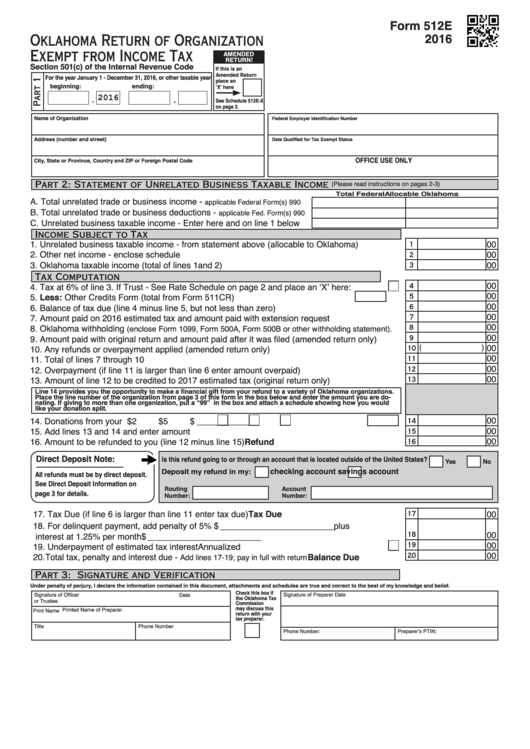

Form 512E

2016

Oklahoma Return of Organization

Exempt from Income Tax

AMENDED

RETURN!

Section 501(c) of the Internal Revenue Code

If this is an

Amended Return

For the year January 1 - December 31, 2016, or other taxable year

place an

beginning:

ending:

‘X’ here

2016

,

,

See Schedule 512E-X

on page 2.

Name of Organization

Federal Employer Identification Number

Address (number and street)

Date Qualified for Tax Exempt Status

OFFICE USE ONLY

City, State or Province, Country and ZIP or Foreign Postal Code

Part 2: Statement of Unrelated Business Taxable Income

(Please read instructions on pages 2-3)

Total Federal

Allocable Oklahoma

A. Total unrelated trade or business income -

applicable Federal Form(s) 990

B. Total unrelated trade or business deductions -

applicable Fed. Form(s) 990

C. Unrelated business taxable income - Enter here and on line 1 below

Income Subject to Tax

1. Unrelated business taxable income - from statement above (allocable to Oklahoma) .............

00

1

2. Other net income - enclose schedule .......................................................................................

00

2

3. Oklahoma taxable income (total of lines 1and 2) ......................................................................

00

3

Tax Computation

00

4. Tax at 6% of line 3. If Trust - See Rate Schedule on page 2 and place an ‘X’ here: ............

4

00

5. Less: Other Credits Form (total from Form 511CR) .............................................

....

5

00

6. Balance of tax due (line 4 minus line 5, but not less than zero) ................................................

6

00

7. Amount paid on 2016 estimated tax and amount paid with extension request .........................

7

00

8. Oklahoma withholding

(enclose Form 1099, Form 500A, Form 500B or other withholding statement).

8

00

9. Amount paid with original return and amount paid after it was filed (amended return only) .....

9

(

)

00

10. Any refunds or overpayment applied (amended return only) ....................................................

10

00

11. Total of lines 7 through 10 .........................................................................................................

11

00

12. Overpayment (if line 11 is larger than line 6 enter amount overpaid) ......................................

12

00

13. Amount of line 12 to be credited to 2017 estimated tax (original return only) ..........................

13

Line 14 provides you the opportunity to make a financial gift from your refund to a variety of Oklahoma organizations.

Place the line number of the organization from page 3 of this form in the box below and enter the amount you are do-

nating. If giving to more than one organization, put a “99” in the box and attach a schedule showing how you would

like your donation split.

00

14. Donations from your refund..........................

$2

$5

$ ___________ ....

14

00

15. Add lines 13 and 14 and enter amount .....................................................................................

15

16. Amount to be refunded to you (line 12 minus line 15) .................................................. Refund

00

16

Direct Deposit Note:

Is this refund going to or through an account that is located outside of the United States?

Yes

No

checking account

savings account

Deposit my refund in my:

All refunds must be by direct deposit.

See Direct Deposit Information on

Routing

Account

page 3 for details.

Number:

Number:

17. Tax Due (if line 6 is larger than line 11 enter tax due) ................................................. Tax Due

00

17

18. For delinquent payment, add penalty of 5% ................. $ ________________________ plus

00

interest at 1.25% per month ........................................... $ ________________________ .......

18

00

19. Underpayment of estimated tax interest ........................................................... Annualized

19

00

20. Total tax, penalty and interest due -

Balance Due

20

Add lines 17-19; pay in full with return .................

Part 3: Signature and Verification

Under penalty of perjury, I declare the information contained in this document, attachments and schedules are true and correct to the best of my knowledge and belief.

Check this box if

Signature of Officer

Date

Signature of Preparer

Date

the Oklahoma Tax

or Trustee

Commission

may discuss this

Printed Name of Preparer

Print Name

return with your

tax preparer.

Phone Number

Title

Phone Number:

Preparer’s PTIN:

1

1 2

2