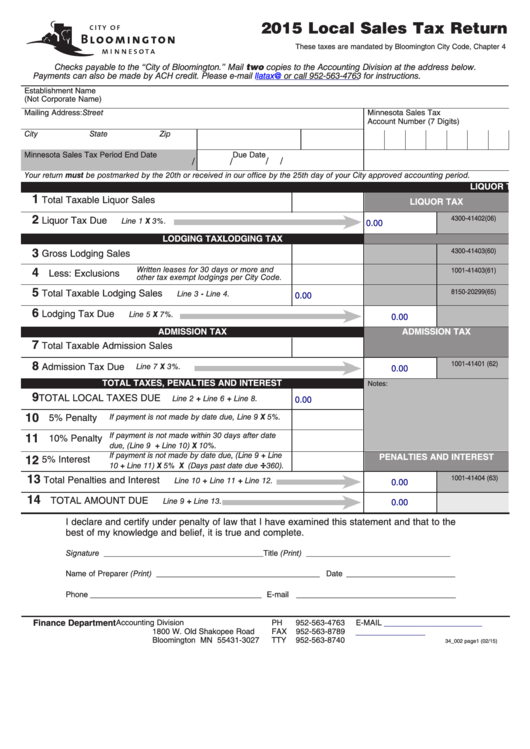

2015 Local Sales Tax Return

These taxes are mandated by Bloomington City Code, Chapter 4

Checks payable to the “City of Bloomington.” Mail two copies to the Accounting Division at the address below.

Payments can also be made by ACH credit. Please e-mail

llatax@BloomingtonMN.gov

or call 952-563-4763 for instructions.

Establishment Name

(Not Corporate Name)

Mailing Address:

Street

Minnesota Sales Tax

Account Number (7 Digits)

City

State

Zip

Minnesota Sales Tax

Period End Date

Due Date

/

/

/

/

Your return must be postmarked by the 20th or received in our office by the 25th day of your City approved accounting period.

LIQUOR TAX

Office Use Only

1

Total Taxable Liquor Sales

LIQUOR TAX

2

4300-41402(06)

Liquor Tax Due

Line 1 X 3%.

0.00

LODGING TAX

LODGING TAX

3

4300-41403(60)

Gross Lodging Sales

4

Written leases for 30 days or more and

1001-41403(61)

Less: Exclusions

other tax exempt lodgings per City Code.

5

8150-20299(65)

Total Taxable Lodging Sales

Line 3 - Line 4.

0.00

6

Lodging Tax Due

Line 5 X 7%.

0.00

ADMISSION TAX

ADMISSION TAX

7

Total Taxable Admission Sales

8

1001-41401 (62)

Admission Tax Due

Line 7 X 3%.

0.00

TOTAL TAXES, PENALTIES AND INTEREST

Notes:

9

TOTAL LOCAL TAXES DUE

Line 2 + Line 6 + Line 8.

0.00

10

5% Penalty

If payment is not made by date due, Line 9 X 5%.

11

If payment is not made within 30 days after date

10% Penalty

due, (Line 9 + Line 10) X 10%.

If payment is not made by date due, (Line 9 + Line

PENALTIES AND INTEREST

12

5% Interest

÷

10 + Line 11) X 5% X (Days past date due

360).

13

1001-41404 (63)

Total Penalties and Interest

Line 10 + Line 11 + Line 12.

0.00

14

TOTAL AMOUNT DUE

Line 9 + Line 13.

0.00

I declare and certify under penalty of law that I have examined this statement and that to the

best of my knowledge and belief, it is true and complete.

Signature _________________________________________ Title (Print) _____________________________________

Name of Preparer (Print) __________________________________________ Date ____________________________

Phone ____________________________________________ E-mail _________________________________________

Finance Department

Accounting Division

PH

952-563-4763

E-MAIL

llatax@BloomingtonMN.gov

1800 W. Old Shakopee Road

FAX

952-563-8789

BloomingtonMN.gov

Bloomington MN 55431-3027

TTY

952-563-8740

34_002 page1 (02/15)

Click to SUBMIT FORM by E-mail (Only if paying via ACH Credit)

Clear Form

1

1