Individuals and Fiduciaries.

5. Keep a record of the payment.

withholding and credits) was less than

Farmers and Fishermen. If at least 2/3 of

$200; or

6. Fiscal-year filers: Fill in the month and

gross income for 2000 or 2001 is from

• The tax for 2001 (after subtracting

year-end information at the top of the

farming or fishing, the estate or trust may:

withholding and credits) will be less than

voucher.

• Pay the total estimated tax by January 15,

$200.

E Failure to Make Estimated

2002; or

• It is a decedent’s estate for any tax year

• File Form 541 for 2001 on or before

Tax Payments

ending before the date that is two years

March 1, 2002 and pay the total tax due.

after the decedent’s death; or

If the estate or trust is required to make

In this case, estimated tax payments are

• It is a trust that was treated as owned by

estimated tax payments and does not, or if it

not due for 2001. Attach form FTB 5805F,

the decedent and if the trust will receive the

underpays any installment, a penalty will be

Underpayment of Estimated Tax by

residue of the decedent’s estate under the

assessed (with certain exceptions) for that

Farmers and Fishermen, to the front of

will (or if no will is admitted to probate, the

portion of estimated tax that was underpaid

Form 541.

trust primarily responsible for paying

from the due date of the installment to the

debts, taxes, and expenses of administra-

Fiscal Year. If the estate or trust files on a

date of payment or the due date of the tax

tion) for any tax year ending before the

fiscal year basis, the due dates will be the

return, whichever is earlier. For more

date that is two years after the decedent’s

15th day of the 4th, 6th, and 9th months of

information, get 2000 form FTB 5805.

death.

the fiscal year and the first month of the

F Other Information

following fiscal year. If the due date is a

Limit on the Use of Prior Year’s Tax. Estates

Saturday, Sunday, or legal holiday, use the

Filing 541-ES on Magnetic Media.

and trusts with 2000 AGI greater than

next business day.

Fiduciaries that make estimated tax pay-

$150,000 must figure estimated tax based

ments for more than 200 taxable trusts may

on the lesser of 80% of their current tax for

D How to Use Form 541-ES

submit the estimated tax information on

2001 or 105% of the tax for 2000.

Payment Voucher

magnetic media or composite listing. For

If the estate or trust must make estimated

additional information, call (800) 852-5711

Use the Estimated Tax Worksheet and the

tax payments, use the Estimated Tax

and select option 5.

2000 Form 541 return as a guide for

Worksheet on the following page to figure

figuring the 2001 estimated tax payment.

Forms By Internet. You may download,

the amount owed.

view, and print tax year 1994 through tax

There is a separate payment voucher for

Real Estate Mortgage Investment Conduit

year 2000 forms and publications. Go to our

each due date. Please be sure you use the

(REMIC) trusts are not required to make

website at:

voucher with the correct due date shown on

estimated payments.

the right side of the voucher.

Tax-exempt trusts and nonexempt charitable

Fill in Form 541-ES:

trusts described in IRC Section 4947(a)(1)

1. Print the estate’s or trust’s name, the

should use FTB Form 100-ES, Corporation

fiduciary’s name and title, mailing address,

Estimated Tax.

and the estate’s or trust’s federal employer

C When to Make Estimated Tax

identification number (FEIN) in the space

Payments

provided on Form 541-ES. Use black or

blue ink. Print all names and words in

For estimated tax purposes, the year is

CAPITAL LETTERS. If the estate’s or trust’s

divided into four payment periods. Each

name or address is too long to fit in the

period has a specific payment due date. If an

boxes provided, do not shorten the name

estate or trust does not pay enough tax by

or address. Instead, ignore the boxes and

the due date of each of the payment periods,

fit the information in the space provided.

Form 541-ES Instructions

Page 1

(REV. 2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1