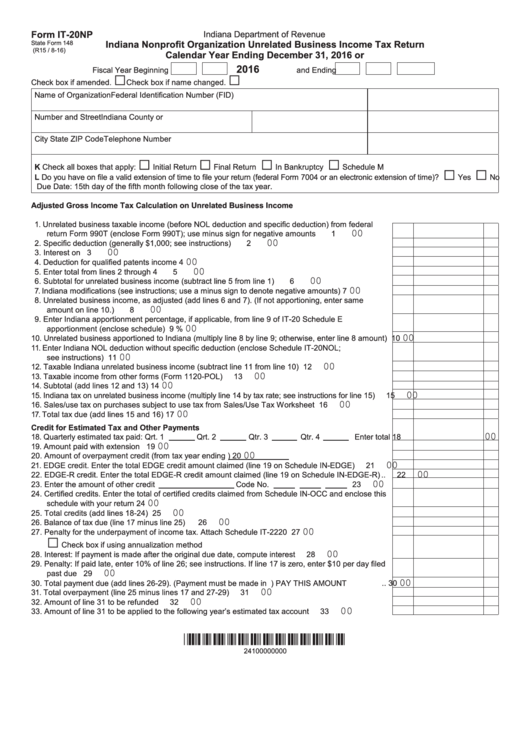

Form IT-20NP

Indiana Department of Revenue

Indiana Nonprofit Organization Unrelated Business Income Tax Return

State Form 148

(R15 / 8-16)

Calendar Year Ending December 31, 2016 or

2016

□

□

Fiscal Year Beginning

and Ending

Check box if amended.

Check box if name changed.

Name of Organization

Federal Identification Number (FID)

Number and Street

Indiana County or O.O.S.

Principal Business Activity Code

City

State

ZIP Code

Telephone Number

□

□

□

□

□

□

K Check all boxes that apply:

Initial Return

Final Return

In Bankruptcy

Schedule M

L Do you have on file a valid extension of time to file your return (federal Form 7004 or an electronic extension of time)?

Yes

No

Due Date: 15th day of the fifth month following close of the tax year.

Adjusted Gross Income Tax Calculation on Unrelated Business Income

1. Unrelated business taxable income (before NOL deduction and specific deduction) from federal

00

return Form 990T (enclose Form 990T); use minus sign for negative amounts .................................

1

00

2. Specific deduction (generally $1,000; see instructions) ......................................................................

2

00

3. Interest on U.S. government obligations on the federal return less related expenses ........................

3

00

4. Deduction for qualified patents income ...............................................................................................

4

00

5. Enter total from lines 2 through 4 ........................................................................................................

5

00

6. Subtotal for unrelated business income (subtract line 5 from line 1)...................................................

6

00

7. Indiana modifications (see instructions; use a minus sign to denote negative amounts) ...................

7

8. Unrelated business income, as adjusted (add lines 6 and 7). (If not apportioning, enter same

00

amount on line 10.)..............................................................................................................................

8

9. Enter Indiana apportionment percentage, if applicable, from line 9 of IT-20 Schedule E

00

apportionment (enclose schedule) ......................................................................................................

9

%

00

10. Unrelated business apportioned to Indiana (multiply line 8 by line 9; otherwise, enter line 8 amount)

10

11. Enter Indiana NOL deduction without specific deduction (enclose Schedule IT-20NOL;

00

see instructions) ..................................................................................................................................

11

00

12. Taxable Indiana unrelated business income (subtract line 11 from line 10) ......................................

12

00

13. Taxable income from other forms (Form 1120-POL) ..........................................................................

13

00

14. Subtotal (add lines 12 and 13) ............................................................................................................

14

00

15. Indiana tax on unrelated business income (multiply line 14 by tax rate; see instructions for line 15) ....

15

00

16. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet ...............................

16

00

17. Total tax due (add lines 15 and 16) .....................................................................................................

17

Credit for Estimated Tax and Other Payments

00

18. Quarterly estimated tax paid: Qrt. 1

Qrt. 2

Qtr. 3

Qtr. 4

Enter total

18

00

19. Amount paid with extension ...............................................................................................................

19

00

20. Amount of overpayment credit (from tax year ending

) ...........................................

20

00

21. EDGE credit. Enter the total EDGE credit amount claimed (line 19 on Schedule IN-EDGE)..............

21

00

22. EDGE-R credit. Enter the total EDGE-R credit amount claimed (line 19 on Schedule IN-EDGE-R) ..

22

00

23. Enter the amount of other credit

Code No.

..................

23

24. Certified credits. Enter the total of certified credits claimed from Schedule IN-OCC and enclose this

00

schedule with your return ....................................................................................................................

24

00

25. Total credits (add lines 18-24) ............................................................................................................

25

00

26. Balance of tax due (line 17 minus line 25) ............................................................................................

26

00

□

27. Penalty for the underpayment of income tax. Attach Schedule IT-2220 ............................................

27

Check box if using annualization method

00

28. Interest: If payment is made after the original due date, compute interest..........................................

28

29. Penalty: If paid late, enter 10% of line 26; see instructions. If line 17 is zero, enter $10 per day filed

00

past due date.......................................................................................................................................

29

00

30. Total payment due (add lines 26-29). (Payment must be made in U.S. funds) PAY THIS AMOUNT ..

30

00

31. Total overpayment (line 25 minus lines 17 and 27-29) .......................................................................

31

00

32. Amount of line 31 to be refunded ........................................................................................................

32

00

33. Amount of line 31 to be applied to the following year’s estimated tax account ...................................

33

*24100000000*

24100000000

1

1 2

2