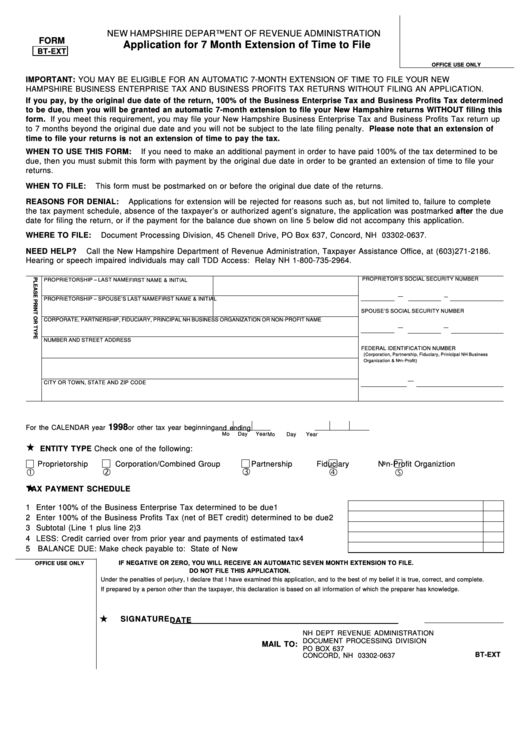

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

Application for 7 Month Extension of Time to File

BT-EXT

OFFICE USE ONLY

IMPORTANT: YOU MAY BE ELIGIBLE FOR AN AUTOMATIC 7-MONTH EXTENSION OF TIME TO FILE YOUR NEW

HAMPSHIRE BUSINESS ENTERPRISE TAX AND BUSINESS PROFITS TAX RETURNS WITHOUT FILING AN APPLICATION.

If you pay, by the original due date of the return, 100% of the Business Enterprise Tax and Business Profits Tax determined

to be due, then you will be granted an automatic 7-month extension to file your New Hampshire returns WITHOUT filing this

form. If you meet this requirement, you may file your New Hampshire Business Enterprise Tax and Business Profits Tax return up

to 7 months beyond the original due date and you will not be subject to the late filing penalty. Please note that an extension of

time to file your returns is not an extension of time to pay the tax.

WHEN TO USE THIS FORM:

If you need to make an additional payment in order to have paid 100% of the tax determined to be

due, then you must submit this form with payment by the original due date in order to be granted an extension of time to file your

returns.

WHEN TO FILE:

This form must be postmarked on or before the original due date of the returns.

REASONS FOR DENIAL:

Applications for extension will be rejected for reasons such as, but not limited to, failure to complete

the tax payment schedule, absence of the taxpayer’s or authorized agent’s signature, the application was postmarked after the due

date for filing the return, or if the payment for the balance due shown on line 5 below did not accompany this application.

WHERE TO FILE:

Document Processing Division, 45 Chenell Drive, PO Box 637, Concord, NH 03302-0637.

NEED HELP?

Call the New Hampshire Department of Revenue Administration, Taxpayer Assistance Office, at (603)271-2186.

Hearing or speech impaired individuals may call TDD Access: Relay NH 1-800-735-2964.

PROPRIETOR’S SOCIAL SECURITY NUMBER

PROPRIETORSHIP – LAST NAME

FIRST NAME & INITIAL

PROPRIETORSHIP – SPOUSE’S LAST NAME

FIRST NAME & INITIAL

SPOUSE’S SOCIAL SECURITY NUMBER

CORPORATE, PARTNERSHIP, FIDUCIARY, PRINCIPAL NH BUSINESS ORGANIZATION OR NON-PROFIT NAME

NUMBER AND STREET ADDRESS

FEDERAL IDENTIFICATION NUMBER

(Corporation, Partnership, Fiduciary, Prinicipal NH Business

Organization & Non-Profit)

CITY OR TOWN, STATE AND ZIP CODE

1998

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

ENTITY TYPE Check one of the following:

Proprietorship

Corporation/Combined Group

Partnership

Fiduciary

Non-Profit Organiztion

TAX PAYMENT SCHEDULE

1 Enter 100% of the Business Enterprise Tax determined to be due ................................ 1

2 Enter 100% of the Business Profits Tax (net of BET credit) determined to be due ..... 2

3 Subtotal (Line 1 plus line 2) ................................................................................................. 3

4 LESS: Credit carried over from prior year and payments of estimated tax ................... 4

5

BALANCE DUE: Make check payable to: State of New Hampshire...........................5

IF NEGATIVE OR ZERO, YOU WILL RECEIVE AN AUTOMATIC SEVEN MONTH EXTENSION TO FILE.

OFFICE USE ONLY

DO NOT FILE THIS APPLICATION.

Under the penalties of perjury, I declare that I have examined this application, and to the best of my belief it is true, correct, and complete.

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

SIGNATURE

DATE

NH DEPT REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

MAIL TO:

PO BOX 637

BT-EXT

CONCORD, NH 03302-0637

1

1