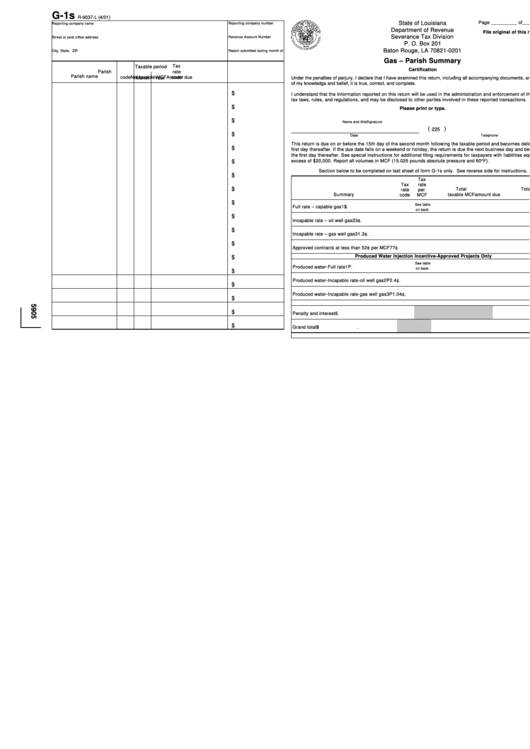

G-1s

R-9037-L (4/01)

State of Louisiana

Page __________ of ___________

Reporting company name

Reporting company number

Department of Revenue

File original of this return only.

Severance Tax Division

Street or post office address

Revenue Account Number

P. O. Box 201

Baton Rouge, LA 70821-0201

City, State, ZIP

Report submitted during month of

Gas – Parish Summary

Tax

Taxable period

Certification

Parish

rate

Parish name

code

code

Net taxable MCF

Amount due

Month

Year

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best

of my knowledge and belief, it is true, correct, and complete.

$

I understand that the information repor ted on this return will be used in the administration and enforcement of the severance

tax laws, rules, and regulations, and may be disclosed to other par ties involved in these repor ted transactions.

$

Please print or type.

$

Name and title

Signature

(

)

$

Date

Telephone

This retur n is due on or before the 15th day of the second month following the taxable period and becomes delinquent on the

$

first day thereafter. If the due date falls on a weekend or holiday, the return is due the next business day and becomes delinquent

the first day thereafter. See special instructions for additional filing requirements for taxpayers with liabilities equal to or in

excess of $20,000. Report all volumes in MCF (15.025 pounds absolute pressure and 60°F).

$

Section below to be completed on last sheet of form G-1s only. See reverse side for instructions.

$

Tax

Tax

rate

$

Total

Total

rate

per

Summary

taxable MCF

amount due

code

MCF

$

See table

Full rate – capable gas

1

$

.

on back.

$

Incapable rate – oil well gas

2

3¢

.

$

Incapable rate – gas well gas

3

1.3¢

.

$

Approved contracts at less than 52¢ per MCF

7

7¢

.

Produced Water Injection Incentive-Approved Projects Only

$

See table

Produced water-Full rate

1P

.

on back.

$

Produced water-Incapable rate-oil well gas

2P

2.4¢

.

$

Produced water-Incapable rate-gas well gas

3P

1.04¢

.

$

$

Penalty and interest

6

.

$

Grand total

$

.

1

1