Form Pfr-02.ins - Illinois Professional Fundraiser Annual Financial Report Filing Instructions

ADVERTISEMENT

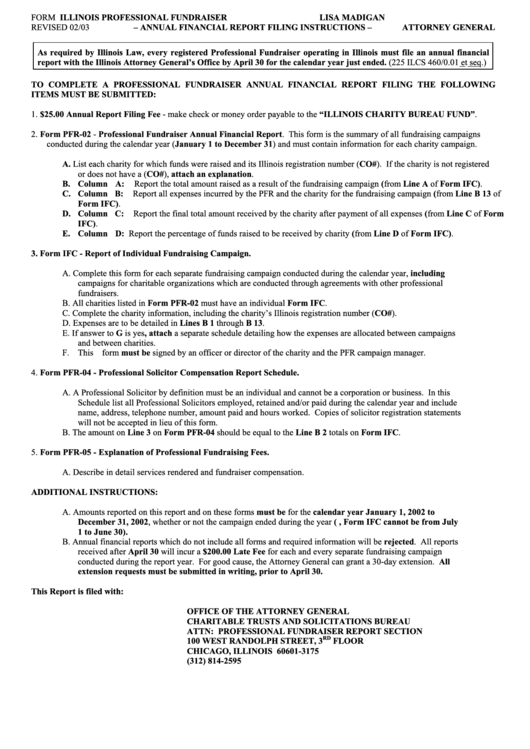

FORM PFR-02.INS

ILLINOIS PROFESSIONAL FUNDRAISER

LISA MADIGAN

REVISED 02/03

– ANNUAL FINANCIAL REPORT FILING INSTRUCTIONS –

ATTORNEY GENERAL

As required by Illinois Law, every registered Professional Fundraiser operating in Illinois must file an annual financial

report with the Illinois Attorney General’s Office by April 30 for the calendar year just ended. (225 ILCS 460/0.01 et seq.)

TO COMPLETE A PROFESSIONAL FUNDRAISER ANNUAL FINANCIAL REPORT FILING THE FOLLOWING

ITEMS MUST BE SUBMITTED:

1. $25.00 Annual Report Filing Fee - make check or money order payable to the “ILLINOIS CHARITY BUREAU FUND”.

2. Form PFR-02 - Professional Fundraiser Annual Financial Report. This form is the summary of all fundraising campaigns

conducted during the calendar year (January 1 to December 31) and must contain information for each charity campaign.

A. List each charity for which funds were raised and its Illinois registration number (CO#). If the charity is not registered

or does not have a (CO#), attach an explanation.

B. Column A: Report the total amount raised as a result of the fundraising campaign (from Line A of Form IFC).

C. Column B: Report all expenses incurred by the PFR and the charity for the fundraising campaign (from Line B 13 of

Form IFC).

D. Column C: Report the final total amount received by the charity after payment of all expenses (from Line C of Form

IFC).

E. Column D: Report the percentage of funds raised to be received by charity (from Line D of Form IFC).

3. Form IFC - Report of Individual Fundraising Campaign.

A. Complete this form for each separate fundraising campaign conducted during the calendar year, including

campaigns for charitable organizations which are conducted through agreements with other professional

fundraisers.

B. All charities listed in Form PFR-02 must have an individual Form IFC.

C. Complete the charity information, including the charity’s Illinois registration number (CO#).

D. Expenses are to be detailed in Lines B 1 through B 13.

E. If answer to G is yes, attach a separate schedule detailing how the expenses are allocated between campaigns

and between charities.

F. This form must be signed by an officer or director of the charity and the PFR campaign manager.

4. Form PFR-04 - Professional Solicitor Compensation Report Schedule.

A. A Professional Solicitor by definition must be an individual and cannot be a corporation or business. In this

Schedule list all Professional Solicitors employed, retained and/or paid during the calendar year and include

name, address, telephone number, amount paid and hours worked. Copies of solicitor registration statements

will not be accepted in lieu of this form.

B. The amount on Line 3 on Form PFR-04 should be equal to the Line B 2 totals on Form IFC.

5. Form PFR-05 - Explanation of Professional Fundraising Fees.

A. Describe in detail services rendered and fundraiser compensation.

ADDITIONAL INSTRUCTIONS:

A. Amounts reported on this report and on these forms must be for the calendar year January 1, 2002 to

December 31, 2002, whether or not the campaign ended during the year (i.e., Form IFC cannot be from July

1 to June 30).

B. Annual financial reports which do not include all forms and required information will be rejected. All reports

received after April 30 will incur a $200.00 Late Fee for each and every separate fundraising campaign

conducted during the report year. For good cause, the Attorney General can grant a 30-day extension. All

extension requests must be submitted in writing, prior to April 30.

This Report is filed with:

OFFICE OF THE ATTORNEY GENERAL

CHARITABLE TRUSTS AND SOLICITATIONS BUREAU

ATTN: PROFESSIONAL FUNDRAISER REPORT SECTION

RD

100 WEST RANDOLPH STREET, 3

FLOOR

CHICAGO, ILLINOIS 60601-3175

(312) 814-2595

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1