Individual Municipal Income Tax Return Form - City Of Hamilton - 2016

ADVERTISEMENT

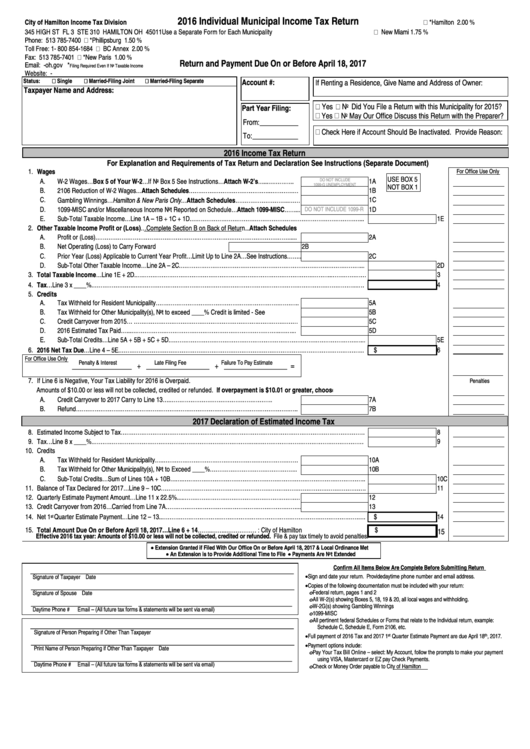

2016 Individual Municipal Income Tax Return

City of Hamilton Income Tax Division

*Hamilton .................. 2.00 %

345 HIGH ST FL 3 STE 310 HAMILTON OH 45011

Use a Separate Form for Each Municipality

New Miami............... 1.75 %

Phone:

513 785-7400

*Phillipsburg ............. 1.50 %

Toll Free: 1- 800 854-1684

BC Annex ................ 2.00 %

Fax:

513 785-7401

*New Paris ................ 1.00 %

Return and Payment Due On or Before April 18, 2017

Email:

citytax@hamilton-oh.gov

*

Filing Required Even If No Taxable Income

Website:

Status:

Single

Married-Filing Joint

Married-Filing Separate

Account #:

If Renting a Residence, Give Name and Address of Owner:

Taxpayer Name and Address:

Yes

No Did You File a Return with this Municipality for 2015?

Part Year Filing:

Yes

No May Our Office Discuss this Return with the Preparer?

From: ___________

Check Here if Account Should Be Inactivated. Provide Reason:

To: _____________

2016 Income Tax Return

For Explanation and Requirements of Tax Return and Declaration See Instructions (Separate Document)

1. Wages

For Office Use Only

USE BOX 5

A.

W-2 Wages…Box 5 of Your W-2…If No Box 5 See Instructions…Attach W-2’s....…...…………..

1A

DO NOT INCLUDE

1099-G UNEMPLOYMENT

NOT BOX 1

B.

2106 Reduction of W-2 Wages…Attach Schedules……………………………………..……………

1B

Gambling Winnings…Hamilton & New Paris Only…Attach Schedules………………………..……

C.

1C

1099-MISC and/or Miscellaneous Income Not Reported on Schedule…Attach 1099-MISC……...

D.

DO NOT INCLUDE 1099-R

1D

E.

Sub-Total Taxable Income…Line 1A – 1B + 1C + 1D.………………………………………………………………………………...

1E

2. Other Taxable Income Profit or (Loss)…Complete Section B on Back of Return...Attach Schedules

A.

Profit or (Loss)……………………………………………….……………….………………………….....

2A

B.

Net Operating (Loss) to Carry Forward .............................................

2B

C.

Prior Year (Loss) Applicable to Current Year Profit…Limit Up to Line 2A…See Instructions……...

2C

D.

Sub-Total Other Taxable Income…Line 2A – 2C.……………………………………………………………………………………...

