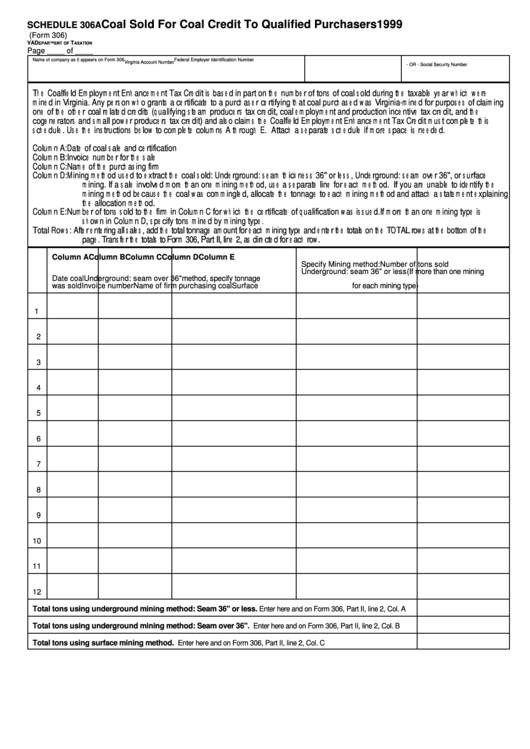

Schedule 306a (Form 306) - Coal Sold For Coal Credit To Qualified Purchasers - Va Department Of Taxation - 1999

ADVERTISEMENT

Coal Sold For Coal Credit To Qualified Purchasers

1999

SCHEDULE 306A

(Form 306)

VA D

T

EPARTMENT OF

AXATION

Page ____ of ____

Name of company as it appears on Form 306

Federal Employer Identification Number

Virginia Account Number

- OR - Social Security Number

Th e Coal f ie l d Em pl oym e nt Enh ance m e nt Tax Cre dit is bas e d in part on t h e num be r of t ons of coal s ol d during t h e t axabl e ye ar w h ich w e re

m ine d in V irginia. Any pe rs on w h o grant s a ce rt if icat e t o a purch as e r ce rt if ying t h at coal purch as e d w as V irginia-m ine d f or purpos e s of cl aim ing

one of t h e ot h e r coal re l at e d cre dit s (q ual if ying s t e am produce rs t ax cre dit , coal e m pl oym e nt and product ion ince nt ive t ax cre dit , and t h e

coge ne rat ors and s m al l pow e r produce rs t ax cre dit ) and al s o cl aim s t h e Coal f ie l d Em pl oym e nt Enh ance m e nt Tax Cre dit m us t com pl e t e t h is

s ch e dul e . Us e t h e ins t ruct ions be l ow t o com pl e t e col um ns A t h rough E. At t ach a s e parat e s ch e dul e if m ore s pace is ne e de d.

Col um n A:

Dat e of coal s al e and ce rt if icat ion

Col um n B:

Invoice num be r f or t h e s al e

Col um n C:

Nam e of t h e purch as ing f irm

Col um n D:

Mining m e t h od us e d t o e xt ract t h e coal s ol d: Unde rground: s e am t h ick ne s s 36" or l e s s , Unde rground: s e am ove r 36", or s urf ace

m ining. I f a s al e invol ve d m ore t h an one m ining m e t h od, us e a s e parat e l ine f or e ach m e t h od. I f you are unabl e t o ide nt if y t h e

m ining m e t h od be caus e t h e coal w as com m ingl e d, al l ocat e t h e t onnage t o e ach m ining m e t h od and at t ach a s t at e m e nt e xpl aining

t h e al l ocat ion m e t h od.

Col um n E:

Num be r of t ons s ol d t o t h e f irm in Col um n C f or w h ich t h e ce rt if icat e of q ual if icat ion w as is s ue d. I f m ore t h an one m ining t ype is

s h ow n in Col um n D, s pe cif y t ons m ine d by m ining t ype

.

Tot al Row s :

Af t e r e nt e ring al l s al e s , add t h e t ot al t onnage am ount f or e ach m ining t ype and e nt e r t h e t ot al s on t h e TOTAL row s at t h e bot t om of t h e

page . Trans f e r t h e t ot al s t o Form 306, Part I I , l ine 2, as dire ct e d f or e ach row .

Column A

Column B

Column C

Column D

Column E

Specify Mining method:

Number of tons sold

Underground: seam 36" or less

(If more than one mining

Date coal

Underground: seam over 36"

method, specify tonnage

was sold

Invoice number

Name of firm purchasing coal

Surface

for each mining type)

1

2

3

4

5

6

7

8

9

10

11

12

Total tons using underground mining method: Seam 36" or less.

Enter here and on Form 306, Part II, line 2, Col. A

Total tons using underground mining method: Seam over 36".

Enter here and on Form 306, Part II, line 2, Col. B

Total tons using surface mining method.

Enter here and on Form 306, Part II, line 2, Col. C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1