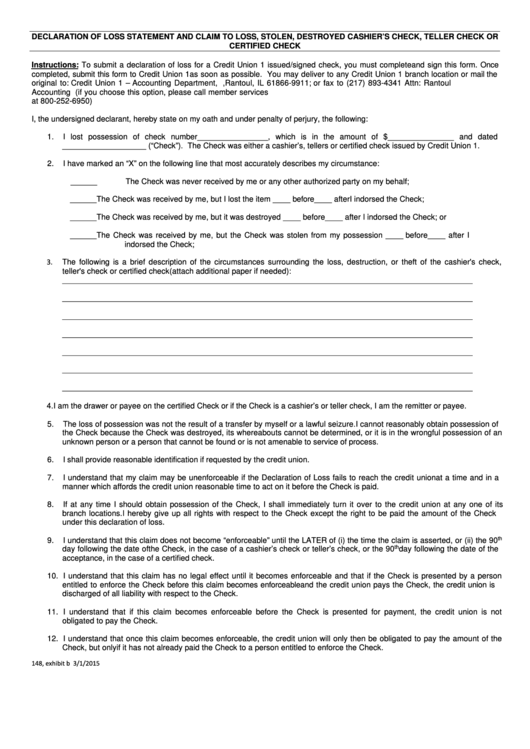

DECLARATION OF LOSS STATEMENT AND CLAIM TO LOSS, STOLEN, DESTROYED CASHIER’S CHECK, TELLER CHECK OR

CERTIFIED CHECK

Instructions: To submit a declaration of loss for a Credit Union 1 issued/signed check, you must complete and sign this form. Once

completed, submit this form to Credit Union 1 as soon as possible. You may deliver to any Credit Union 1 branch location or mail the

original to: Credit Union 1 – Accounting Department, P.O. Box 100, Rantoul, IL 61866-9911; or fax to (217) 893-4341 Attn: Rantoul

Accounting Dept. This form may be sent to you and returned via secure email (if you choose this option, please call member services

at 800-252-6950)

I, the undersigned declarant, hereby state on my oath and under penalty of perjury, the following:

1.

I lost possession of check number ________________, which is in the amount of $_______________ and dated

___________________ (“Check”). The Check was either a cashier’s, tellers or certified check issued by Credit Union 1.

2.

I have marked an “X” on the following line that most accurately describes my circumstance:

______

The Check was never received by me or any other authorized party on my behalf;

______

The Check was received by me, but I lost the item ____ before ____ after I indorsed the Check;

______

The Check was received by me, but it was destroyed ____ before ____ after I indorsed the Check; or

______

The Check was received by me, but the Check was stolen from my possession ____ before ____ after I

indorsed the Check;

3.

The following is a brief description of the circumstances surrounding the loss, destruction, or theft of the cashier's check,

teller's check or certified check (attach additional paper if needed):

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

4.

I am the drawer or payee on the certified Check or if the Check is a cashier’s or teller check, I am the remitter or payee.

5.

The loss of possession was not the result of a transfer by myself or a lawful seizure. I cannot reasonably obtain possession of

the Check because the Check was destroyed, its whereabouts cannot be determined, or it is in the wrongful possession of an

unknown person or a person that cannot be found or is not amenable to service of process.

6.

I shall provide reasonable identification if requested by the credit union.

7.

I understand that my claim may be unenforceable if the Declaration of Loss fails to reach the credit union at a time and in a

manner which affords the credit union reasonable time to act on it before the Check is paid.

8.

If at any time I should obtain possession of the Check, I shall immediately turn it over to the credit union at any one of its

branch locations. I hereby give up all rights with respect to the Check except the right to be paid the amount of the Check

under this declaration of loss.

th

9.

I understand that this claim does not become “enforceable” until the LATER of (i) the time the claim is asserted, or (ii) the 90

th

day following the date of the Check, in the case of a cashier’s check or teller’s check, or the 90

day following the date of the

acceptance, in the case of a certified check.

10. I understand that this claim has no legal effect until it becomes enforceable and that if the Check is presented by a person

entitled to enforce the Check before this claim becomes enforceable and the credit union pays the Check, the credit union is

discharged of all liability with respect to the Check.

11. I understand that if this claim becomes enforceable before the Check is presented for payment, the credit union is not

obligated to pay the Check.

12. I understand that once this claim becomes enforceable, the credit union will only then be obligated to pay the amount of the

Check, but only if it has not already paid the Check to a person entitled to enforce the Check.

148, exhibit b 3/1/2015

1

1 2

2