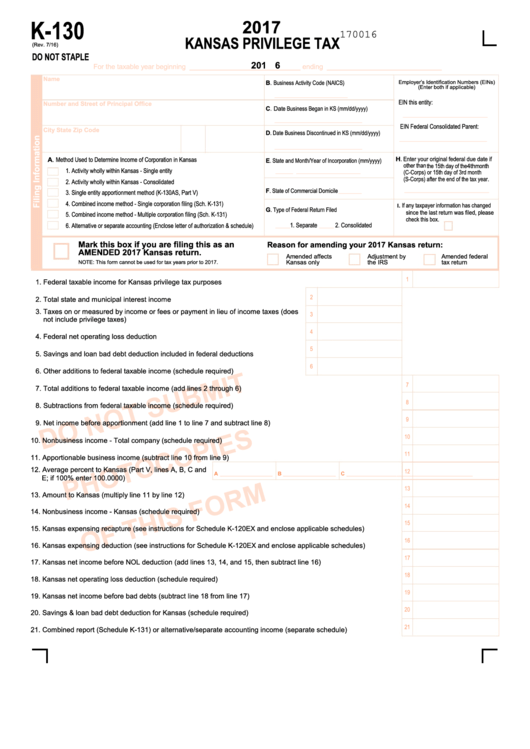

K-130

2017

170016

KANSAS PRIVILEGE TAX

(Rev. 7/16)

DO NOT STAPLE

2 0 1 6

For the taxable year beginning _____________________________ ending ______________________________

Name

B. Business Activity Code (NAICS)

Employer’s Identification Numbers (EINs)

(Enter both if applicable)

_________________________

EIN this entity:

Number and Street of Principal Office

C. Date Business Began in KS (mm/dd/yyyy)

_____________________________

______________________________

EIN Federal Consolidated Parent:

City

State

Zip Code

D. Date Business Discontinued in KS (mm/dd/yyyy)

______________________________

______________________________

H. Enter your original federal due date if

A. Method Used to Determine Income of Corporation in Kansas

E. State and Month/Year of Incorporation (mm/yyyy)

other than the 15th day of the 4th month

1. Activity wholly within Kansas - Single entity

______ ______________________

(C-Corps) or 15th day of 3rd month

(S-Corps) after the end of the tax year.

2. Activity wholly within Kansas - Consolidated

_____________________________

________

F. State of Commercial Domicile

3. Single entity apportionment method (K-130AS, Part V)

4. Combined income method - Single corporation filing (Sch. K-131)

If any taxpayer information has changed

I.

G. Type of Federal Return Filed

since the last return was filed, please

5. Combined income method - Multiple corporation filing (Sch. K-131)

check this box.

_____

1. Separate

_____

2. Consolidated

6. Alternative or separate accounting (Enclose letter of authorization & schedule)

Mark this box if you are filing this as an

Reason for amending your 2017 Kansas return:

AMENDED 2017 Kansas return.

Amended affects

Adjustment by

Amended federal

the IRS

tax return

NOTE: This form cannot be used for tax years prior to 2017.

Kansas only

1

1. Federal taxable income for Kansas privilege tax purposes ...........................................................................................

2

2. Total state and municipal interest income ...................................................................

3. Taxes on or measured by income or fees or payment in lieu of income taxes (does

3

not include privilege taxes) ..........................................................................................

4

4. Federal net operating loss deduction ..........................................................................

5

5. Savings and loan bad debt deduction included in federal deductions ........................

6

6. Other additions to federal taxable income (schedule required) ...................................

7

7. Total additions to federal taxable income (add lines 2 through 6) .................................................................................

8

8. Subtractions from federal taxable income (schedule required) .....................................................................................

9

9. Net income before apportionment (add line 1 to line 7 and subtract line 8) .................................................................

10

10. Nonbusiness income - Total company (schedule required) ..........................................................................................

11

11. Apportionable business income (subtract line 10 from line 9) .......................................................................................

12. Average percent to Kansas (Part V, lines A, B, C and

12

A

__________________

B

__________________

C

_________________

__________________________

E; if 100% enter 100.0000) .........................................

13

13. Amount to Kansas (multiply line 11 by line 12)..............................................................................................................

14

14. Nonbusiness income - Kansas (schedule required) ......................................................................................................

15

15. Kansas expensing recapture (see instructions for Schedule K-120EX and enclose applicable schedules) .................

16

16. Kansas expensing deduction (see instructions for Schedule K-120EX and enclose applicable schedules) .................

17

17. Kansas net income before NOL deduction (add lines 13, 14, and 15, then subtract line 16) .......................................

18

18. Kansas net operating loss deduction (schedule required).............................................................................................

19

19. Kansas net income before bad debts (subtract line 18 from line 17) ............................................................................

20

20. Savings & loan bad debt deduction for Kansas (schedule required) .............................................................................

21

21. Combined report (Schedule K-131) or alternative/separate accounting income (separate schedule) ..........................

1

1 2

2 3

3 4

4