Form Rpd-41372 - Veteran Employment Tax Credit Claim Form Instructions

ADVERTISEMENT

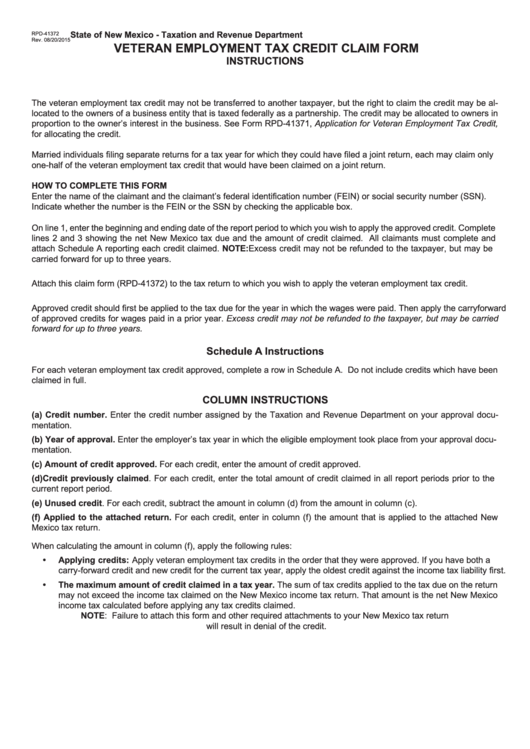

State of New Mexico - Taxation and Revenue Department

RPD-41372

Rev. 08/20/2015

VETERAN EMPLOYMENT TAX CREDIT CLAIM FORM

INSTRUCTIONS

The veteran employment tax credit may not be transferred to another taxpayer, but the right to claim the credit may be al-

located to the owners of a business entity that is taxed federally as a partnership. The credit may be allocated to owners in

proportion to the owner’s interest in the business. See Form RPD-41371, Application for Veteran Employment Tax Credit,

for allocating the credit.

Married individuals filing separate returns for a tax year for which they could have filed a joint return, each may claim only

one-half of the veteran employment tax credit that would have been claimed on a joint return.

HOW TO COMPLETE THIS FORM

Enter the name of the claimant and the claimant’s federal identification number (FEIN) or social security number (SSN).

Indicate whether the number is the FEIN or the SSN by checking the applicable box.

On line 1, enter the beginning and ending date of the report period to which you wish to apply the approved credit. Complete

lines 2 and 3 showing the net New Mexico tax due and the amount of credit claimed. All claimants must complete and

attach Schedule A reporting each credit claimed. NOTE: Excess credit may not be refunded to the taxpayer, but may be

carried forward for up to three years.

Attach this claim form (RPD-41372) to the tax return to which you wish to apply the veteran employment tax credit.

Approved credit should first be applied to the tax due for the year in which the wages were paid. Then apply the carryforward

of approved credits for wages paid in a prior year. Excess credit may not be refunded to the taxpayer, but may be carried

forward for up to three years.

Schedule A Instructions

For each veteran employment tax credit approved, complete a row in Schedule A. Do not include credits which have been

claimed in full.

COLUMN INSTRUCTIONS

(a) Credit number. Enter the credit number assigned by the Taxation and Revenue Department on your approval docu-

mentation.

(b) Year of approval. Enter the employer’s tax year in which the eligible employment took place from your approval docu-

mentation.

(c) Amount of credit approved. For each credit, enter the amount of credit approved.

(d) Credit previously claimed. For each credit, enter the total amount of credit claimed in all report periods prior to the

current report period.

(e) Unused credit. For each credit, subtract the amount in column (d) from the amount in column (c).

(f) Applied to the attached return. For each credit, enter in column (f) the amount that is applied to the attached New

Mexico tax return.

When calculating the amount in column (f), apply the following rules:

•

Applying credits: Apply veteran employment tax credits in the order that they were approved. If you have both a

carry-forward credit and new credit for the current tax year, apply the oldest credit against the income tax liability first.

•

The maximum amount of credit claimed in a tax year. The sum of tax credits applied to the tax due on the return

may not exceed the income tax claimed on the New Mexico income tax return. That amount is the net New Mexico

income tax calculated before applying any tax credits claimed.

NOTE: Failure to attach this form and other required attachments to your New Mexico tax return

will result in denial of the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1