Clear Form

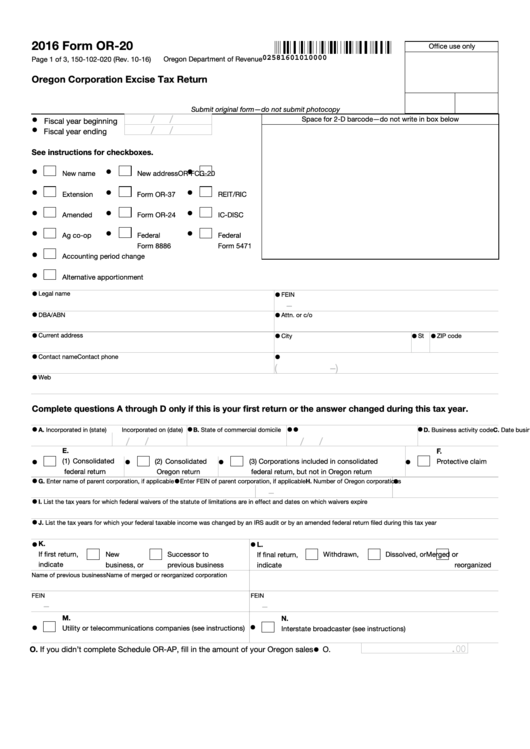

2016 Form OR‑20

Office use only

02581601010000

Page 1 of 3, 150-102-020 (Rev. 10-16)

Oregon Department of Revenue

Oregon Corporation Excise Tax Return

Submit original form—do not submit photocopy

•

/

/

Space for 2-D barcode—do not write in box below

Fiscal year beginning

•

/

/

Fiscal year ending

See instructions for checkboxes.

•

•

•

New name

New address

OR-FCG-20

•

•

•

Extension

Form OR-37

REIT/RIC

•

•

•

Amended

Form OR-24

IC-DISC

•

•

•

Ag co-op

Federal

Federal

Form 8886

Form 5471

•

Accounting period change

•

Alternative apportionment

•

•

Legal name

FEIN

–

•

•

DBA/ABN

Attn. or c/o

•

•

•

•

Current address

City

St

ZIP code

•

•

Contact name

Contact phone

(

)

–

•

Web

Complete questions A through D only if this is your first return or the answer changed during this tax year.

•

•

•

•

•

A. Incorporated in (state)

Incorporated on (date)

B. State of commercial domicile

C. Date business activity began in Oregon

D. Business activity code

/

/

/

/

E.

F.

•

•

•

•

(1) Consolidated

(2) Consolidated

(3) Corporations included in consolidated

Protective claim

federal return

Oregon return

federal return, but not in Oregon return

•

•

•

G. Enter name of parent corporation, if applicable

Enter FEIN of parent corporation, if applicable

H. Number of Oregon corporations

–

•

I. List the tax years for which federal waivers of the statute of limitations are in effect and dates on which waivers expire

•

J. List the tax years for which your federal taxable income was changed by an IRS audit or by an amended federal return filed during this tax year

•

•

K.

L.

If first return,

New

Successor to

If final return,

Withdrawn,

Dissolved, or

Merged or

indicate

business, or

previous business

reorganized

indicate

Name of previous business

Name of merged or reorganized corporation

FEIN

FEIN

–

–

M.

N.

•

•

Utility or telecommunications companies (see instructions)

Interstate broadcaster (see instructions)

.00

•

O. If you didn’t complete Schedule OR-AP, fill in the amount of your Oregon sales ..........

O.

1

1 2

2 3

3 4

4