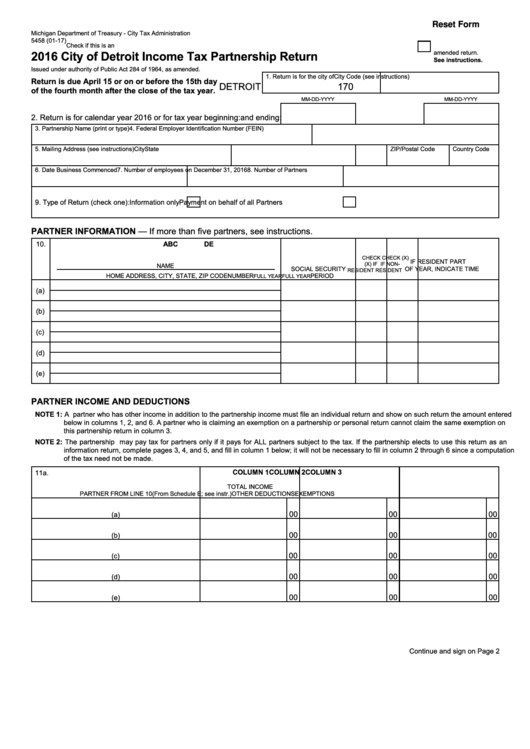

Reset Form

Michigan Department of Treasury - City Tax Administration

5458 (01-17)

Check if this is an

2016 City of Detroit Income Tax Partnership Return

amended return.

See instructions.

Issued under authority of Public Act 284 of 1964, as amended.

1. Return is for the city of

City Code (see instructions)

Return is due April 15 or on or before the 15th day

DeTRoIT

170

of the fourth month after the close of the tax year.

MM-DD-YYYY

MM-DD-YYYY

2. Return is for calendar year 2016 or for tax year beginning:

and ending:

3. Partnership Name (print or type)

4. Federal Employer Identification Number (FEIN)

5. Mailing Address (see instructions)

City

State

ZIP/Postal Code

Country Code

6. Date Business Commenced

7. Number of employees on December 31, 2016

8. Number of Partners

9. Type of Return (check one):

Information only

Payment on behalf of all Partners

PARTNER INFORMATION — If more than five partners, see instructions.

10.

A

B

C

D

E

CheCk

CheCk (X)

If ReSIDeNT PART

(X) If

If NoN-

NAMe

SoCIAl SeCuRITY

of YeAR, INDICATe TIMe

ReSIDeNT ReSIDeNT

hoMe ADDReSS, CITY, STATe, ZIP CoDe

NuMBeR

PeRIoD

full YeAR full YeAR

(a)

(b)

(c)

(d)

(e)

PARTNER INCOME AND DEDuCTIONS

NOTE 1: A partner who has other income in addition to the partnership income must file an individual return and show on such return the amount entered

below in columns 1, 2, and 6. A partner who is claiming an exemption on a partnership or personal return cannot claim the same exemption on

this partnership return in column 3.

NOTE 2: The partnership may pay tax for partners only if it pays for All partners subject to the tax. If the partnership elects to use this return as an

information return, complete pages 3, 4, and 5, and fill in column 1 below; it will not be necessary to fill in column 2 through 6 since a computation

of the tax need not be made.

COluMN 1

COluMN 2

COluMN 3

11a.

ToTAl INCoMe

PARTNeR fRoM lINe 10

(From Schedule E; see instr.)

oTheR DeDuCTIoNS

eXeMPTIoNS

00

00

00

(a)

00

00

00

(b)

00

00

00

(c)

00

00

00

(d)

00

00

00

(e)

Continue and sign on Page 2

1

1 2

2 3

3 4

4 5

5