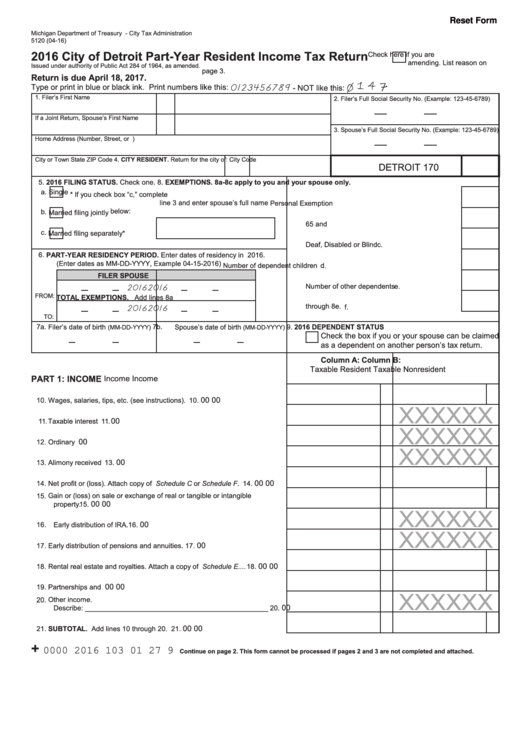

Reset Form

Michigan Department of Treasury - City Tax Administration

5120 (04-16)

2016 City of Detroit Part-Year Resident Income Tax Return

Check here if you are

amending. List reason on

Issued under authority of Public Act 284 of 1964, as amended.

page 3.

Return is due April 18, 2017.

1 4

Type or print in blue or black ink. Print numbers like this:

0123456789

- NOT like this:

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, or P.O. Box)

City or Town

State

ZIP Code

4. CITY RESIDENT. Return for the city of:

City Code

DETROIT

170

5. 2016 FILING STATUS. Check one.

8. EXEMPTIONS. 8a-8c apply to you and your spouse only.

a.

Single

* If you check box “c,” complete

line 3 and enter spouse’s full name

Personal Exemption ......................................

a.

below:

b.

Married filing jointly

65 and over.....................................................

b.

c.

Married filing separately*

Deaf, Disabled or Blind ...................................

c.

6.

PART-YEAR RESIDENCY PERIOD. Enter dates of residency in 2016.

(Enter dates as MM-DD-YYYY, Example 04-15-2016)

Number of dependent children .......................

d.

FILER

SPOUSE

Number of other dependents

..........................

e.

2016

2016

FROM:

TOTAL EXEMPTIONS. Add lines 8a

through 8e. ......................................................

f.

2016

2016

TO:

7a. Filer’s date of birth

7b. Spouse’s date of birth

9. 2016 DEPENDENT STATUS

(MM-DD-YYYY)

(MM-DD-YYYY)

Check the box if you or your spouse can be claimed

as a dependent on another person’s tax return.

Column A:

Column B:

Taxable Resident

Taxable Nonresident

PART 1: INCOME

Income

Income

00

00

10. Wages, salaries, tips, etc. (see instructions). ........................................ 10.

XXXXXX

00

11. Taxable interest ..................................................................................... 11.

XXXXXX

00

12. Ordinary dividends................................................................................. 12.

XXXXXX

00

13. Alimony received ................................................................................... 13.

00

00

14. Net profit or (loss). Attach copy of U.S. Schedule C or Schedule F. ..... 14.

15. Gain or (loss) on sale or exchange of real or tangible or intangible

00

00

property. ................................................................................................. 15.

XXXXXX

00

16. Early distribution of IRA. ........................................................................ 16.

XXXXXX

00

17. Early distribution of pensions and annuities. ......................................... 17.

00

00

18. Rental real estate and royalties. Attach a copy of U.S. Schedule E....

18.

00

00

19. Partnerships and trusts........................................................................

19.

XXXXXX

20. Other income.

00

Describe: _______________________________________________

20.

00

00

21. SUBTOTAL. Add lines 10 through 20. .................................................. 21.

+

0000 2016 103 01 27 9

Continue on page 2. This form cannot be processed if pages 2 and 3 are not completed and attached.

1

1 2

2 3

3