Instructions For Schedule L (Form 990 Or 990-Ez) - Transactions With Interested Persons - 2014

ADVERTISEMENT

2014

Department of the Treasury

Internal Revenue Service

Instructions for Schedule L

(Form 990 or 990-EZ)

Transactions With Interested Persons

disqualified person(s) under section

Each reportable transaction is to be

Section references are to the Internal Revenue

Code unless otherwise noted.

4958 or other interested persons.

reported in only one part of Schedule L, as

Schedule L is also used to determine

described below.

Future Developments

whether a member of the organization's

Interested persons. For purposes of

governing body is an independent

For the latest information about

Part I, an interested person is a

member for purposes of Form 990, Part

disqualified person under section 4958.

developments related to Form 990 and its

VI, line 1b.

For purposes of Parts II-IV, an interested

instructions, such as legislation enacted

Supplemental information. Parts I-IV

person is one of the following:

after they were published, go to

can be duplicated if additional space is

1. For Form 990 filers, a person

needed. Also, Part V may be used to

required to be listed in Form 990, Part VII,

What's New

explain a transaction or to provide

Section A as a current or former officer,

additional information.

director, trustee, or key employee, and

The definition of interested person for

for Form 990-EZ filers, a current officer,

purposes of Parts II-IV of Schedule L has

Who Must File

director, trustee, or key employee required

been harmonized, as provided in the

to be listed on Form 990-EZ, Part IV. For

The chart at the bottom of this page

introduction to the Specific Instructions.

purposes of reporting management

provides which organizations must

Certain special definitions continue to

company transactions in Part IV, however,

complete all or a part of Schedule L and

apply for purposes of Part III only.

a former officer, director, trustee, or key

must attach Schedule L to Form 990 or

The reasonable effort instructions have

employee of the organization within the

990-EZ. If an organization is not required

been harmonized.

last five tax years is treated as a

to file Form 990 or 990-EZ but chooses to

Business transactions between the

disqualified person whether or not

do so, it must file a complete return and

organization and a publicly-traded

required to be so listed.

provide all of the information requested,

company in the ordinary course of its

including the required schedules.

business, on the same terms as it

2. The creator or founder of the

generally offers to the public, are excepted

organization, including the sponsoring

Specific Instructions

from Part IV reporting.

organizations of a VEBA.

3. A substantial contributor. For

General Instructions

For Parts I, II, and III, report all

purposes of Schedule L Parts II-IV, a

transactions regardless of amount. Part IV

Note. Terms in bold are defined in the

substantial contributor is an individual or

instructions provide individual and total

Glossary of the Instructions for Form 990.

organization that made contributions

reporting thresholds below which reporting

during the tax year in the aggregate of at

Purpose of Schedule

is not required for an interested person.

least $5,000 and is required to be reported

Parts III and IV contain separate

by name in Schedule B (Form 990,

Schedule L (Form 990 or 990-EZ) is used

reasonable effort instructions which

990-EZ, or 990-PF), Schedule of

by an organization that files Form 990 or

organizations may rely on to satisfy

Contributors, for the organization’s tax

990-EZ to provide information on certain

reporting requirements for those parts.

year. A substantial contributor may include

financial transactions or arrangements

an employer that contributes to a VEBA.

between the organization and

4. For purposes of Part III, a member

of the organization’s grant selection

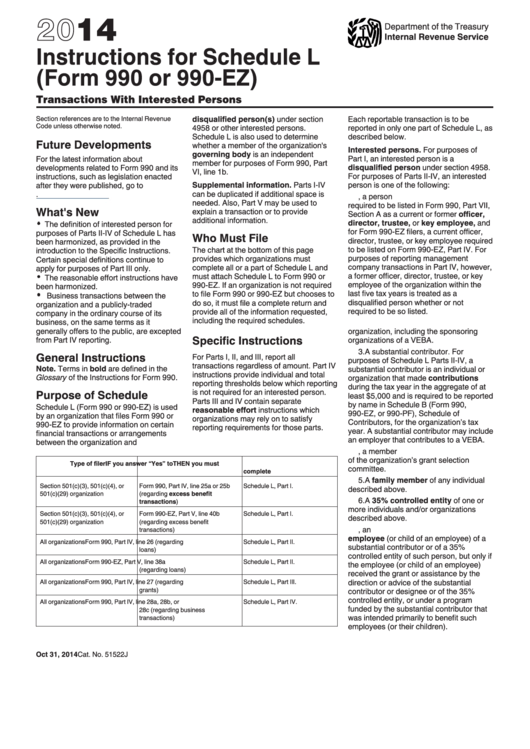

Type of filer

IF you answer “Yes” to

THEN you must

. . . .

committee.

complete

. . . . . . . . . . .

5. A family member of any individual

Section 501(c)(3), 501(c)(4), or

Form 990, Part IV, line 25a or 25b

Schedule L, Part I.

described above.

501(c)(29) organization

(regarding excess benefit

6. A 35% controlled entity of one or

transactions)

more individuals and/or organizations

Section 501(c)(3), 501(c)(4), or

Form 990-EZ, Part V, line 40b

Schedule L, Part I.

described above.

501(c)(29) organization

(regarding excess benefit

7. For purposes of Part III, an

transactions)

employee (or child of an employee) of a

All organizations

Form 990, Part IV, line 26 (regarding

Schedule L, Part II.

substantial contributor or of a 35%

loans)

controlled entity of such person, but only if

All organizations

Form 990-EZ, Part V, line 38a

Schedule L, Part II.

the employee (or child of an employee)

(regarding loans)

received the grant or assistance by the

direction or advice of the substantial

All organizations

Form 990, Part IV, line 27 (regarding

Schedule L, Part III.

grants)

contributor or designee or of the 35%

controlled entity, or under a program

All organizations

Form 990, Part IV, line 28a, 28b, or

Schedule L, Part IV.

funded by the substantial contributor that

28c (regarding business

was intended primarily to benefit such

transactions)

employees (or their children).

Oct 31, 2014

Cat. No. 51522J

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5