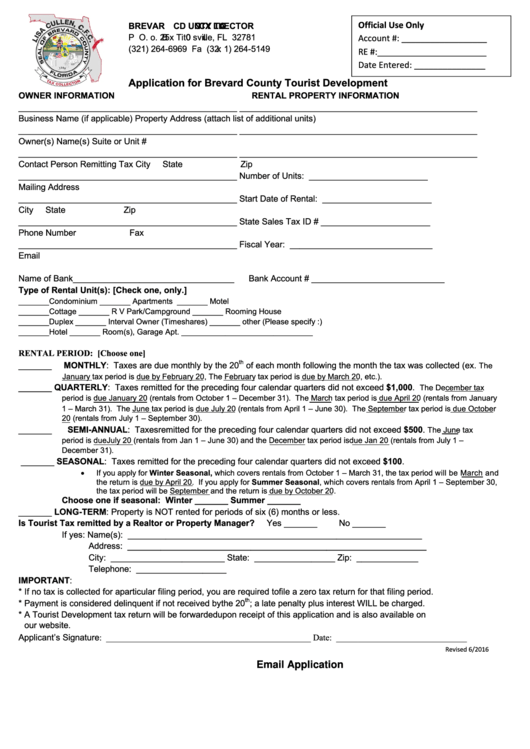

Official Use Only

BREVAR C

D O UNTY TA C

X O LLECTOR

P O

.

.

B o

x

25

0 Tit

0

u sville, FL 32781

Account #: __________________

(321) 264-6969 Fa x (32

:

1) 264-5149

RE #:_______________________

Date Entered: _______________

Application for Brevard County Tourist Development

OWNER INFORMATION

RENTAL PROPERTY INFORMATION

______________________________________________

__________________________________________________

Business Name (if applicable)

Property Address (attach list of additional units)

______________________________________________

__________________________________________________

Owner(s) Name(s)

Suite or Unit #

______________________________________________

__________________________________________________

Contact Person Remitting Tax

City

State

Zip

______________________________________________

Number of Units: _________________________

Mailing Address

______________________________________________

Start Date of Rental: _______________________

City

State

Zip

______________________________________________

State Sales Tax ID # _______________________

Phone Number

Fax

______________________________________________

Fiscal Year: ______________________________

Email

(By providing an email address, I authorize the Tax Collector's office to send reminders and delinquent notices via email.)

Name of Bank__________________________________

Bank Account # ____________________________

Type of Rental Unit(s): [Check one, only.]

_______Condominium

_______ Apartments

_______ Motel

_______Cottage

_______ R V Park/Campground

_______ Rooming House

_______Duplex

_______ Interval Owner (Timeshares)

_______ other (Please specify :)

_______Hotel

_______ Room(s), Garage Apt.

______________________________

RENTAL PERIOD: [Choose one]

th

_______

MONTHLY: Taxes are due monthly by the 20

of each month following the month the tax was collected (ex.

The

January tax period is due by February 20, The February tax period is due by March 20, etc.).

_______ QUARTERLY: Taxes remitted for the preceding four calendar quarters did not exceed $1,000.

The December tax

period is due January 20 (rentals from October 1 – December 31). The March tax period is due April 20 (rentals from January

1 – March 31). The June tax period is due July 20 (rentals from April 1 – June 30). The September tax period is due October

20 (rentals from July 1 – September 30).

The June tax

_______

SEMI-ANNUAL: Taxes remitted for the preceding four calendar quarters did not exceed $500.

period is due July 20 (rentals from Jan 1 – June 30) and the December tax period is due Jan 20 (rentals from July 1 –

December 31).

_______ SEASONAL: Taxes remitted for the preceding four calendar quarters did not exceed $100.

If you apply for Winter Seasonal, which covers rentals from October 1 – March 31, the tax period will be March and

the return is due by April 20. If you apply for Summer Seasonal, which covers rentals from April 1 – September 30,

the tax period will be September and the return is due by October 20.

Choose one if seasonal: Winter _______

Summer _______

_______ LONG-TERM: Property is NOT rented for periods of six (6) months or less.

Is Tourist Tax remitted by a Realtor or Property Manager?

Yes _______

No _______

If yes: Name(s): ______________________________________________________________

Address: _______________________________________________________________

City: ________________________ State: _________________ Zip: _____________

Telephone: ___________________

IMPORTANT:

* If no tax is collected for a particular filing period, you are required to file a zero tax return for that filing period.

th

* Payment is considered delinquent if not received by the 20

; a late penalty plus interest WILL be charged.

* A Tourist Development tax return will be forwarded upon receipt of this application and is also available on

our website.

Applicant’s Signature: _______________________________________________

Date: ______________________________

Revised 6/2016

Email Application

1

1