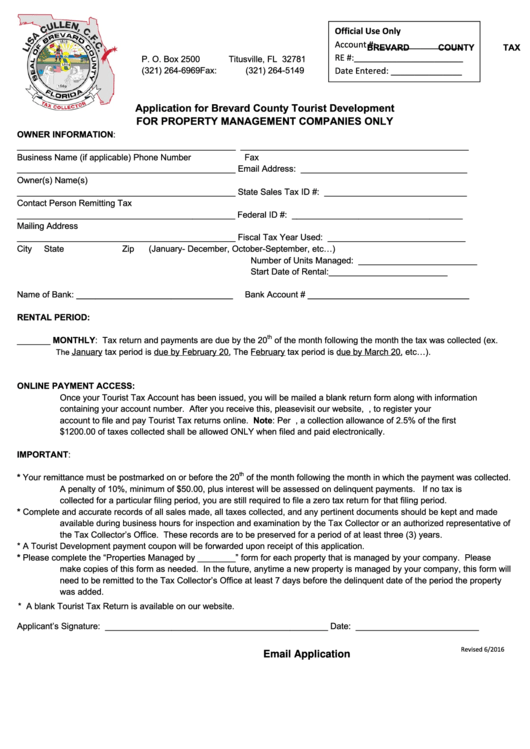

Official Use Only

Account #: __________________

BREVARD COUNTY TAX COLLECTOR

RE #:_______________________

P. O. Box 2500 Titusville, FL 32781

(321) 264-6969 Fax: (321) 264-5149

Date Entered: _______________

Application for Brevard County Tourist Development

FOR PROPERTY MANAGEMENT COMPANIES ONLY

OWNER INFORMATION:

______________________________________________

________________________________________________

Email Address: ___________________________________

Business Name (if applicable)

Phone Number

Fax

*By providing an email address, I authorize the Tax Collector's

______________________________________________

Email Address: ___________________________________

office to send reminders and delinquent notices via email.

Owner(s) Name(s)

______________________________________________

State Sales Tax ID #: ______________________________

Contact Person Remitting Tax

______________________________________________

Federal ID #: ____________________________________

Mailing Address

______________________________________________

Fiscal Tax Year Used: _____________________________

City

State

Zip

(January- December, October-September, etc…)

Number of Units Managed: _________________________

Start Date of Rental:

_________________________

Phone Number

Fax

Name of Bank: _________________________________

Bank Account # __________________________________

RENTAL PERIOD:

th

_______ MONTHLY: Tax return and payments are due by the 20

of the month following the month the tax was collected (ex.

January tax period is due by February 20, The February tax period is due by March 20, etc…).

The

ONLINE PAYMENT ACCESS:

Once your Tourist Tax Account has been issued, you will be mailed a blank return form along with information

containing your account number. After you receive this, please visit our website, , to register your

account to file and pay Tourist Tax returns online. Note: Per F.S. 212.12, a collection allowance of 2.5% of the first

$1200.00 of taxes collected shall be allowed ONLY when filed and paid electronically.

IMPORTANT:

th

* Your remittance must be postmarked on or before the 20

of the month following the month in which the payment was collected.

A penalty of 10%, minimum of $50.00, plus interest will be assessed on delinquent payments. If no tax is

collected for a particular filing period, you are still required to file a zero tax return for that filing period.

* Complete and accurate records of all sales made, all taxes collected, and any pertinent documents should be kept and made

available during business hours for inspection and examination by the Tax Collector or an authorized representative of

the Tax Collector’s Office. These records are to be preserved for a period of at least three (3) years.

* A Tourist Development payment coupon will be forwarded upon receipt of this application.

* Please complete the “Properties Managed by ________” form for each property that is managed by your company. Please

make copies of this form as needed. In the future, anytime a new property is managed by your company, this form will

need to be remitted to the Tax Collector’s Office at least 7 days before the delinquent date of the period the property

was added.

* A blank Tourist Tax Return is available on our website.

Applicant’s Signature: _______________________________________________

Date: __________________________

Revised 6/2016

Email Application

1

1 2

2