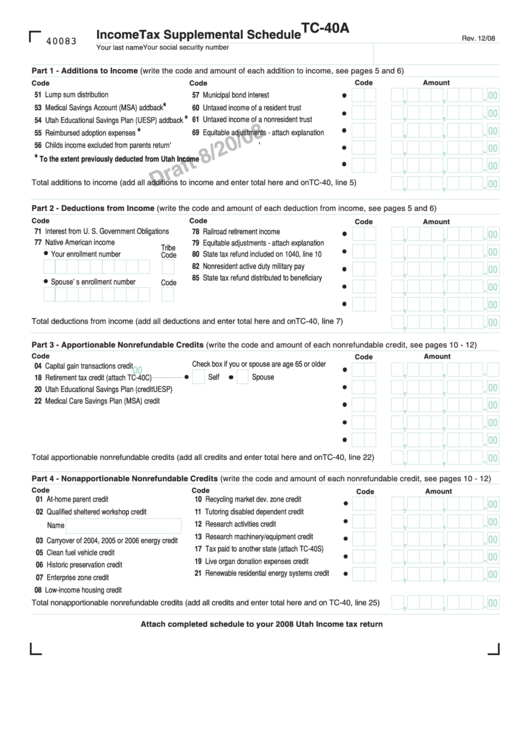

Form Tc-40a - Income Tax Supplemental Schedule - Draft

ADVERTISEMENT

TC-40A

Income Tax Supplemental Schedule

Rev. 12/08

40083

Your last name

Your social security number

Part 1 - Additions to Income (write the code and amount of each addition to income, see pages 5 and 6)

Code

Amount

Code

Code

51 Lump sum distribution

57 Municipal bond interest

,

00

,

*

53 Medical Savings Account (MSA) addback

60 Untaxed income of a resident trust

00

,

,

*

61 Untaxed income of a nonresident trust

54 Utah Educational Savings Plan (UESP) addback

00

,

,

*

69 Equitable adjustments - attach explanation

55 Reimbursed adoption expenses

56 Child s income excluded from parent s return

'

'

00

,

,

*

To the extent previously deducted from Utah Income

00

,

,

Total additions to income (add all additions to income and enter total here and on TC-40, line 5)

,

00

,

Part 2 - Deductions from Income (write the code and amount of each deduction from income, see pages 5 and 6)

Code

Code

Code

Amount

71 Interest from U. S. Government Obligations

78 Railroad retirement income

00

,

,

77 Native American income

79 Equitable adjustments - attach explanation

Tribe

00

,

,

80 State tax refund included on 1040, line 10

Your enrollment number

Code

82 Nonresident active duty military pay

00

,

,

85 State tax refund distributed to beneficiary

Spouse' s enrollment number

Code

00

,

,

00

,

,

Total deductions from income (add all deductions and enter total here and on TC-40, line 7)

00

,

,

Part 3 - Apportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 10 - 12)

Code

Amount

Code

Check box if you or spouse are age 65 or older

04 Capital gain transactions credit

00

,

,

Spouse

Self

18 Retirement tax credit (attach TC-40C)

00

,

,

20 Utah Educational Savings Plan (

UESP)

credit

22 Medical Care Savings Plan (MSA) credit

00

,

,

00

,

,

00

,

,

Total apportionable nonrefundable credits (add all credits and enter total here and on TC-40, line 22)

00

,

,

Part 4 - Nonapportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 10 - 12)

Code

Code

Amount

Code

01 At-home parent credit

10 Recycling market dev. zone credit

00

,

,

11 Tutoring disabled dependent credit

02 Qualified sheltered workshop credit

00

,

,

12 Research activities credit

Name

13 Research machinery/equipment credit

,

00

,

03 Carryover of 2004, 2005 or 2006 energy credit

17 Tax paid to another state (attach TC-40S)

05 Clean fuel vehicle credit

00

,

,

19 Live organ donation expenses credit

06 Historic preservation credit

21 Renewable residential energy systems credit

00

,

,

07 Enterprise zone credit

08 Low-income housing credit

,

,

00

Total nonapportionable nonrefundable credits (add all credits and enter total here and on TC-40, line 25)

Attach completed schedule to your 2008 Utah Income tax return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5