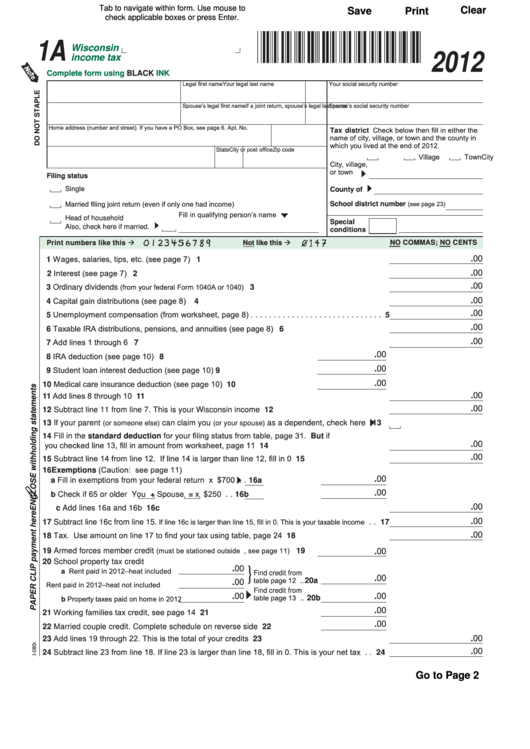

Tab to navigate within form. Use mouse to

Clear

Save

Print

check applicable boxes or press Enter.

1A

Wisconsin

2012

income tax

Complete form using

BLACK

INK

Your legal last name

Legal first name

M.I.

Your social security number

If a joint return, spouse’s legal last name

Spouse’s legal first name

M.I.

Spouse’s social security number

Home address (number and street). If you have a PO Box, see page 6.

Apt. No.

Tax district Check below then fill in either the

name of city, village, or town and the county in

which you lived at the end of 2012.

City or post office

State

Zip code

Village

Town

City

City, village,

or town

Filing status

Single

County of

Married filing joint return (even if only one had income)

(see page 23)

School district number

Fill in qualifying person’s name

Head of household

Special

Also, check here if married.

conditions

Print numbers like this

Not like this

NO COMMAS; NO CENTS

1 Wages, salaries, tips, etc. (see page 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2 Interest (see page 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

(from your federal Form 1040A or 1040)

.00

3 Ordinary dividends

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Capital gain distributions (see page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5 Unemployment compensation (from worksheet, page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Taxable IRA distributions, pensions, and annuities (see page 8) . . . . . . . . . . . . . . . . . . . . . . . 6

.00

7 Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

8 IRA deduction (see page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

9 Student loan interest deduction (see page 10) . . . . . . . . . . . . . . . . . . . 9

.00

10 Medical care insurance deduction (see page 10) . . . . . . . . . . . . . . . . . 10

.00

11 Add lines 8 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

.00

12 Subtract line 11 from line 7. This is your Wisconsin income . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 If your parent

can claim you

as a dependent, check here

13

(or someone else)

(or your spouse)

14 Fill in the standard deduction for your filing status from table, page 31. But if

you checked line 13, fill in amount from worksheet, page 11 . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

15 Subtract line 14 from line 12. If line 14 is larger than line 12, fill in 0 . . . . . . . . . . . . . . . . . . 15

.00

16 Exemptions (Caution: see page 11)

x $700 . . 16a

.00

a Fill in exemptions from your federal return . . . . .

x $250 . . 16b

.00

b Check if 65 or older

You +

Spouse =

.00

c Add lines 16a and 16b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16c

If line 16c is larger than line 15, fill in 0. This is your taxable income

.00

17 Subtract line 16c from line 15.

. . 17

18 Tax. Use amount on line 17 to find your tax using table, page 24 . . . . . . . . . . . . . . . . . . . . 18

.00

(must be stationed outside U.S., see page 11)

19 Armed forces member credit

19

.00

20 School property tax credit

.00

}

a Rent paid in 2012–heat included

Find credit from

.00

table page 12

.. 20a

.00

Rent paid in 2012–heat not included

Find credit from

.00

.00

table page 13

b Property taxes paid on home in 2012

.. 20b

21 Working families tax credit, see page 14 . . . . . . . . . . . . . . . . . . . . . . . 21

.00

.00

22 Married couple credit. Complete schedule on reverse side . . . . . . . . . 22

23 Add lines 19 through 22. This is the total of your credits . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

.00

24 Subtract line 23 from line 18. If line 23 is larger than line 18, fill in 0. This is your net tax . . 24

.00

Go to Page 2

1

1 2

2