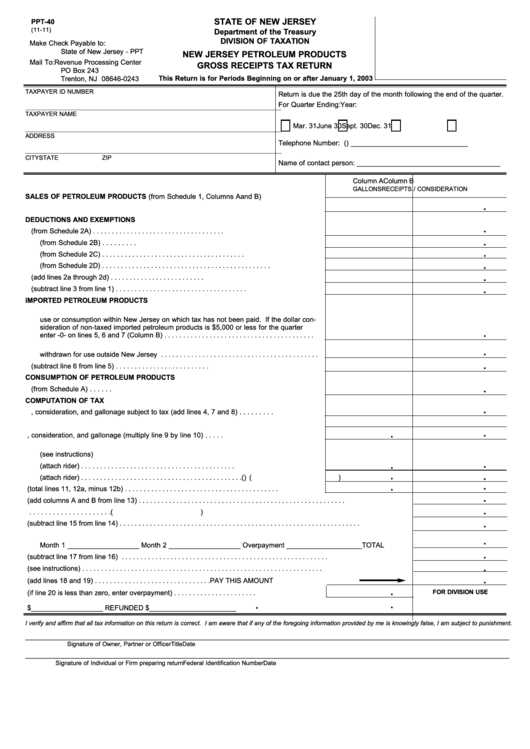

STATE OF NEW JERSEY

PPT-40

(11-11)

Department of the Treasury

DIVISION OF TAXATION

Make Check Payable to:

State of New Jersey - PPT

NEW JERSEY PETROLEUM PRODUCTS

Mail To: Revenue Processing Center

GROSS RECEIPTS TAX RETURN

PO Box 243

Trenton, NJ 08646-0243

This Return is for Periods Beginning on or after January 1, 2003

TAXPAYER ID NUMBER

Return is due the 25th day of the month following the end of the quarter.

For Quarter Ending:

Year:

_________________________________________________________________________________

TAXPAYER NAME

Mar. 31

June 30

Sept. 30

Dec. 31

_________________________________________________________________________________

ADDRESS

Telephone Number: (

) _______________________________

_________________________________________________________________________________

CITY

STATE

ZIP

Name of contact person: ______________________________________

Column A

Column B

GALLONS

RECEIPTS / CONSIDERATION

SALES OF PETROLEUM PRODUCTS (from Schedule 1, Columns A and B)

.

1. Sales of petroleum products made to points in New Jersey . . . . . . . . . . . . . . . . . . . . . . . . . .

DEDUCTIONS AND EXEMPTIONS

.

2. a. Sales for residential use (from Schedule 2A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

b. Sales to governmental entities and exempt organizations (from Schedule 2B) . . . . . . . . .

.

c. Other exempt sales (from Schedule 2C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

d. Deductions (from Schedule 2D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

3. Total deductions and exemptions (add lines 2a through 2d) . . . . . . . . . . . . . . . . . . . . . . . . .

.

4. Sales subject to tax (subtract line 3 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IMPORTED PETROLEUM PRODUCTS

5. Dollar consideration / gallons of petroleum products imported or caused to be imported for

use or consumption within New Jersey on which tax has not been paid. If the dollar con-

sideration of non-taxed imported petroleum products is $5,000 or less for the quarter

.

enter -0- on lines 5, 6 and 7 (Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Dollar consideration / gallons of petroleum products which were subsequently

.

withdrawn for use outside New Jersey . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

7. Imported products subject to tax (subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . .

CONSUMPTION OF PETROLEUM PRODUCTS

.

8. Petroleum products consumed or deemed consumed by aircraft (from Schedule A) . . . . . .

COMPUTATION OF TAX

.

9. Total receipts, consideration, and gallonage subject to tax (add lines 4, 7 and 8) . . . . . . . . .

10. Tax Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.04

.0275

.

.

11. Total tax liability on receipts, consideration, and gallonage (multiply line 9 by line 10) . . . . .

12. Adjustments to the Petroleum Products Gross Receipts Tax for prior period transactions.

(see instructions)

.

.

a. Addition to tax liability (attach rider) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

b. Credit to tax liability (attach rider) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

) (

)

.

.

13. Tax Due (total lines 11, 12a, minus 12b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

14. Total Tax Due (add columns A and B from line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

15. Neighborhood Revitalization Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

.

16. Tax Due (subtract line 15 from line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Monthly Remittances during the quarter and overpayment credit from previous return

.

Month 1 ___________________ Month 2 ___________________ Overpayment ____________________

TOTAL

.

18. Balance of Tax Due (subtract line 17 from line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

19. Penalty and Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

20. Total Amount Due (add lines 18 and 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PAY THIS AMOUNT

.

FOR DIVISION USE

21. Overpayment (if line 20 is less than zero, enter overpayment) . . . . . . . . . . . . . . . . . . . . . .

.

.

22. Amount of Line 21 to be CREDITED to next quarter $___________________ REFUNDED $_______________________

I verify and affirm that all tax information on this return is correct. I am aware that if any of the foregoing information provided by me is knowingly false, I am subject to punishment.

______________________________________________________________________________________________________________________________________________

Signature of Owner, Partner or Officer

Title

Date

______________________________________________________________________________________________________________________________________________

Signature of Individual or Firm preparing return

Federal Identification Number

Date

1

1 2

2