Clear Form

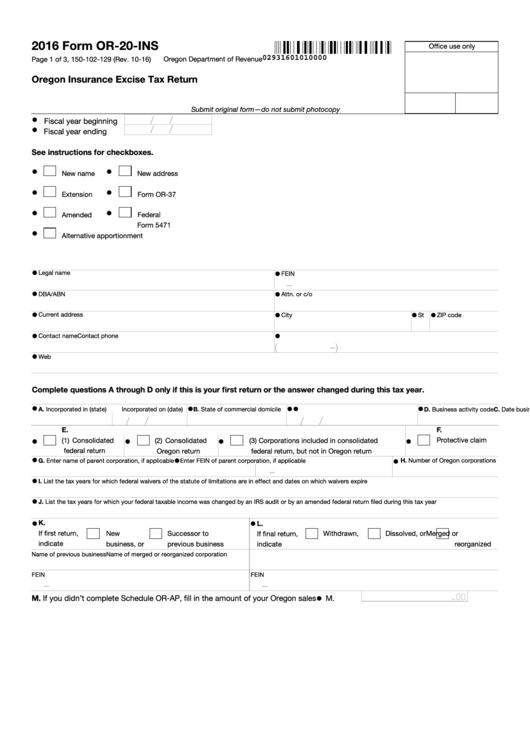

2016 Form OR‑20‑INS

Office use only

02931601010000

Page 1 of 3, 150-102-129 (Rev. 10-16)

Oregon Department of Revenue

Oregon Insurance Excise Tax Return

Submit original form—do not submit photocopy

•

/

/

Fiscal year beginning

•

/

/

Fiscal year ending

See instructions for checkboxes.

•

•

New name

New address

•

•

Extension

Form OR-37

•

•

Amended

Federal

Form 5471

•

Alternative apportionment

•

•

Legal name

FEIN

–

•

•

DBA/ABN

Attn. or c/o

•

•

•

•

Current address

City

St

ZIP code

•

•

Contact name

Contact phone

(

)

–

•

Web

Complete questions A through D only if this is your first return or the answer changed during this tax year.

•

•

•

•

•

A. Incorporated in (state)

B. State of commercial domicile

C. Date business activity began in Oregon

D. Business activity code

Incorporated on (date)

/

/

/

/

E.

F.

•

•

•

•

(1) Consolidated

(2) Consolidated

(3) Corporations included in consolidated

Protective claim

federal return

Oregon return

federal return, but not in Oregon return

•

•

•

G. Enter name of parent corporation, if applicable

Enter FEIN of parent corporation, if applicable

H. Number of Oregon corporations

–

•

I. List the tax years for which federal waivers of the statute of limitations are in effect and dates on which waivers expire

•

J. List the tax years for which your federal taxable income was changed by an IRS audit or by an amended federal return filed during this tax year

•

•

K.

L.

If first return,

New

Successor to

Withdrawn,

Dissolved, or

Merged or

If final return,

indicate

business, or

previous business

indicate

reorganized

Name of previous business

Name of merged or reorganized corporation

FEIN

FEIN

–

–

.00

•

M. If you didn’t complete Schedule OR-AP, fill in the amount of your Oregon sales ..........

M.

1

1 2

2 3

3 4

4