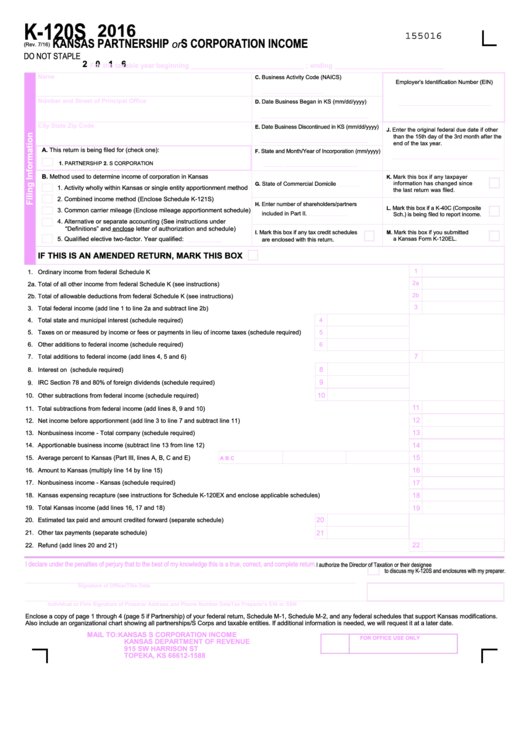

K-120S

2016

155016

KANSAS PARTNERSHIP

S CORPORATION INCOME

or

(Rev. 7/16)

DO NOT STAPLE

2 0 1 6

For the taxable year beginning _____________________________ ; ending ____________________________

Name

Business Activity Code (NAICS)

C.

Employer’s Identification Number (EIN)

________________________

Number and Street of Principal Office

________________________________

Date Business Began in KS (mm/dd/yyyy)

D.

_____________________________________

City

State

Zip Code

Date Business Discontinued in KS (mm/dd/yyyy)

E.

Enter the original federal due date if other

J.

than the 15th day of the 3rd month after the

_____________________________________

end of the tax year.

A. This return is being filed for (check one):

State and Month/Year of Incorporation (mm/yyyy)

F.

_____________________________________

_______

_________________________

1. PARTNERSHIP

2. S CORPORATION

B. Method used to determine income of corporation in Kansas

K.

Mark this box if any taxpayer

_________

information has changed since

State of Commercial Domicile

G.

1. Activity wholly within Kansas or single entity apportionment method

the last return was filed.

2. Combined income method (Enclose Schedule K-121S)

Enter number of shareholders/partners

H.

L.

Mark this box if a K-40C (Composite

3. Common carrier mileage (Enclose mileage apportionment schedule)

_______________

included in Part II.

Sch.) is being filed to report income.

4. Alternative or separate accounting (See instructions under

“Definitions” and enclose letter of authorization and schedule)

Mark this box if you submitted

Mark this box if any tax credit schedules

M.

I.

5. Qualified elective two-factor. Year qualified:

__________

a Kansas Form K-120EL.

are enclosed with this return.

IF THIS IS AN AMENDED RETURN, MARK THIS BOX

1

1.

Ordinary income from federal Schedule K ........................................................................................................................................................

2a

2a. Total of all other income from federal Schedule K (see instructions).................................................................................................................

2b

2b. Total of allowable deductions from federal Schedule K (see instructions).........................................................................................................

3

3.

Total federal income (add line 1 to line 2a and subtract line 2b) ......................................................................................................................

4.

Total state and municipal interest (schedule required) ..............................................................................

4

5.

Taxes on or measured by income or fees or payments in lieu of income taxes (schedule required).........

5

6.

Other additions to federal income (schedule required) ............................................................................

6

7

7.

Total additions to federal income (add lines 4, 5 and 6)..................................................................................................................................

8

8.

Interest on U.S. government obligations (schedule required)..................................................................

9

9.

IRC Section 78 and 80% of foreign dividends (schedule required) .........................................................

10

10.

Other subtractions from federal income (schedule required)...................................................................

11

11.

Total subtractions from federal income (add lines 8, 9 and 10)........................................................................................................................

12

12.

Net income before apportionment (add line 3 to line 7 and subtract line 11).....................................................................................................

13

13.

Nonbusiness income - Total company (schedule required) ..............................................................................................................................

14

14.

Apportionable business income (subtract line 13 from line 12)........................................................................................................................

15

15.

Average percent to Kansas (Part III, lines A, B, C and E).................

A

B

C

16

16.

Amount to Kansas (multiply line 14 by line 15) ...............................................................................................................................................

17

17.

Nonbusiness income - Kansas (schedule required) .......................................................................................................................................

18

18.

Kansas expensing recapture (see instructions for Schedule K-120EX and enclose applicable schedules).....................................................

19

19.

Total Kansas income (add lines 16, 17 and 18) ................................................................................................................................................

20

20.

Estimated tax paid and amount credited forward (separate schedule)....................................................

21

21.

Other tax payments (separate schedule) ..................................................................................................

22

22.

Refund (add lines 20 and 21) ............................................................................................................................................................................

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct, and complete return.

I authorize the Director of Taxation or their designee

to discuss my K-120S and enclosures with my preparer.

Signature of Officer

Title

Date

Individual or Firm Signature of Preparer

Address and Phone Number

Date

Tax Preparer’s EIN or SSN

Enclose a copy of page 1 through 4 (page 5 if Partnership) of your federal return, Schedule M-1, Schedule M-2, and any federal schedules that support Kansas modifications.

Also include an organizational chart showing all partnerships/S Corps and taxable entities. If additional information is needed, we will request it at a later date.

MAIL TO: KANSAS S CORPORATION INCOME

FOR OFFICE USE ONLY

KANSAS DEPARTMENT OF REVENUE

915 SW HARRISON ST

TOPEKA, KS 66612-1588

1

1 2

2