Form Fid-1 - New Mexico Fiduciary Income Tax Return - 1999

ADVERTISEMENT

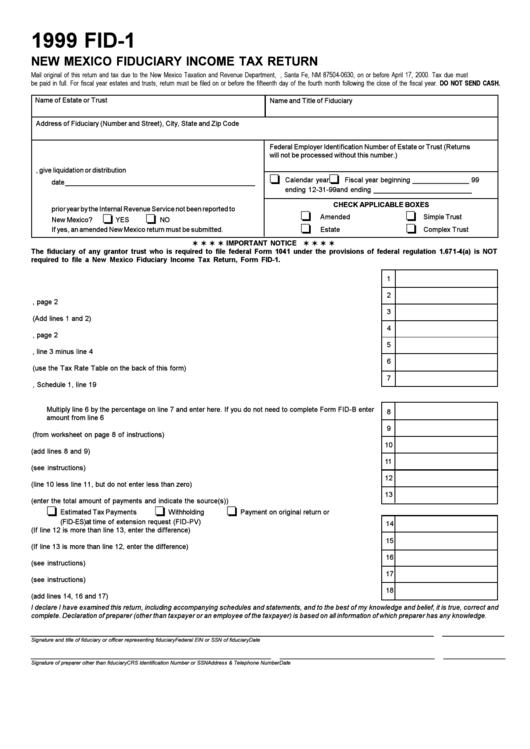

1999 FID-1

NEW MEXICO FIDUCIARY INCOME TAX RETURN

Mail original of this return and tax due to the New Mexico Taxation and Revenue Department, P.O. Box 630, Santa Fe, NM 87504-0630, on or before April 17, 2000. Tax due must

be paid in full. For fiscal year estates and trusts, return must be filed on or before the fifteenth day of the fourth month following the close of the fiscal year. DO NOT SEND CASH.

o

o

o

o

o

o

o

o

V V V V

V V V V

o

o

o

I declare I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and

complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

______________________________________________________

__________________________________________________

________________

Signature and title of fiduciary or officer representing fiduciary

Federal EIN or SSN of fiduciary

Date

__________________________________

____________________________

________________________________________

________________

Signature of preparer other than fiduciary

CRS Identification Number or SSN

Address & Telephone Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4