Instructions For Form Cert-134 - Sales And Use Tax Exemption For Purchases By Qualifying Governmental Agencies - Connecticut Department Of Revenue

ADVERTISEMENT

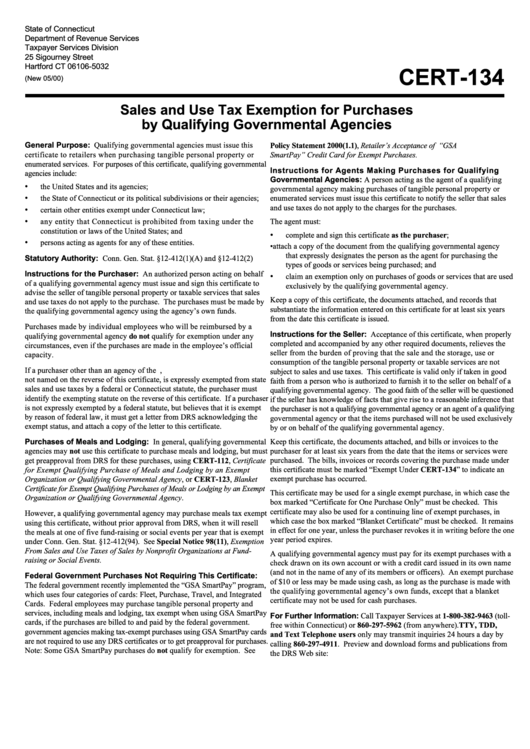

State of Connecticut

Department of Revenue Services

Taxpayer Services Division

25 Sigourney Street

Hartford CT 06106-5032

CERT-134

(New 05/00)

Sales and Use Tax Exemption for Purchases

by Qualifying Governmental Agencies

General Purpose:

Policy Statement 2000(1.1) Retailer’s Acceptance of U.S. Government “GSA

SmartPay” Credit Card for Exempt Purchases.

Instructions for Agents Making Purchases for Qualifying

Governmental Agencies:

as the purchaser

Statutory Authority:

Instructions for the Purchaser:

Instructions for the Seller:

do not

Purchases of Meals and Lodging:

not

CERT-112 Certificate

for Exempt Qualifying Purchase of Meals and Lodging by an Exempt

CERT-134

Organization or Qualifying Governmental Agency

CERT-123 Blanket

Certificate for Exempt Qualifying Purchases of Meals or Lodging by an Exempt

Organization or Qualifying Governmental Agency

Special Notice 98(11) Exemption

From Sales and Use Taxes of Sales by Nonprofit Organizations at Fund-

raising or Social Events.

Federal Government Purchases Not Requiring This Certificate:

For Further Information:

1-800-382-9463

860-297-5962

TTY, TDD,

and Text Telephone users

860-297-4911

not

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1