Instructions For Form 1040nr-Ez U.s. Income Tax Return - 2006

ADVERTISEMENT

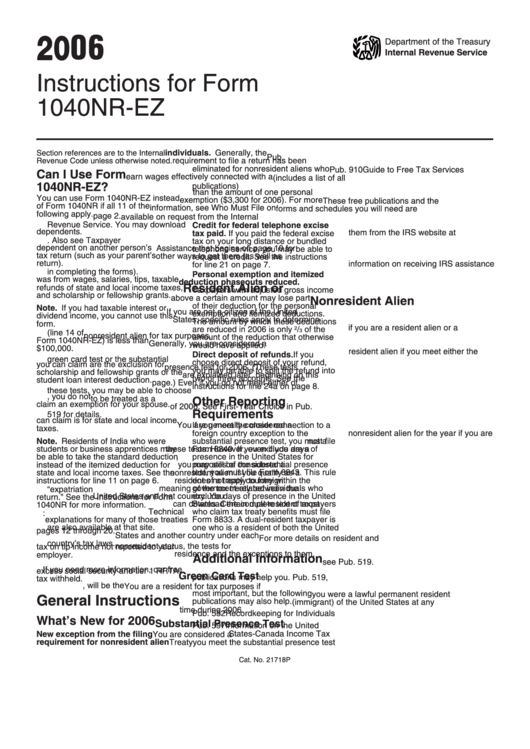

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form

1040NR-EZ

U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

Section references are to the Internal

individuals. Generally, the

Pub. 901 U.S. Tax Treaties

Revenue Code unless otherwise noted.

requirement to file a return has been

eliminated for nonresident aliens who

Pub. 910 Guide to Free Tax Services

Can I Use Form

earn wages effectively connected with a

(includes a list of all

U.S. trade or business that are less

1040NR-EZ?

publications)

than the amount of one personal

You can use Form 1040NR-EZ instead

exemption ($3,300 for 2006). For more

These free publications and the

of Form 1040NR if all 11 of the

information, see Who Must File on

forms and schedules you will need are

following apply.

page 2.

available on request from the Internal

1. You do not claim any

Revenue Service. You may download

Credit for federal telephone excise

dependents.

them from the IRS website at

tax paid. If you paid the federal excise

2. You cannot be claimed as a

Also see Taxpayer

tax on your long distance or bundled

dependent on another person’s U.S.

Assistance that begins on page 10 for

telephone service, you may be able to

tax return (such as your parent’s

other ways to get them (as well as

request a credit. See the instructions

return).

information on receiving IRS assistance

for line 21 on page 7.

3. Your only U.S. source income

in completing the forms).

Personal exemption and itemized

was from wages, salaries, tips, taxable

deduction phaseouts reduced.

Resident Alien or

refunds of state and local income taxes,

Taxpayers with adjusted gross income

and scholarship or fellowship grants.

above a certain amount may lose part

Nonresident Alien

of their deduction for the personal

Note. If you had taxable interest or

If you are not a citizen of the United

exemption and itemized deductions.

dividend income, you cannot use this

States, specific rules apply to determine

The amount by which these deductions

form.

if you are a resident alien or a

are reduced in 2006 is only

2

/

of the

3

4. Your taxable income (line 14 of

nonresident alien for tax purposes.

amount of the reduction that otherwise

Form 1040NR-EZ) is less than

Generally, you are considered a

would have applied.

$100,000.

resident alien if you meet either the

Direct deposit of refunds. If you

5. The only adjustments to income

green card test or the substantial

choose direct deposit of your refund,

you can claim are the exclusion for

presence test for 2006. (These tests

you may be able to split the refund into

scholarship and fellowship grants or the

are explained later, beginning on this

two or three accounts. See the

student loan interest deduction.

page.) Even if you do not meet either of

instructions for line 24a on page 8.

6. You do not claim any tax credits.

these tests, you may be able to choose

7. If you were married, you do not

to be treated as a U.S. resident for part

Other Reporting

claim an exemption for your spouse.

of 2006. See First-Year Choice in Pub.

8. The only itemized deduction you

Requirements

519 for details.

can claim is for state and local income

If you meet the closer connection to a

You are generally considered a

taxes.

foreign country exception to the

nonresident alien for the year if you are

Note. Residents of India who were

substantial presence test, you must file

not a U.S. resident under either of

students or business apprentices may

Form 8840. If you exclude days of

these tests. However, even if you are a

be able to take the standard deduction

presence in the United States for

U.S. resident under one of these tests,

instead of the itemized deduction for

purposes of the substantial presence

you may still be considered a

state and local income taxes. See the

test, you must file Form 8843. This rule

nonresident alien if you qualify as a

instructions for line 11 on page 6.

does not apply to foreign

resident of a treaty country within the

government-related individuals who

meaning of the tax treaty between the

9. This is not an “expatriation

exclude days of presence in the United

United States and that country. You

return.” See the Instructions for Form

States. Certain dual-resident taxpayers

can download the complete text of most

1040NR for more information.

who claim tax treaty benefits must file

U.S. treaties at Technical

10. The only taxes you owe are:

Form 8833. A dual-resident taxpayer is

explanations for many of those treaties

a. The tax from the Tax Table on

one who is a resident of both the United

are also available at that site.

pages 12 through 20.

States and another country under each

For more details on resident and

b. The social security and Medicare

country’s tax laws.

nonresident status, the tests for

tax on tip income not reported to your

residence and the exceptions to them,

employer.

Additional Information

see Pub. 519.

11. You do not claim a credit for

If you need more information, our free

excess social security and tier 1 RRTA

Green Card Test

publications may help you. Pub. 519,

tax withheld.

U.S. Tax Guide for Aliens, will be the

You are a resident for tax purposes if

most important, but the following

you were a lawful permanent resident

General Instructions

publications may also help.

(immigrant) of the United States at any

time during 2006.

Pub. 552 Recordkeeping for Individuals

What’s New for 2006

Substantial Presence Test

Pub. 597 Information on the United

States-Canada Income Tax

New exception from the filing

You are considered a U.S. resident if

requirement for nonresident alien

Treaty

you meet the substantial presence test

Cat. No. 21718P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20