Instructions For Form Ol-3 - Net Profit License Fee Return - City Of Covington, Kentucky

ADVERTISEMENT

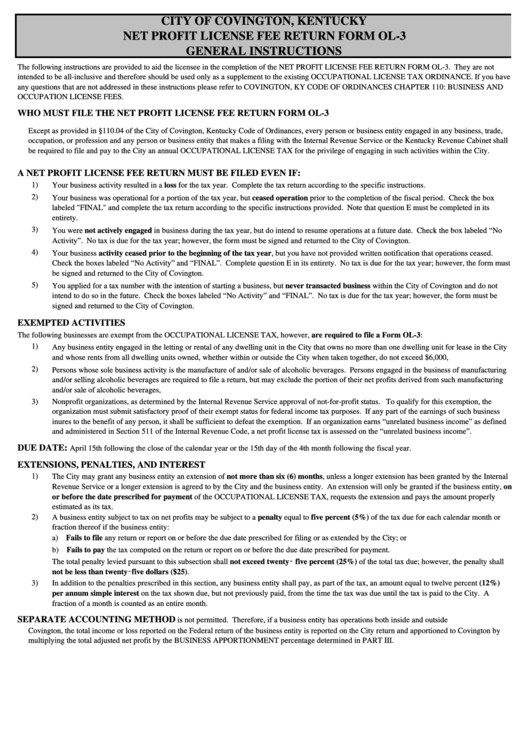

CITY OF COVINGTON, KENTUCKY

NET PROFIT LICENSE FEE RETURN FORM OL-3

GENERAL INSTRUCTIONS

The following instructions are provided to aid the licensee in the completion of the NET PROFIT LICENSE FEE RETURN FORM OL-3. They are not

intended to be all-inclusive and therefore should be used only as a supplement to the existing OCCUPATIONAL LICENSE TAX ORDINANCE. If you have

any questions that are not addressed in these instructions please refer to COVINGTON, KY CODE OF ORDINANCES CHAPTER 110: BUSINESS AND

OCCUPATION LICENSE FEES.

WHO MUST FILE THE NET PROFIT LICENSE FEE RETURN FORM OL-3

Except as provided in §110.04 of the City of Covington, Kentucky Code of Ordinances, every person or business entity engaged in any business, trade,

occupation, or profession and any person or business entity that makes a filing with the Internal Revenue Service or the Kentucky Revenue Cabinet shall

be required to file and pay to the City an annual OCCUPATIONAL LICENSE TAX for the privilege of engaging in such activities within the City.

A NET PROFIT LICENSE FEE RETURN MUST BE FILED EVEN IF:

1)

Your business activity resulted in a loss for the tax year. Complete the tax return according to the specific instructions.

2)

Your business was operational for a portion of the tax year, but ceased operation prior to the completion of the fiscal period. Check the box

labeled "FINAL" and complete the tax return according to the specific instructions provided. Note that question E must be completed in its

entirety.

3)

You were not actively engaged in business during the tax year, but do intend to resume operations at a future date. Check the box labeled “No

Activity”. No tax is due for the tax year; however, the form must be signed and returned to the City of Covington.

4)

Your business activity ceased prior to the beginning of the tax year, but you have not provided written notification that operations ceased.

Check the boxes labeled “No Activity” and “FINAL”. Complete question E in its entirety. No tax is due for the tax year; however, the form must

be signed and returned to the City of Covington.

5)

You applied for a tax number with the intention of starting a business, but never transacted business within the City of Covington and do not

intend to do so in the future. Check the boxes labeled “No Activity” and “FINAL”. No tax is due for the tax year; however, the form must be

signed and returned to the City of Covington.

EXEMPTED ACTIVITIES

The following businesses are exempt from the OCCUPATIONAL LICENSE TAX, however, are required to file a Form OL-3:

1)

Any business entity engaged in the letting or rental of any dwelling unit in the City that owns no more than one dwelling unit for lease in the City

and whose rents from all dwelling units owned, whether within or outside the City when taken together, do not exceed $6,000,

2)

Persons whose sole business activity is the manufacture of and/or sale of alcoholic beverages. Persons engaged in the business of manufacturing

and/or selling alcoholic beverages are required to file a return, but may exclude the portion of their net profits derived from such manufacturing

and/or sale of alcoholic beverages,

3)

Nonprofit organizations, as determined by the Internal Revenue Service approval of not-for-profit status. To qualify for this exemption, the

organization must submit satisfactory proof of their exempt status for federal income tax purposes. If any part of the earnings of such business

inures to the benefit of any person, it shall be sufficient to defeat the exemption. If an organization earns “unrelated business income” as defined

and administered in Section 511 of the Internal Revenue Code, a net profit license tax is assessed on the “unrelated business income”.

DUE DATE:

April 15th following the close of the calendar year or the 15th day of the 4th month following the fiscal year.

EXTENSIONS, PENALTIES, AND INTEREST

1)

The City may grant any business entity an extension of not more than six (6) months, unless a longer extension has been granted by the Internal

Revenue Service or a longer extension is agreed to by the City and the business entity. An extension will only be granted if the business entity, on

or before the date prescribed for payment of the OCCUPATIONAL LICENSE TAX, requests the extension and pays the amount properly

estimated as its tax.

2)

A business entity subject to tax on net profits may be subject to a penalty equal to five percent (5%) of the tax due for each calendar month or

fraction thereof if the business entity:

a) Fails to file any return or report on or before the due date prescribed for filing or as extended by the City; or

b) Fails to pay the tax computed on the return or report on or before the due date prescribed for payment.

The total penalty levied pursuant to this subsection shall not exceed twenty‑ five percent (25%) of the total tax due; however, the penalty shall

not be less than twenty‑five dollars ($25).

3)

In addition to the penalties prescribed in this section, any business entity shall pay, as part of the tax, an amount equal to twelve percent (12%)

per annum simple interest on the tax shown due, but not previously paid, from the time the tax was due until the tax is paid to the City. A

fraction of a month is counted as an entire month.

SEPARATE ACCOUNTING METHOD

is not permitted. Therefore, if a business entity has operations both inside and outside

Covington, the total income or loss reported on the Federal return of the business entity is reported on the City return and apportioned to Covington by

multiplying the total adjusted net profit by the BUSINESS APPORTIONMENT percentage determined in PART III.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4