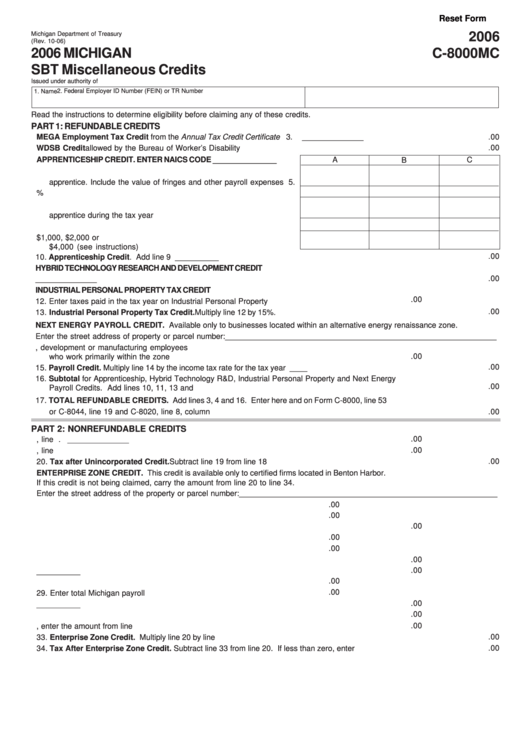

Reset Form

Michigan Department of Treasury

2006

(Rev. 10-06)

2006 MICHIGAN

C-8000MC

SBT Miscellaneous Credits

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

2. Federal Employer ID Number (FEIN) or TR Number

1. Name

Read the instructions to determine eligibility before claiming any of these credits.

PART 1: REFUNDABLE CREDITS

3. Enter the MEGA Employment Tax Credit from the Annual Tax Credit Certificate ........................................

3.

______________

.00

4. Enter the amount of WDSB Credit allowed by the Bureau of Worker’s Disability Compensation ..............

4.

______________

.00

APPRENTICESHIP CREDIT. ENTER NAICS CODE _______________

A

C

B

5. Enter all payroll and wages paid to each apprentice or special

apprentice. Include the value of fringes and other payroll expenses 5.

6. Multiply line 5 by 50% .......................................................................

6.

7. Enter all educational costs paid for each apprentice or special

apprentice during the tax year ..........................................................

7.

8. Add lines 6 and 7 ..............................................................................

8.

9. Enter the amount on line 8 - limited to $1,000, $2,000 or

$4,000 (see instructions) .................................................................

9.

.00

10. Apprenticeship Credit. Add line 9 across ................................................................................................... 10. _______________

HYBRID TECHNOLOGY RESEARCH AND DEVELOPMENT CREDIT

.00

11. Enter amount from the Annual Tax Credit Certificate received from MEGA .................................................. 11. _______________

INDUSTRIAL PERSONAL PROPERTY TAX CREDIT

.00

12. Enter taxes paid in the tax year on Industrial Personal Property ............................. 12. ______________

.00

13. Industrial Personal Property Tax Credit. Multiply line 12 by 15%. ............................................................. 13. _______________

NEXT ENERGY PAYROLL CREDIT. Available only to businesses located within an alternative energy renaissance zone.

Enter the street address of property or parcel number: ______________________________________________________________

14. Enter the total payroll of research, development or manufacturing employees

.00

who work primarily within the zone ........................................................................... 14. ______________

.00

15. Payroll Credit. Multiply line 14 by the income tax rate for the tax year ........................................................

15. _______________

16. Subtotal for Apprenticeship, Hybrid Technology R&D, Industrial Personal Property and Next Energy

.00

Payroll Credits. Add lines 10, 11, 13 and 15 ...............................................................................................

16. _______________

17. TOTAL REFUNDABLE CREDITS. Add lines 3, 4 and 16. Enter here and on Form C-8000, line 53

or C-8044, line 19 and C-8020, line 8, column A .........................................................................................

17. _______________

.00

PART 2: NONREFUNDABLE CREDITS

.00

18. Enter the amount from Form C-8000, line 45 ........................................................... 18. ______________

.00

19. Amount of the Unincorporated Credit from Form C-8000, line 46 ........................... 19. ______________

20. Tax after Unincorporated Credit. Subtract line 19 from line 18 ................................................................. 20. _______________

.00

ENTERPRISE ZONE CREDIT. This credit is available only to certified firms located in Benton Harbor.

If this credit is not being claimed, carry the amount from line 20 to line 34.

Enter the street address of the property or parcel number: ___________________________________________________________

.00

21. Enter the average value of property located within the zone . 21. _____________

.00

22. Multiply rentals within the zone by 8 and enter the result ..... 22. _____________

.00

23. Total property value within the zone. Add lines 21 and 22 ....................................... 23. ______________

.00

24. Enter the average value of all Michigan property .................. 24. _____________

.00

25. Multiply Michigan rentals by 8 and enter the result ............... 25. _____________

.00

26. Add lines 24 and 25 .................................................................................................. 26. ______________

.00

27. Divide line 23 by line 26 ............................................................................................ 27. ______________

.00

28. Enter the total payroll within the zone .................................... 28. _____________

.00

29. Enter total Michigan payroll ................................................... 29. _____________

.00

30. Divide line 28 by line 29 ............................................................................................ 30. ______________

.00

31. Add lines 27 and 30 .................................................................................................. 31. ______________

.00

32. Divide line 31 by 2. If there is only one factor, enter the amount from line 31 ......... 32. ______________

.00

33. Enterprise Zone Credit. Multiply line 20 by line 32 ...................................................................................... 33. ______________

.00

34. Tax After Enterprise Zone Credit. Subtract line 33 from line 20. If less than zero, enter zero .................. 34. ______________

1

1 2

2 3

3 4

4