Form Kw-5 - Kansas Withholding Tax Deposit Report And Change Forms

ADVERTISEMENT

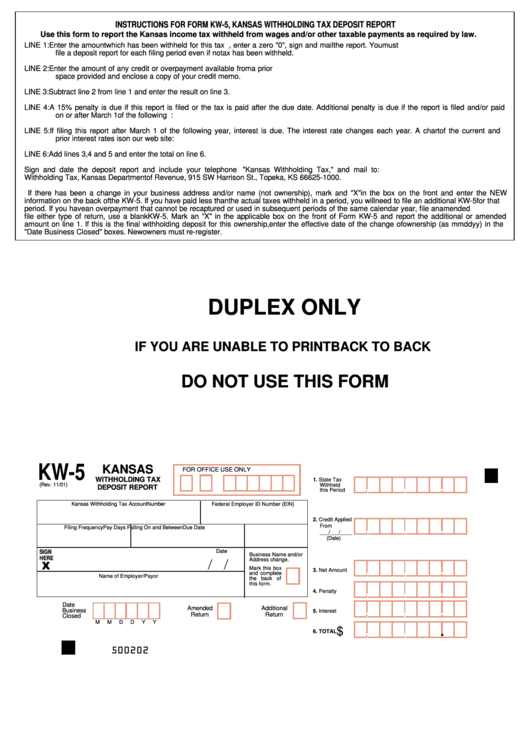

INSTRUCTIONS FOR FORM KW-5, KANSAS WITHHOLDING TAX DEPOSIT REPORT

Use this form to report the Kansas income tax withheld from wages and/or other taxable payments as required by law.

LINE 1: Enter the amount which has been withheld for this tax period. If no tax was withheld, enter a zero "0", sign and mail the report. You must

file a deposit report for each filing period even if no tax has been withheld.

LINE 2: Enter the amount of any credit or overpayment available from a prior period. Enter the date of the filing period generating the credit in the

space provided and enclose a copy of your credit memo.

LINE 3: Subtract line 2 from line 1 and enter the result on line 3.

LINE 4: A 15% penalty is due if this report is filed or the tax is paid after the due date. Additional penalty is due if the report is filed and/or paid

on or after March 1 of the following year. Information about additional penalty rates is on our web site:

LINE 5: If filing this report after March 1 of the following year, interest is due. The interest rate changes each year. A chart of the current and

prior interest rates is on our web site:

LINE 6: Add lines 3, 4 and 5 and enter the total on line 6.

Sign and date the deposit report and include your telephone number. Make remittance payable to "Kansas Withholding Tax," and mail to:

Withholding Tax, Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66625-1000.

If there has been a change in your business address and/or name (not ownership), mark and "X" in the box on the front and enter the NEW

information on the back of the KW-5. If you have paid less than the actual taxes withheld in a period, you will need to file an additional KW-5 for that

period. If you have an overpayment that cannot be recaptured or used in subsequent periods of the same calendar year, file an amended KW-5. To

file either type of return, use a blank KW-5. Mark an "X" in the applicable box on the front of Form KW-5 and report the additional or amended

amount on line 1. If this is the final withholding deposit for this ownership, enter the effective date of the change of ownership (as mmddyy) in the

"Date Business Closed" boxes. New owners must re-register.

DUPLEX ONLY

IF YOU ARE UNABLE TO PRINT BACK TO BACK

DO NOT USE THIS FORM

KW-5

KANSAS

FOR OFFICE USE ONLY

WITHHOLDING TAX

1. State Tax

,

,

.

(Rev. 11/01)

Withheld

DEPOSIT REPORT

this Period

Kansas Withholding Tax Account Number

Federal Employer ID Number (EIN)

2. Credit Applied

,

,

.

From

Filing Frequency

Pay Days Falling On and Between

Due Date

___/___/____

(Date)

Date

SIGN

Business Name and/or

HERE

Address change.

;

,

.

,

Mark this box

3. Net Amount

and complete

Name of Employer/Payor

the back of

this form.

,

.

,

4. Penalty

,

Date

,

.

Amended

Additional

Business

5. Interest

Return

Return

Closed

M

M

D

D

Y

Y

,

,

.

$

6. TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2