Form Sm-100 - Sports And Entertainment Facility Tax - Millville District - Worksheet

ADVERTISEMENT

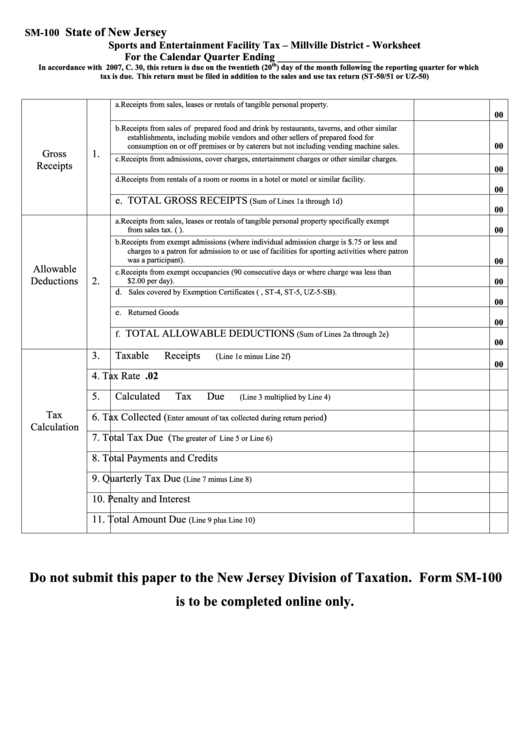

State of New Jersey

SM-100

Sports and Entertainment Facility Tax – Millville District - Worksheet

For the Calendar Quarter Ending __________________

th

In accordance with P.L. 2007, C. 30, this return is due on the twentieth (20

) day of the month following the reporting quarter for which

tax is due

This return must be filed in addition to the sales and use tax return (ST-50/51 or UZ-50)

.

a. Receipts from sales, leases or rentals of tangible personal property.

00

b. Receipts from sales of prepared food and drink by restaurants, taverns, and other similar

establishments, including mobile vendors and other sellers of prepared food for

00

consumption on or off premises or by caterers but not including vending machine sales.

Gross

1.

Receipts

c. Receipts from admissions, cover charges, entertainment charges or other similar charges.

00

d. Receipts from rentals of a room or rooms in a hotel or motel or similar facility.

00

e. TOTAL GROSS RECEIPTS

(

)

Sum of Lines 1a through 1d

00

a. Receipts from sales, leases or rentals of tangible personal property specifically exempt

00

from sales tax. (e.g. clothing).

b. Receipts from exempt admissions (where individual admission charge is $.75 or less and

charges to a patron for admission to or use of facilities for sporting activities where patron

was a participant).

00

Allowable

c. Receipts from exempt occupancies (90 consecutive days or where charge was less than

Deductions

2.

$2.00 per day).

00

d.

Sales covered by Exemption Certificates (e.g. ST-3, ST-4, ST-5, UZ-5-SB).

00

e.

Returned Goods

00

TOTAL ALLOWABLE DEDUCTIONS

f.

)

(Sum of Lines 2a through 2e

00

3.

Taxable Receipts

(

)

Line 1e minus Line 2f

00

4.

Tax Rate

.02

5.

Calculated Tax Due

(Line 3 multiplied by Line 4)

Tax

6.

Tax Collected (

)

Enter amount of tax collected during return period

Calculation

7.

Total Tax Due (

The greater of Line 5 or Line 6)

8.

Total Payments and Credits

9.

Quarterly Tax Due

(

Line 7 minus Line 8)

10. Penalty and Interest

11. Total Amount Due

(

)

Line 9 plus Line 10

Do not submit this paper to the New Jersey Division of Taxation. Form SM-100

is to be completed online only.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1