Reset Form

Michigan Department of Treasury - City Tax Administration

5459 (01-17)

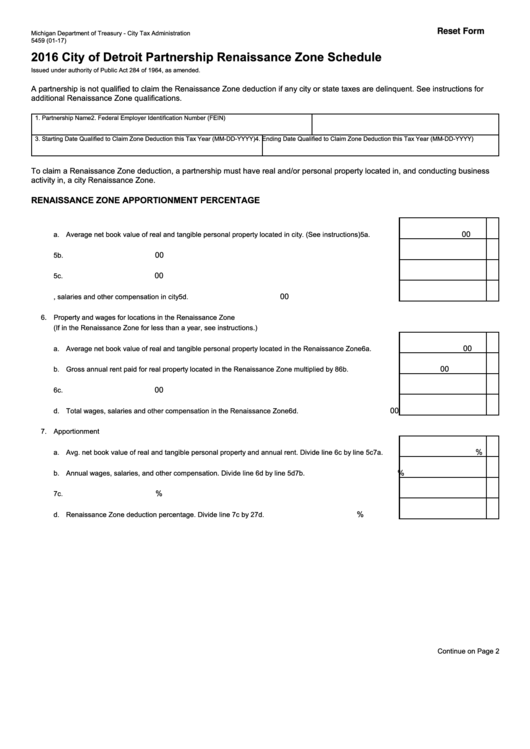

2016 City of Detroit Partnership Renaissance Zone Schedule

Issued under authority of Public Act 284 of 1964, as amended.

A partnership is not qualified to claim the Renaissance Zone deduction if any city or state taxes are delinquent. See instructions for

additional Renaissance Zone qualifications.

1. Partnership Name

2. Federal Employer Identification Number (FEIN)

3. Starting Date Qualified to Claim Zone Deduction this Tax Year (MM-DD-YYYY)

4. Ending Date Qualified to Claim Zone Deduction this Tax Year (MM-DD-YYYY)

To claim a Renaissance Zone deduction, a partnership must have real and/or personal property located in, and conducting business

activity in, a city Renaissance Zone.

RenaiSSanCe Zone aPPoRtionment PeRCentage

5. Property and wages for locations in city

00

a. Average net book value of real and tangible personal property located in city. (See instructions) ...........

5a.

00

b. Gross annual rent paid for real property located in city multiplied by 8 ....................................................

5b.

00

c. Add line 5a and line 5b .............................................................................................................................

5c.

00

d. Total wages, salaries and other compensation in city ..............................................................................

5d.

6. Property and wages for locations in the Renaissance Zone

(If in the Renaissance Zone for less than a year, see instructions.)

00

a. Average net book value of real and tangible personal property located in the Renaissance Zone ..........

6a.

00

b. Gross annual rent paid for real property located in the Renaissance Zone multiplied by 8 .....................

6b.

00

c. Add line 6a and line 6b .............................................................................................................................

6c.

00

d. Total wages, salaries and other compensation in the Renaissance Zone ................................................

6d.

7. Apportionment

%

a. Avg. net book value of real and tangible personal property and annual rent. Divide line 6c by line 5c ....

7a.

%

b. Annual wages, salaries, and other compensation. Divide line 6d by line 5d ............................................

7b.

%

c. Add line 7a and line 7b .............................................................................................................................

7c.

%

d. Renaissance Zone deduction percentage. Divide line 7c by 2 .................................................................

7d.

Continue on Page 2

1

1 2

2