General Information For Claiming Tax Credits - Form D-400tc, Form D-429 - Worksheet For Determining The Credit For The Disabled Taxpayer

ADVERTISEMENT

General Information for Claiming Tax Credits - Form D-400TC

Page 1

Credit for Tax Paid to Another

entered on Line 1, Part 1 of Form D–400TC

Line 6, Part 1, Form D–400TC the net tax you

State or Country

is total income from all sources received

paid another state on your share of S Corporation

while a resident of North Carolina, adjusted

income or your pro rata share of the net corporate

When income is taxed by North Carolina for

by the applicable additions and/or deductions

tax paid by the S Corporation to another state that

a period during which you were a legal resident

to federal taxable income that relate to gross

taxes the corporation rather than the shareholder.

of North Carolina and the same income is also

income that you listed on Form D–400, Page

Attach a schedule to your return showing the

taxed by another state or country because it was

3. The amount of net tax paid on Line 6 is any

total amount of tax paid to the other state by the

earned in or derived from sources within that

prepayment of tax (tax withheld, estimated tax

S Corporation, and how your pro rata share of

state or country, a tax credit may be claimed, but

payments, amount paid with extension, etc.)

the tax was determined.

not on the basis of a withholding statement alone.

plus any additional tax paid or less any refunds

If you claim credit for tax paid to more than

Attach a copy of the return filed with the other

received or expected to be received. Attach a

one state or country, use the worksheet below

state or country and a copy of the check or receipt

copy of the tax return filed with the other state

to determine the tax credit allowable for each

if a balance of tax was paid with the return.

and proof of the payment.

state or country. Determine the total credits for

Complete the North Carolina return and

Include on Line 2, Part 1 of Form D–400TC

all states by adding the amount on Line 7 of each

include all income both within and outside the

your share of any S Corporation income that

worksheet and enter the total on Form D-400TC,

State. Compute the tax as though no credit is to

is attributable to and taxed by another state,

Line 7a. Be sure to use separate worksheets to

be claimed. Complete Part 1 of Form D-400TC to

whether or not the other state taxed the income

determine the separate credits for each state

determine the allowable tax credit. The amount

at the individual or corporate level. Include on

or country.

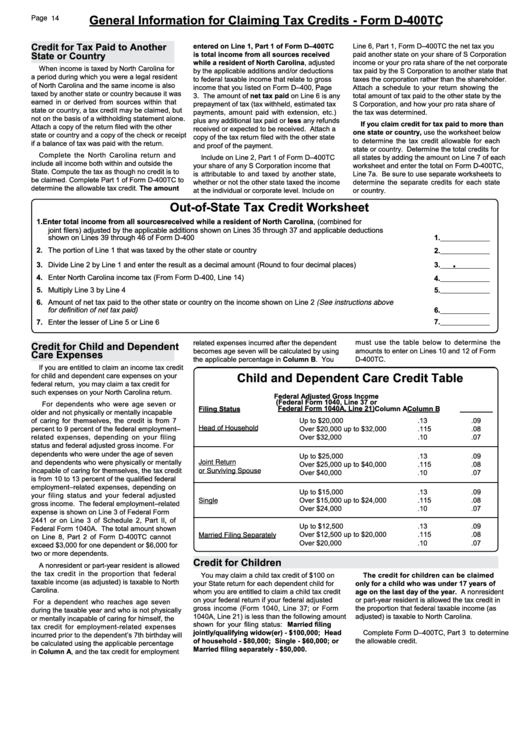

Out-of-State Tax Credit Worksheet

1. Enter total income from all sources received while a resident of North Carolina, (combined for

joint filers) adjusted by the applicable additions shown on Lines 35 through 37 and applicable deductions

shown on Lines 39 through 46 of Form D-400 ...................................................................................................................

1.

2. The portion of Line 1 that was taxed by the other state or country . ....................................................................................

2.

.

3. Divide Line 2 by Line 1 and enter the result as a decimal amount (Round to four decimal places) ...................................

3.

4. Enter North Carolina income tax (From Form D-400, Line 14) . ..........................................................................................

4.

5. Multiply Line 3 by Line 4 .....................................................................................................................................................

5.

6. Amount of net tax paid to the other state or country on the income shown on Line 2 (See instructions above

for definition of net tax paid) ...............................................................................................................................................

6.

7. Enter the lesser of Line 5 or Line 6 . ....................................................................................................................................

7.

related expenses incurred after the dependent

must use the table below to determine the

Credit for Child and Dependent

amounts to enter on Lines 10 and 12 of Form

becomes age seven will be calculated by using

Care Expenses

the applicable percentage in Column B. You

D-400TC.

If you are entitled to claim an income tax credit

Child and Dependent Care Credit Table

for child and dependent care expenses on your

federal return, you may claim a tax credit for

such expenses on your North Carolina return.

Federal Adjusted Gross Income

(Federal Form 1040, Line 37 or

For dependents who were age seven or

Federal Form 1040A, Line 21)

Filing Status

Column A

Column B

older and not physically or mentally incapable

of caring for themselves, the credit is from 7

Up to $20,000

.13

.09

Head of Household

Over $20,000 up to $32,000

.115

.08

percent to 9 percent of the federal employment–

related expenses, depending on your filing

Over $32,000

.10

.07

status and federal adjusted gross income. For

dependents who were under the age of seven

Up to $25,000

.13

.09

and dependents who were physically or mentally

Joint Return

Over $25,000 up to $40,000

.115

.08

incapable of caring for themselves, the tax credit

or Surviving Spouse

Over $40,000

.10

.07

is from 10 to 13 percent of the qualified federal

employment–related expenses, depending on

Up to $15,000

.13

.09

your filing status and your federal adjusted

Single

Over $15,000 up to $24,000

.115

.08

gross income. The federal employment–related

Over $24,000

.10

.07

expense is shown on Line 3 of Federal Form

2441 or on Line 3 of Schedule 2, Part II, of

Up to $12,500

.13

.09

Federal Form 1040A. The total amount shown

Over $12,500 up to $20,000

.115

.08

Married Filing Separately

on Line 8, Part 2 of Form D-400TC cannot

Over $20,000

.10

.07

exceed $3,000 for one dependent or $6,000 for

two or more dependents.

Credit for Children

A nonresident or part-year resident is allowed

the tax credit in the proportion that federal

You may claim a child tax credit of $100 on

The credit for children can be claimed

taxable income (as adjusted) is taxable to North

your State return for each dependent child for

only for a child who was under 17 years of

Carolina.

whom you are entitled to claim a child tax credit

age on the last day of the year. A nonresident

on your federal return if your federal adjusted

or part-year resident is allowed the tax credit in

For a dependent who reaches age seven

gross income (Form 1040, Line 37; or Form

the proportion that federal taxable income (as

during the taxable year and who is not physically

1040A, Line 21) is less than the following amount

adjusted) is taxable to North Carolina.

or mentally incapable of caring for himself, the

shown for your filing status: Married filing

tax credit for employment-related expenses

jointly/qualifying widow(er) - $100,000; Head

Complete Form D–400TC, Part 3 to determine

incurred prior to the dependent’s 7th birthday will

of household - $80,000; Single - $60,000; or

the allowable credit.

be calculated using the applicable percentage

Married filing separately - $50,000.

in Column A, and the tax credit for employment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5