2D

3. Total Taxable Income…Line 1E + 2D..…………………………………………………………………………………………...………………

3

4. Tax…Line 3 x ____%.………………….….……………………………………………………………………………………………………...…

4

5. Credits

A.

Tax Withheld for Resident Municipality…………………………………………………………………..

5A

Tax Withheld for Other Municipality(s), Not to exceed ____% Credit is limited - See

B.

5B

C.

Credit Carryover from 2015… ………………………………………………………….…………………

5C

D.

2016 Estimated Tax Paid…...……………………………………………………………………..……...

5D

E.

Sub-Total Credits…Line 5A + 5B + 5C + 5D.…………………………………………………………………………………………...

5E

6. 2016 Net Tax Due…Line 4 – 5E.………………………………………………………………………………………………………………….. $

6

For Office Use Only

_________________ + __________________ + __________________ =

Penalty & Interest

Late Filing Fee

Failure To Pay Estimate

7. If Line 6 is Negative, Your Tax Liability for 2016 is Overpaid.

Penalties

Amounts of $10.00 or less will not be collected, credited or refunded. If overpayment is $10.01 or greater, choose:

A.

Credit Carryover to 2017 Estimate...Carry to Line 13….……………………………………………….

7A

B.

Refund………………………………………………………………………………………………………..

7B

2017 Declaration of Estimated Income Tax

8. Estimated Income Subject to Tax……………………………..……………………………………………………………………………………

8

9. Tax…Line 8 x ____%.…………………………………………………………………………….…………………………………………………

9

10. Credits

A.

Tax Withheld for Resident Municipality…..………………………………………………………………

10A

B.

Tax Withheld for Other Municipality(s), Not to Exceed ____%………………………………………..

10B

C.

Sub-Total Credits…Sum of Lines 10A + 10B…….……………………………………………………………………………………..

10C

11. Balance of Tax Declared for 2017…Line 9 – 10C…………….………………………………………………………………………………….

11

12. Quarterly Estimate Payment Amount…Line 11 x 22.5%.....…………………………………………….…….…

12

13. Credit Carryover from 2016…Carried from Line 7A……………….……………………………………………...

13

14. Net 1

Quarter Estimate Payment…Line 12 – 13..………………………………………………………………………………………………. $

14

st

15. Total Amount Due On or Before April 18, 2017…Line 6 + 14……..…… ...……………..Make Check Payable To: City of Hamilton

$

15

Effective 2016 tax year: Amounts of $10.00 or less will not be collected, credited or refunded. File & pay tax timely to avoid penalties.

• Extension Granted if Filed With Our Office On or Before April 18, 2017 & Local Ordinance Met

• An Extension is to Provide Additional Time to File • Payments Are Not Extended

____________________________________________________________

Confirm All Items Below Are Complete Before Submitting Return

• Sign and date your return. Provide daytime phone number and email address.

Signature of Taxpayer

Date

____________________________________________________________

• Copies of the following documentation must be included with your return:

o Federal return, pages 1 and 2

Signature of Spouse

Date

_______________________ ___________________________________

o All W-2(s) showing Boxes 5, 18, 19 & 20, all local wages and withholding.

o W-2G(s) showing Gambling Winnings

Daytime Phone #

Email – (All future tax forms & statements will be sent via email)

o 1099-MISC

o All pertinent federal Schedules or Forms that relate to the Individual return, example:

____________________________________________________________

Schedule C, Schedule E, Form 2106, etc.

Signature of Person Preparing if Other Than Taxpayer

• Full payment of 2016 Tax and 2017 1

Quarter Estimate Payment are due April 18

, 2017.

st

th

____________________________________________________________

• Payment options include:

Print Name of Person Preparing if Other Than Taxpayer

Date

o Pay Your Tax Bill Online – select: My Account, follow the prompts to make your payment

_______________________ ___________________________________

using VISA, Mastercard or EZ pay Check Payments.

Daytime Phone #

Email – (All future tax forms & statements will be sent via email)

o Check or Money Order payable to City of Hamilton

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2