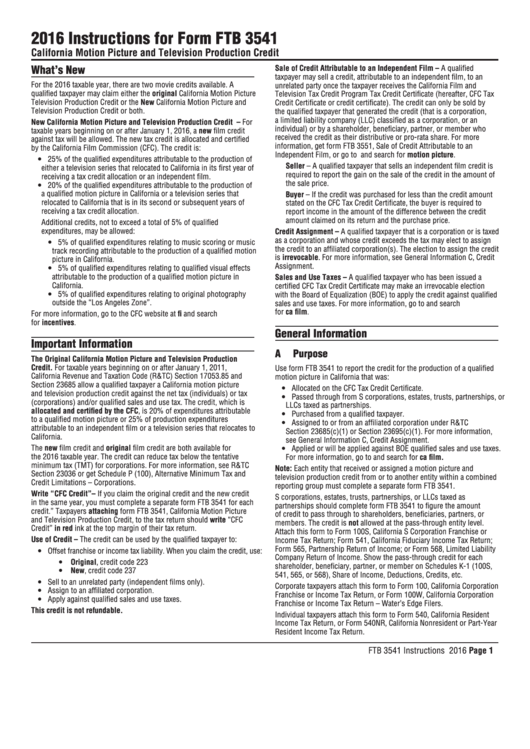

Instructions For Form Ftb 3541 - California Motion Picture And Television Production Credit - 2016

ADVERTISEMENT

2016 Instructions for Form FTB 3541

California Motion Picture and Television Production Credit

What’s New

Sale of Credit Attributable to an Independent Film – A qualified

taxpayer may sell a credit, attributable to an independent film, to an

For the 2016 taxable year, there are two movie credits available. A

unrelated party once the taxpayer receives the California Film and

qualified taxpayer may claim either the original California Motion Picture

Television Tax Credit Program Tax Credit Certificate (hereafter, CFC Tax

Television Production Credit or the New California Motion Picture and

Credit Certificate or credit certificate). The credit can only be sold by

Television Production Credit or both.

the qualified taxpayer that generated the credit (that is a corporation,

a limited liability company (LLC) classified as a corporation, or an

New California Motion Picture and Television Production Credit – For

individual) or by a shareholder, beneficiary, partner, or member who

taxable years beginning on or after January 1, 2016, a new film credit

received the credit as their distributive or pro-rata share. For more

against tax will be allowed. The new tax credit is allocated and certified

information, get form FTB 3551, Sale of Credit Attributable to an

by the California Film Commission (CFC). The credit is:

Independent Film, or go to ftb.ca.gov and search for motion picture.

y 25% of the qualified expenditures attributable to the production of

Seller – A qualified taxpayer that sells an independent film credit is

either a television series that relocated to California in its first year of

required to report the gain on the sale of the credit in the amount of

receiving a tax credit allocation or an independent film.

the sale price.

y 20% of the qualified expenditures attributable to the production of

a qualified motion picture in California or a television series that

Buyer – If the credit was purchased for less than the credit amount

relocated to California that is in its second or subsequent years of

stated on the CFC Tax Credit Certificate, the buyer is required to

receiving a tax credit allocation.

report income in the amount of the difference between the credit

amount claimed on its return and the purchase price.

Additional credits, not to exceed a total of 5% of qualified

expenditures, may be allowed:

Credit Assignment – A qualified taxpayer that is a corporation or is taxed

as a corporation and whose credit exceeds the tax may elect to assign

y 5% of qualified expenditures relating to music scoring or music

the credit to an affiliated corporation(s). The election to assign the credit

track recording attributable to the production of a qualified motion

is irrevocable. For more information, see General Information C, Credit

picture in California.

Assignment.

y 5% of qualified expenditures relating to qualified visual effects

attributable to the production of a qualified motion picture in

Sales and Use Taxes – A qualified taxpayer who has been issued a

California.

certified CFC Tax Credit Certificate may make an irrevocable election

y 5% of qualified expenditures relating to original photography

with the Board of Equalization (BOE) to apply the credit against qualified

outside the “Los Angeles Zone”.

sales and use taxes. For more information, go to boe.ca.gov and search

for ca film.

For more information, go to the CFC website at film.ca.gov and search

for incentives.

General Information

Important Information

A

Purpose

The Original California Motion Picture and Television Production

Credit. For taxable years beginning on or after January 1, 2011,

Use form FTB 3541 to report the credit for the production of a qualified

California Revenue and Taxation Code (R&TC) Section 17053.85 and

motion picture in California that was:

Section 23685 allow a qualified taxpayer a California motion picture

y Allocated on the CFC Tax Credit Certificate.

and television production credit against the net tax (individuals) or tax

y Passed through from S corporations, estates, trusts, partnerships, or

(corporations) and/or qualified sales and use tax. The credit, which is

LLCs taxed as partnerships.

allocated and certified by the CFC, is 20% of expenditures attributable

y Purchased from a qualified taxpayer.

to a qualified motion picture or 25% of production expenditures

y Assigned to or from an affiliated corporation under R&TC

attributable to an independent film or a television series that relocates to

Section 23685(c)(1) or Section 23695(c)(1). For more information,

California.

see General Information C, Credit Assignment.

The new film credit and original film credit are both available for

y Applied or will be applied against BOE qualified sales and use taxes.

the 2016 taxable year. The credit can reduce tax below the tentative

For more information, go to boe.ca.gov and search for ca film.

minimum tax (TMT) for corporations. For more information, see R&TC

Note: Each entity that received or assigned a motion picture and

Section 23036 or get Schedule P (100), Alternative Minimum Tax and

television production credit from or to another entity within a combined

Credit Limitations – Corporations.

reporting group must complete a separate form FTB 3541.

Write “CFC Credit”– If you claim the original credit and the new credit

S corporations, estates, trusts, partnerships, or LLCs taxed as

in the same year, you must complete a separate form FTB 3541 for each

partnerships should complete form FTB 3541 to figure the amount

credit.” Taxpayers attaching form FTB 3541, California Motion Picture

of credit to pass through to shareholders, beneficiaries, partners, or

and Television Production Credit, to the tax return should write “CFC

members. The credit is not allowed at the pass-through entity level.

Credit” in red ink at the top margin of their tax return.

Attach this form to Form 100S, California S Corporation Franchise or

Use of Credit – The credit can be used by the qualified taxpayer to:

Income Tax Return; Form 541, California Fiduciary Income Tax Return;

Form 565, Partnership Return of Income; or Form 568, Limited Liability

y Offset franchise or income tax liability. When you claim the credit, use:

Company Return of Income. Show the pass-through credit for each

y Original, credit code 223

shareholder, beneficiary, partner, or member on Schedules K-1 (100S,

y New, credit code 237

541, 565, or 568), Share of Income, Deductions, Credits, etc.

y Sell to an unrelated party (independent films only).

Corporate taxpayers attach this form to Form 100, California Corporation

y Assign to an affiliated corporation.

Franchise or Income Tax Return, or Form 100W, California Corporation

y Apply against qualified sales and use taxes.

Franchise or Income Tax Return – Water’s Edge Filers.

This credit is not refundable.

Individual taxpayers attach this form to Form 540, California Resident

Income Tax Return, or Form 540NR, California Nonresident or Part-Year

Resident Income Tax Return.

FTB 3541 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4